US stocks closed lower on Wednesday, with the S&P 500 and Nasdaq decreasing by 0.17% and 0.55%, respectively, and the Dow Jones losing 23 points.

Investors were anticipating the key PCE inflation report scheduled for today and digested the latest comments from several Fed officials.

NY Fed's Williams stated that the central bank has 'a ways to go,' and Atlanta Fed chief Bostic favours a patient approach to monetary policy.

Meanwhile, the second estimate for Q4 2023 revealed a 3.2% annualised growth in the US economy, slightly below the initial projection of 3.3%.

In corporate developments, Urban Outfitters faced a 12.78% decline following disappointing Q4 results.

We get inflation data today. The Fed is watching its favoured measure of inflation, likely to hit 2.3%-2.4% in today’s report - as it continues to stairstep lower toward the Fed's target of 2%.

Going into last month's PCE report, which was December data (reported end of January), the 10-year yield was trading 4.11%.

The data in that report showed that inflation continued to fall in December. Two weeks later, we had January CPI which showed the lowest reading of the prior seven months. The core measure was the lowest of the inflation cycle. After all of that, we go into the day’'s report with yields higher, not lower (at 4.26%).

Meanwhile, stocks are 3% higher than a month ago, and have continued to hug this trendline, which originated from October, when Jerome Powell verbally signalled that the tightening cycle was over.

The most important difference relative to the prior PCE report:

On January 26th, the interest rate market was pricing in a 4.0% Fed Funds rate by year end.

It's now pricing in a 4.6% Fed Funds rate by year end.

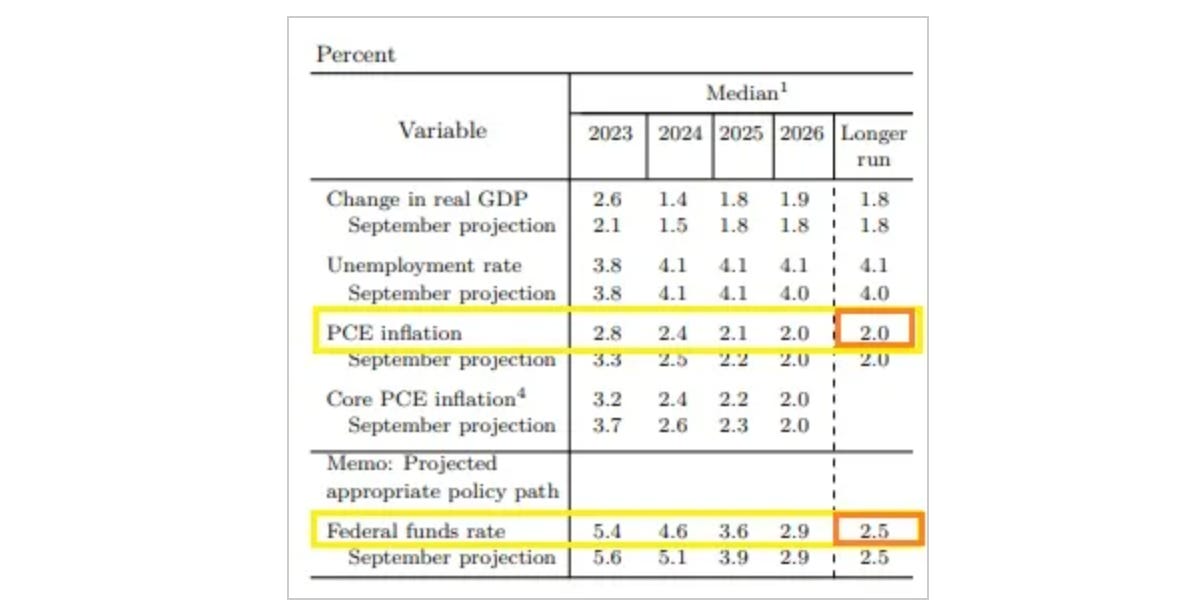

So, the market has repriced to align with the Fed's guidance, which is inarguably very conservative (on the rate outlook) given that inflation is running just a few tenths of a percentage point from the Fed's 2% target. And remember, within the Fed's Summary of Economic Projections, they've told us where they think the Fed Funds rate should be, when inflation is at target.

As you can see (framed in orange), it's 2.5%. The current Fed Funds effective Fed Funds rate is 5.33%. Clearly, that's much higher/much tighter than where the Fed sees sustainable real rates.

Click on the link below to get daily (free) insights into “Market Movers” as derived by our AI - putting yourself on the right side of statistically backed trends.