We talked yesterday about the FDA vaccine approval as another November 9th, 2020-like moment, where markets interpret it as new hope that the pandemic will end. This - combined with even more extravagant government spending coming down the line, and a Fed that has prepared markets for an end of emergency policies - is a recipe for the beginning of the end of ultra-low rates. And it all is reflective of a sustained economic recovery.

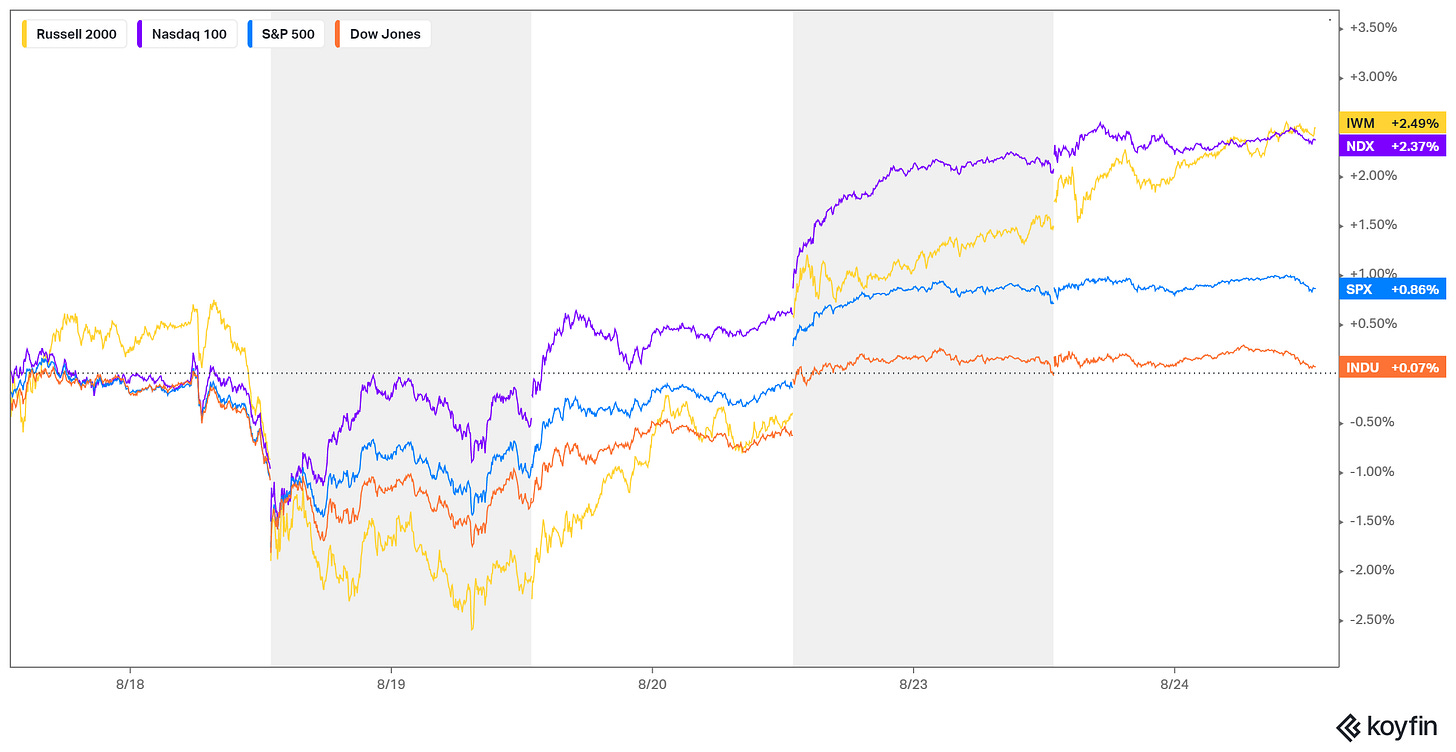

Indeed, rates were on the move yesterday, trading up to 1.30%. And no surprise, when we look across the stock market, small cap and value stocks have been the outperformers the past two days on this formula of "pandemic escape" and sustained economic recovery.

After all, coming out of recession, small caps tend to follow the path of interest rates (climbing rates, suggests more optimism about the outlook). With that, as interest rates (the 10-year yield) rose from as low as 31 basis points, last year, to as high as 1.78% this year, small cap value stocks soared. Conversely, as you can see in the chart below, as we've seen a decline back to 1.13% on the ten-year over the past few months, small caps have fallen, diverging from the performance of large cap growth stocks (and the broader market).

So, with the above in mind, with a fresh catalyst for a move in rates (higher), we should expect small cap value to roar back into the end of the year.

The Russell 2000 is now up 13% year-to-date. That is underperforming the broader market, which is up 19%. Again, history tells us we should expect the opposite coming out of recession. Be long small-caps!