The Fed spent much of the year telling us that inflation is "transitory." This was clearly intended to mean "temporary."

This, despite the $5 trillion growth in money supply, and despite the nearly $10 trillion in fiscal stimulus (either disbursed, in the process of being disbursed or on the table for Congressional approval). Within these policies, wages were artificially reset higher by government subsidised unemployment - wages are a key driver in the inflation formula.

With that, now that the Fed has changed its tune and is prepping for an end of emergency policies, we should expect markets to question the Fed's judgement (too soon?). We've had knee jerk selling in stocks.

But as we've discussed throughout the year, the Fed's "transitory" tune was clearly a campaign to manipulate inflation expectations (lower). The Fed was singing a tune that was in complete contradiction to the inflationary data and the underlying drivers of inflation - there's a very good chance that we will see double-digit inflation over the next year, and a Fed that ends up behind the curve and ultimately chasing inflation higher (with aggressive rate hikes).

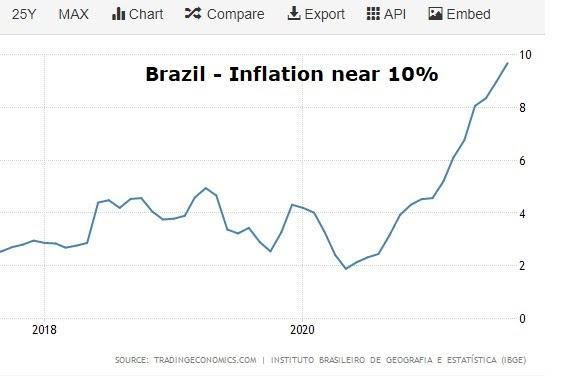

We're already seeing it in Brazil. The Brazilian central bank hiked rates by 100 basis points last week- making it 425 basis points since March... Tthey are doing so, because of this chart...