Any Pullback?

US stocks trimmed their losses on Wednesday after the Federal Reserve held its rates unchanged.

The S&P 500 closed 0.5% lower, the Nasdaq 100 dropped 0.5%, and the Dow Jones finished 0.3% lower, with the S&P 500 and Nasdaq 100 paring 0.8% losses in the afternoon.

Nvidia remained in the spotlight with a 4% plunge, extending its volatile momentum after claims of efficient AI models from China risked the urgency for more AI infrastructure.

In the meantime, Microsoft, Meta, and Tesla were mixed ahead of their earnings after the closing bell.

On a more positive note, shares of T-Mobile US surged 6.3% after reporting stronger-than-expected earnings.

No surprises from the Fed. Jerome Powell says they are in "meaningfully restrictive" territory (i.e. still putting downward pressure on prices and the economy), but also says that they are in "no hurry" to remove that restriction.

The bigger news on Fed policy came from Trump. Shortly after the Fed press conference, he posted this …

Trump has made it clear that he wants lower rates. In his first term, he voiced his displeasure with Jay Powell's Fed for taking rates up from 25 basis points to 225 basis points, despite inflation running mostly below target throughout.

The Fed ended up reversing course in late 2019, forced by markets back into an easing cycle.

Let's talk about earnings …

Building from yesterday, we heard earnings from three of the big data center builders after the market close.

The advanced AI model out of China (DeepSeek) was thought, by some, to have exposed the big hyperscalers as having over-invested in infrastructure capacity.

Would they signal any pullback on spending? The answer is no.

Microsoft continues to project around $80 billion in capex this year, still well behind in fulfilling on a $300 billion backlog of orders.

Meta sees $60-$65 billion in infrastructure spend to support scaling Meta AI to over a billion people this year.

As we discussed yesterday, one lesson from DeepSeek is that there will be more cheaply developed AI models, which will lead to more overall AI usage (requiring more global computing power).

The other lesson is that dealing with China will become, maybe, priority number one of Trump 2.0.

On that note, Howard Lutnick had his Senate hearing, on his nomination to become the Secretary of Commerce. He said this about DeepSeek …

"I do not believe that DeepSeek was done all above board, that's nonsense. They stole things, they broke-in, they've taken our IP. It's got to end."

Lutnick's job will be all about China.

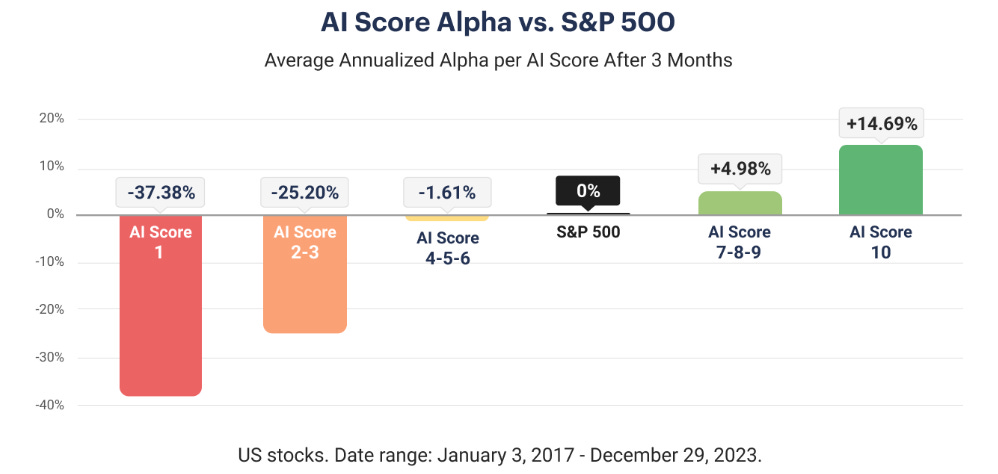

GRYNING | Research: Access stock analytics, driven by explainable artificial intelligence, that empowers you to take more intelligent risks and understand where to spot opportunities. Our models rate stocks and ETFs with an easy-to-understand AI Score, ranging from 1 to 10: