In my previous note, we talked about the importance of the Bank of Japan's role in offsetting the policy tightening that's underway in the rest of the world.

This "offsetting" is not by coincidence - if there is one common word we hear spoken from policymakers around the world (from the Great Financial Crisis era, through the pandemic and post-pandemic period) it's coordination.

They have resolved that, in a world of global interconnectedness, the only way to avert the spiral of global economic crises into an apocalyptic outcome is to coordinate policies.

With that, just a month ago, the top finance ministers from G7 countries met in Germany.

It's safe to say, they all know that the only way the world can start reversing emergency level monetary policy, while simultaneously running record level debt and deficits, is if the Bank of Japan is running wide-open-throttle, unlimited QE.

In doing so, the BOJ has become the shock absorber for the global economy.

In return, they get to devalue the yen, and devalue the world's worst debt burden.

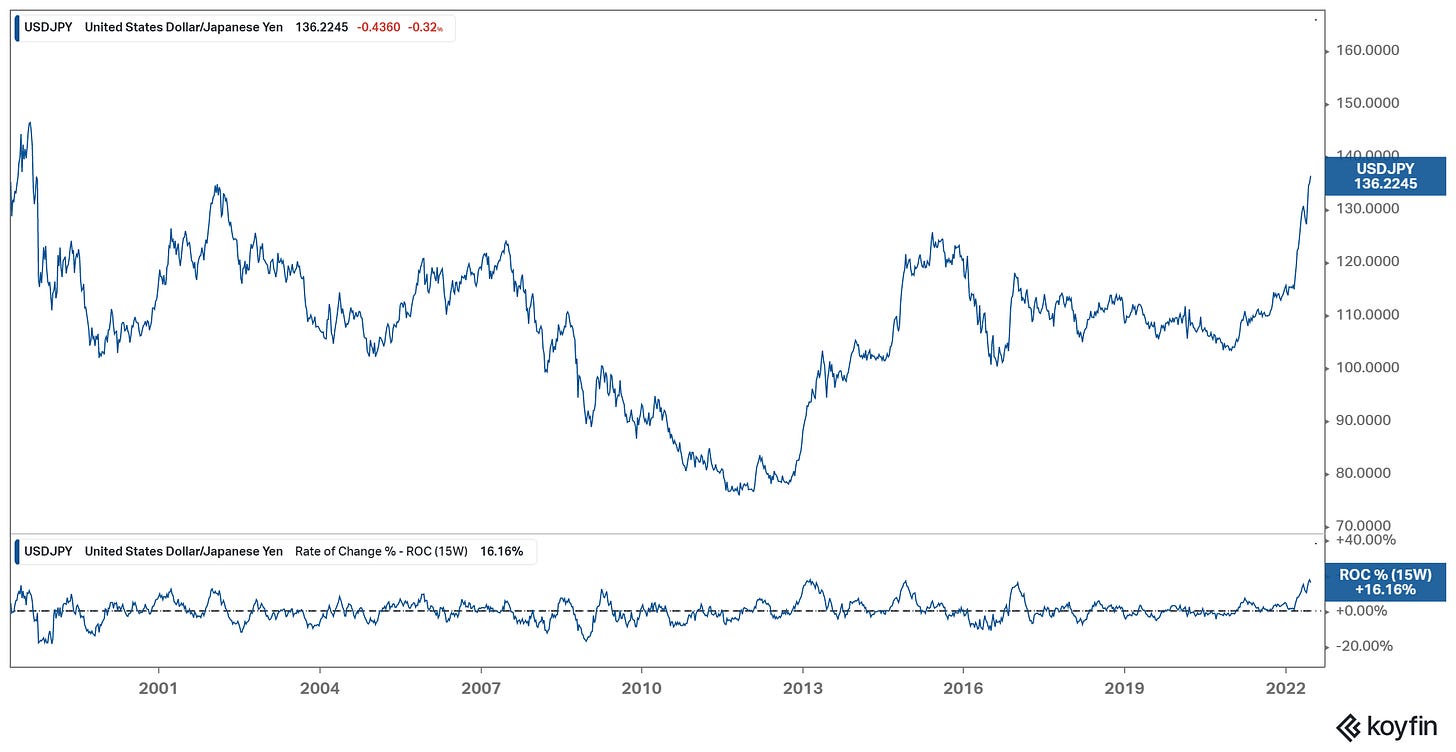

With this policy divergence, and implicit license to devalue the yen, the yen has crashed more than 17% since the Fed made its first rate hike in March. By April it had already experienced a record losing streak. Yesterday it posted a new 24-year low against the dollar.

PS: If you, or someone you know, want to gain access to institutional portfolio’s, please share and subscribe. Our Anti Constraint Portfolio, shown below, is composed of 10 tickers that allow for duration and convexity to form the tail winds for outsized gains, whilst remaining minimally correlated to the broad market.