Bigger is Better

The S&P 500 and Nasdaq 100 both closed at record highs on Friday, rising 0.5% and 1%, respectively, while the Dow Jones gained 67 points.

Market sentiment was bolstered by data showing a slowdown in US hiring in June and an increase in the unemployment rate to its highest level since late 2021, which put downward pressure on Treasury yields and increased speculation about a potential rate cut in September.

Communication services stocks led the gains of the session, with Meta surging 5.9% and Alphabet advancing 2.5%.

Consumer staples also performed well, with Walmart up 2.6% and Costco rising 2.7%.

Conversely, energy stocks lagged, with Exxon dropping 1.3% and Chevron falling 1.6%.

The S&P 500 was up +15.2% for the first six months of the year.

The index is market cap weighted, meaning larger companies have more significance in its performance.

The Equal Weighted S&P 500 ETF (RSP) was up +5% during the same period.

Notably, the top ten stocks (table below) in the S&P 500 account for 36% of the index's total weight, whereas the top ten stocks in RSP make up roughly 2%.

Eight of the ten largest companies in the S&P 500 are technology firms. Apple, the largest stock holding in Berkshire Hathaway - a holding company with its core business in insurance - significantly influences this trend.

Large cap growth stocks have been outperforming large blend (aka core) stocks for the past 10 years, with annualised returns of 16.4% compared to 12.9% for large blend stocks. When comparing large growth to large blend and large value stocks, the disparity is evident, with mid cap and small cap performances lagging even further.

From a performance perspective, 130 companies, or 26% of the S&P 500, have outperformed the index, meaning 74% did not. Among those underperforming, nearly half have posted negative returns year-to-date (YTD).

Top performing companies YTD.

Worst performing companies YTD.

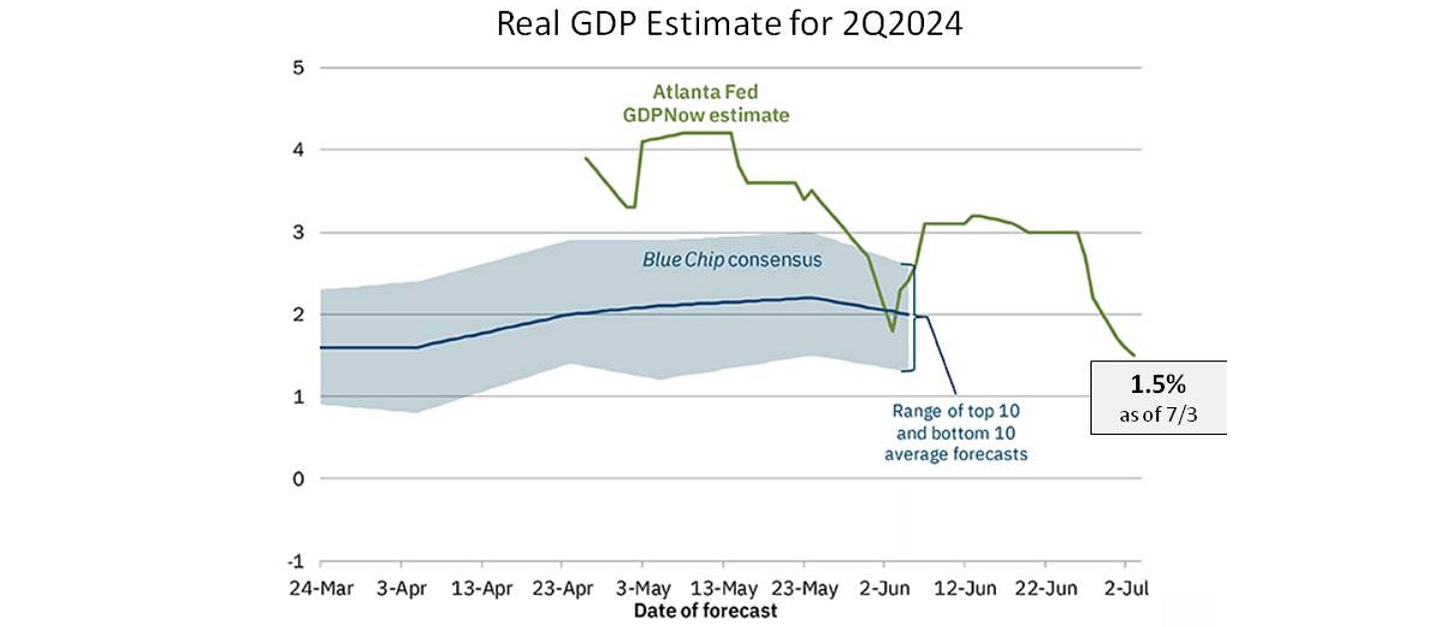

Which leaves us with the latest Atlanta Fed GDPNow estimate for real GDP growth in the second quarter of 1.5%, down from 2.7% last week and 3.9% at the end of April. The average forecast for Q2 since the first estimate at the end of April is 2.8%.