Last week we talked about the flip-flop by Jerome Powell on inflation. He flipped from inflation-denier to inflation-fighter, all over the course of just a morning congressional testimony.

Just like that, the market is now beginning to talk about a March rate hike.

On that note, we'll hear from the Fed next week, where they will likely lay out a (new) timeline for that possibility.

This new interest rate tightening cycle will be bad news for the high-flying, high-valuation growth stocks - particularly, the "no EPS" stocks. Many of these stocks that have been valued by Wall Street on a multiple of sales (not earnings) have already taken a beating in just the days since Powell's flip-flop.

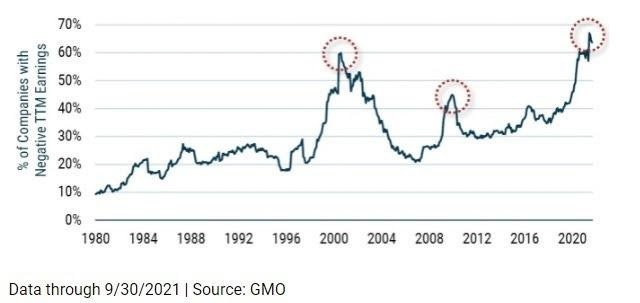

The big asset manager, GMO has a good chart that describes the impending fate for these stocks...

In this chart, we can see the percent of companies in the Russell 3000 Growth Index that have negative earnings - it's a record high. Things don't tend to go well at these levels (the red circles).

What else is at a record extreme? The ratio of growth stock performance (outperformance) relative to value stocks.

This all sets up for a rising rate environment, driving money out of growth and into value. The catalyst, a Fed tightening/inflation fighting cycle), is here.