At A Discount

Global Trend Report → Turning Points

US equities seesawed on Tuesday as investors weighed a fresh batch of corporate earnings and tariff headlines.

The S&P 500 and the Dow Jones dipped 0.1% and 0.3%, respectively, poised to end a two-day winning streak, while the Nasdaq 100 hovered near the flatline.

Despite recent rebounds, all three major indexes remain well below their early April levels, weighed down by ongoing geopolitical tensions and fragile investor sentiment.

Johnson & Johnson slipped 0.3% despite beating estimates, while Boeing dropped nearly 2% after China reportedly paused new jet deliveries, adding to trade worries.

While stocks have sharply corrected under tariff fears and the Fed's missteps on policy, the AI revolution continues to charge forward.

Over the weekend, the Trump administration signaled exemptions for critical AI inputs from China, while Nvidia announced it has started production on its most advanced AI chips in Arizona, and will be building "supercomputers" in Texas in 12-15 months.

This "onshoring" is new global capacity, and that will be like pressing the accelerator on the AI revolution. With that in mind, one of the handful of people working on the frontier of this technology revolution said this about the state of AI back in February ...

Elon is talking about teetering on the edge of artificial general intelligence (AGI). It's where the machine can reason better, like a human – in any domain. The next stage, it can constantly improve itself with no downtime.

Related to that, remember, earlier this year Jensen Huang (Nvidia founder, CEO) said "the 'ChatGPT moment' for general robotics is just around the corner."

He said over the next several years, the combination of 1) agentic AI robots, 2) autonomous cars and 3) humanoid robots will become "the largest technology industry the world has ever seen."

So agentic AI seems to be getting close (where the machine has "full agency"), fully autonomous cars are getting very close, and this year Tesla's Optimus humanoid robots are expected to be working in the Tesla factory - with an aggressive plan to grow the humanoid robot population.

Which takes us back to when Elon said that the introduction of humanoid robots into the world, would mean "no meaningful limit to the size of the economy." Jeff Bezos has recently echoed that view.

So, as the crowd obsesses over tariffs, tight money and political mudslinging, the real story ithe relentlessss ascent of world changing technology.

And as we've discussed often here in my daily notes, there is a wartime-like effort, by the U.S., to win the AI arms race.

With that, if you can look through the noise and pushback surrounding the Trump agenda, this broad market correction is an opportunity to buy the key stocks that are powering the AI revolution, on sale - the below is a slide from Jan’24.

For those that think this is another tech boom/bust cycle?

For perspective, the AI revolution is as transformative, if not more, than the advent of the internet, but there are clear differences in the investment.

The dot-com bubble was fuelled by a speculative mania.

Money was being poured into companies with little-to-no revenue (like a few hundred thousand dollars in revenue) and valued on the basis of eyeballs (web traffic).

On the other hand, as a proxy on the AI revolution, if we step through our AI-Innovation Portfolio (AI-Portfolio) — we've built a 24-stock portfolio since launching in June of 2023, and ALL but one are profitable, and ALL have positive net cash.

Not accounting tricks, legitimate net income. That's a big difference.

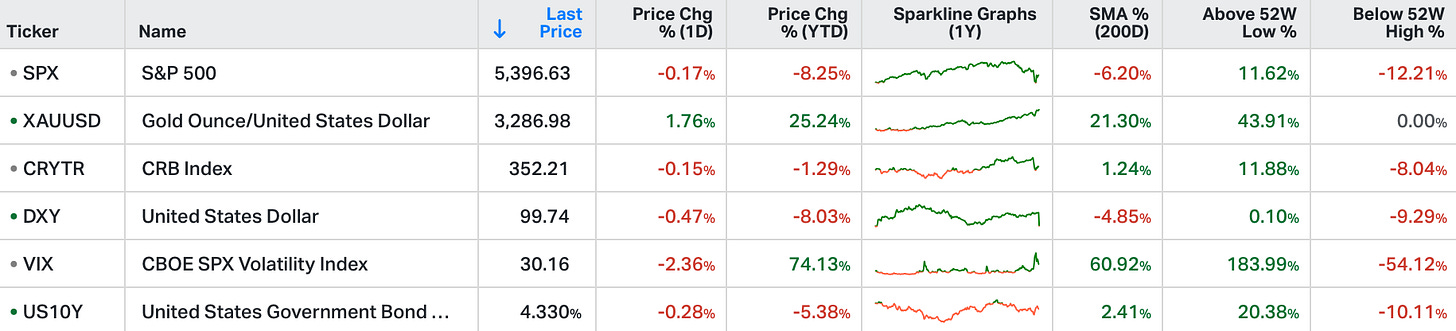

Following yesterday’s note, there were a number of enquiries regarding the Market Turning Points reports/trend indicators offered through this publication. Please find below the monthly edition of the Global Trend Report for Feb’25.

The best investors in the world have built their careers in markets like this—trading ahead of the herd. This is an opportunity for you to gain access to a hedge fund strategy at a fraction of the cost.

Easter Sale: £50 off! Send me a comment/email for a discounted payment link. → aaj.tgt@protonmail.com