Better Times

Stocks in the US finished lower on the last trading session of June, as investors digested a batch of economic data.

The S&P lost 0.4% after touching a fresh high of 5.5K, the Nasdaq 100 slid 0.7% after briefly hitting a record level of 19980.

Fresh data showed the Fed's preferred inflation measure was virtually unchanged in May, paving the way for the Fed to cut rates this year.

Meanwhile, the Michigan consumer sentiment was revised sharply higher and inflation expectations were lower than previously reported.

Communication services led the decline as Alphabet (-1.7%), Meta (-2.9%), Netflix (-1.4%) and Walt Disney (-2.8%) dropped.

The United Kingdom general election is scheduled for this week, Thursday, 4 July 2024. With that, I want to take a quick look at the UK stock market and a couple of reasons why it may be heading for better times.

The UK stock market is cheap – if you focus solely on valuation rather than growth. - sitting on about a 12x price/earnings ratio, compared to 17x for global equities and 21x for US markets.

In the first five months of this year there’s been over £60bn of bids for UK listed companies. A threefold increase in M&A activity compared to the whole of 2023, with an average bid premium of over 30%.

Additionally, for many years a key disadvantage for the UK stock market has been its high exposure to commodities and financials, rather than growth or technology. Might this now turn into an advantage?

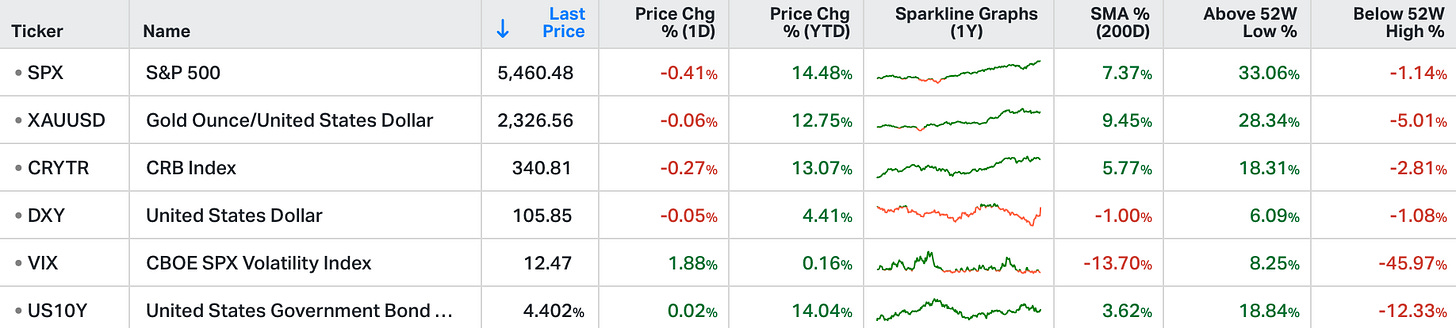

Research suggests commodities are the best performing asset class in periods of elevated inflation. If we are heading to a higher/a more inflationary future, then commodities may be the next big thing. Gold has outstripped the S&P 500 so far this year, whilst copper - despite being down over 9% over the last month - and silver have matched the broad market.

Meanwhile global commodity giant BHP has (now unsuccessfully) bid over £37bn for fellow miner Anglo American. Could this be the start of a new trend?

At the same time, normalised interest rates accompanied by a better-than-expected economic outlook, both domestically and internationally, have delivered a boost to beleaguered bank stocks. NatWest and Barclays are both up over 40% year to date.

And since we’re talking all things English, how about that game…