US stocks kicked off the week mixed, with investors shifting their focus to the upcoming inflation report, which could signal the beginning of interest rate cuts.

The S&P 500 closed marginally lower, the Dow Jones snapped its 8-day win streak, losing 81 points, while the Nasdaq ticked up 0.3%.

Market participants are also awaiting the PPI and retail sales reports, as well as statements from various Fed officials, including Chair Powell.

In the corporate news, Apple gained 1.7% after news the company is finalising a deal with OpenAI to integrate ChatGPT on the iPhone.

Shares of GameStop finished 74.1% higher, adjusting over 110% jump, after social media star 'Roaring Kitty' posted on X and AMC also closed 78.3% higher after rallying as much as 100% during the day.

When you constantly threaten a "higher for longer" interest rate, at a level that's already historically very tight, and you attribute that stance to a persistently higher than desired inflation rate, the market starts believing you - on both fronts;

On the former, due to the Fed's hawkish rhetoric of the past few months, the market has reduced its expectations on rate cuts this year by more than 125 basis points (i.e. pricing in a higher interest rate for longer).

On the latter, the Fed's hawkish rhetoric may have also influenced inflation expectations, higher (higher inflation rate for longer) - we've had two consumer surveys on inflation expectations reported over the past two trading days, and both jumped higher.

As we've discussed in the past, what the Fed fears more than inflation itself, is losing control of inflation expectations (consumer and business). When people lose confidence in the Fed to stabilise prices, behaviours change - and we can get one of two scenarios.

Scenario 1: Expectations of higher prices, can lead to consumer and business behaviours that lead to higher prices (pulling forward purchases, leading to higher inflation).

However, in the current case, a spike in inflation expectations was accompanied by a plunge in sentiment.

With that, we can get the opposite outcome for behaviours, and prices …

Scenario 2: A plunge in sentiment, due to high prices can lead to a plunge in spending. Things become unaffordable, and people stop spending. High prices can cure high prices.

But that puts the economy at a significant risk of a downturn, and suddenly deflation can become the greater risk.

With all of this in mind, we had a similar dynamic in November of last year. The University of Michigan survey on the expectations for price changes over the next five years spiked to around 12-year highs (of 3.2%). And sentiment was in a multi-month plunge.

What did the Fed do? Did they posture for more tightening?

No. They signalled the end of the tightening cycle.

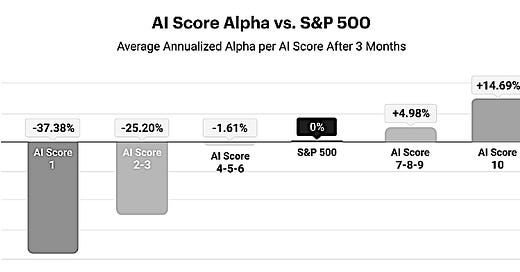

These are today's rankings based on our AI score, which rates stocks and ETFs every day from 1 to 10 according to the probability of beating the market in the next 3 months, analysing +900 fundamental, technical, and sentiment indicators.

Use these rankings as a starting point to find new investment ideas in the US and European markets.

Create your first portfolio to track the daily AI score of your stocks and ETFs. Hold the best stocks and avoid the losers.

Check our Trade Idea’s report. It highlights current potential trades for which our AI Scores have been sharper in the past, with an impressive success rate: up to a 94% win rate in a 3-month investment time frame.

I must admit, it is incomprehensible to me, at least, that deflation could be a valid worry in the current economy, regardless of the economic activity. short of a virtual depression like. recession, with growth contracting rapidly, while the pace of price increases may slow, heading to negative seems quite the stretch.