In just a few days, the pendulum has swung from despair to building enthusiasm.

We ended last week with the May consumer sentiment survey - it has been plunging back to levels of the Global Financial Crisis, and the 2011 debt ceiling standoff (which was also accompanied by a sovereign debt crisis in Europe).

This chart is, indeed, reflecting despair.

But there's good news: We have new information entering the mix, just over the past few days.

The Nvidia earnings call on Wednesday, revealed a retooling of computing technology that's underway (and in early stages), and (related) transformative economic outcomes that are coming, via generative AI.

By early Friday morning, it was leaked that a deal was coming together on the debt ceiling.

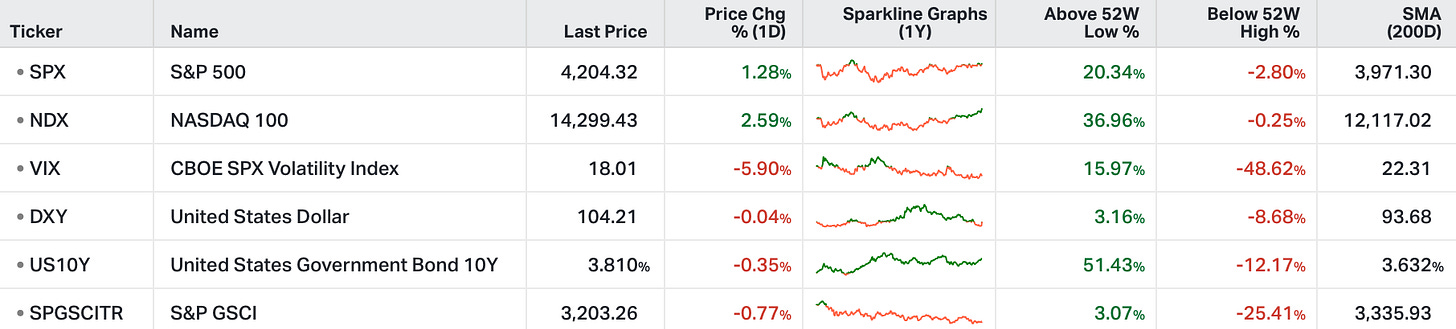

With all of the above in mind, as we discussed on Thursday, the markets were already giving signals of change.

We start this week, with the interest rate market now pricing in a 71% chance of another rate hike next month - a week ago, it was just 17%. The probability of rate cuts coming by year-end are being priced-out, rapidly.

This rate outlook is not driven by a firm inflation number, instead it is incorporating the shifting view toward bright economic growth prospects.

As I've said here in my daily notes, we need this following formula to grow out of, and inflate away, the debt burden:

a period of hot growth + stable (but higher than average) inflation + rising wages.

On that note, the AI transformation should bring us a productivity boom . . . and a productivity boom should bring about the above formula.

PS: If you, or someone you know, are looking for institutional grade analysis to build your trading on, join us by clicking below:

As a sample, and free alpha, this morning’s Crypto chartbook is attached below - please share with those you think will benefit from it.