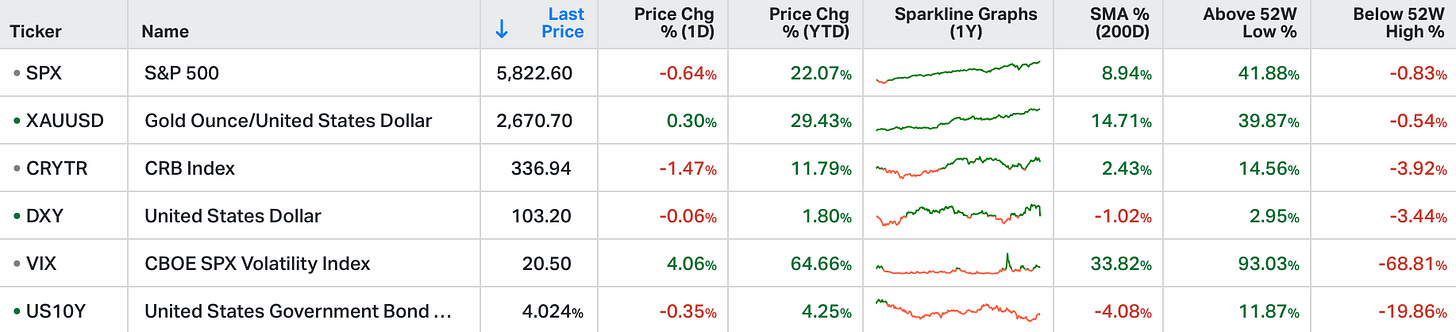

Wall Street closed sharply lower on Tuesday, driven by weak earnings from ASML, which led to a broad selloff in chipmakers, and a sharp decline in oil prices that pressured energy stocks.

The S&P 500 slid 0.7%, the Nasdaq 100 lost 1.2%, and the Dow tumbled 324 points.

Energy stocks were under pressure as Exxon Mobil (-3%) and Chevron (-2.7%) declined on the back of a sharp drop in oil prices.

Additionally, UnitedHealth fell 8.2% after issuing a weaker earnings forecast.

In contrast, Bank of America gained 0.5% after reporting stronger-than-expected third-quarter profits and revenue.

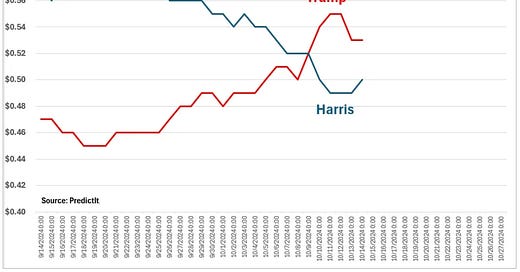

The latest betting markets have a gap that has widened in favour of Trump. Let's take a look.

Here's Polymarket, which is an offshore betting platform. Regulatory restrictions prohibit U.S. users, so this is perhaps a pulse of global sentiment — and it's running away for Trump …

Next is Kalshi. This is the first fully regulated prediction market in the U.S., where U.S. users can bet on event outcomes. This too has had a dramatic widening in favour of Trump …

Lastly is PredictIt, which is a prediction market focused on political events, but operates under a U.S. regulatory exemption, which (among other things) limits the number of traders per market and maximum bet size. This is a narrower margin but favors Trump …

With this in mind, Trump did a sit down interview with a Bloomberg economics reporter at the Economic Club of Chicago where he talked about the economic agenda.

These types of crowds have historically given a chilly reception to Trump. That wasn't the case this time. It wasn't the case last week at the Detroit Economic Club. The audiences were clearly in favour of pro-growth, pro-business, pro-American economic policy.

Maybe the most important topic discussed was the world reserve currency status of the dollar. Trump puts the highest priority on preserving it. He says, "if you want to go to third world status, lose your reserve currency."

So, if we look through the Trump economic policy platform, these are the three explicit actions that will protect the currency:

lift restrictions on American energy production,

terminate the Green New Deal initiatives within the Inflation Reduction Act,

oppose the creation of a central bank digital currency.

Why are these moves critical to maintaining the world reserve currency status of the dollar?

Because the agreement to trade global oil in U.S. dollars (i.e. "petrodollars") has been the cornerstone of the dollar's role as the "world's reserve currency," since the end of the gold standard.

Maintaining this global demand for the dollar has been central to the U.S. building and maintaining its position as an economic superpower. The dollar's reserve currency status allows the U.S. to borrow cheaply and run large trade deficits, among other economic advantages.

So, the explicit anti-oil policies of the current administration are a self-determined path to loss of reserve currency status of the dollar, and therefore a destruction of wealth and sovereignty of the country.

Please explain to me the anti oil policies of this administration, under Biden we have become the world largest oil producer. and you want people to subscribe