Bessent's Signals

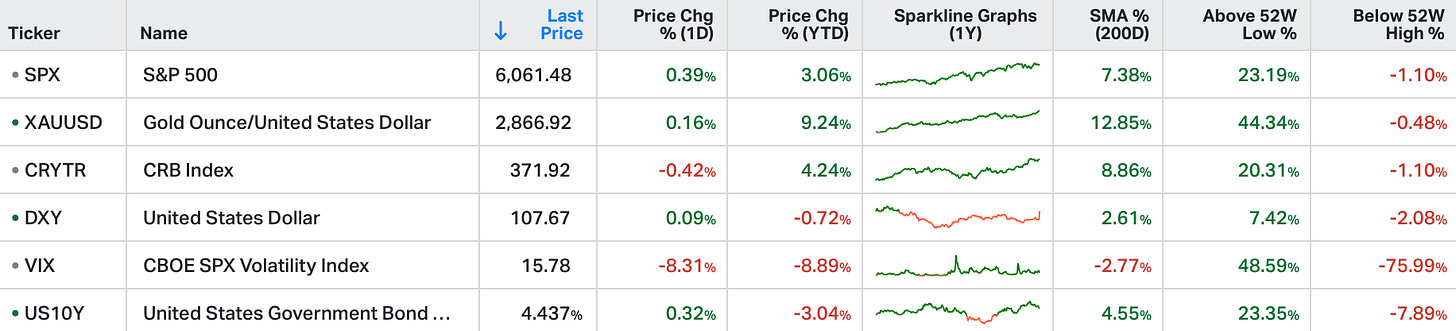

US stocks closed higher on Wednesday, buoyed by a sharp drop in long-term Treasury yields as investors digested a mix of earnings reports and economic data.

The S&P 500 and Nasdaq 100 both rose 0.5%, while the Dow surged 317 points, driven by strong performances from Nvidia and Amgen.

Amgen rose 6.5% after reporting better-than-expected fourth-quarter earnings and revenue.

Alphabet and AMD saw significant losses following disappointing earnings reports, with Alphabet down 6.9% due to a cloud revenue miss and AMD falling 6.3% on weaker-than-expected data center sales.

Despite these setbacks, growing concerns about heightened scrutiny of major tech firms, especially Apple, by Chinese regulators weighed on investor sentiment, adding a layer of uncertainty to the market.

The new Treasury Secretary has now been on the job for a week. He has started to give some signals to markets.

Signal #1: The Treasury released plans to rollover Treasury debt that matures in the quarter.

Bessent himself has said that Janet Yellen left the bond market in a vulnerable position. She funded the deficit last year, largely with short-term debt. That helped to suppress longer-term interest rates, which proved to maintain confidence in markets at the time.

But it leaves Bessent with a third of the outstanding government debt to rollover this year. For now, Bessent is going to stick with Yellen's strategy - not to rock the bond market boat.

It signals near-term stability, and the perception that Bessent is confident he'll see lower rates later in the year, to issue longer term maturities. The bond market liked it. The 10-year yield fell 20 basis points on the day.

Signal #2: In the same interview, Bessent made his appeal to Congress to make the 2017 Trump tax cuts permanent. And adding a little pressure, he warned not doing so would result in the biggest tax hike in history.

This builds on his Senate confirmation hearing three weeks ago, where he said that if Congress were to communicate to markets the intent to make the tax cuts permanent, that it would unleash animal spirits and "a new golden age" for the economy.

Signal #3): He conveyed confidence that inflation would come down, rates would come down, and wars would end, with the presence of lower energy prices (by "unleashing American oil").

Signal #4): When prodded for an official statement on the dollar, as Treasury Secretary, Bessent said, "there is no alternative to the dollar."

Lastly, U.S. Trade Deficit widened in the month of December - the page below breaks down the headline numbers.

Click on the button to receive detailed macro summaries (like the above) for all major economic news releases alongside access to;

4 Quantitative Investment Strategy Portfolio’s

1 Model Portfolio with a 2 to 5 yr outlook.

Long Form essays and market commentary.

Daily Option Spread Trades.