Anchored

Stocks in the US surged on Friday, fueled by a weaker-than-expected April jobs report, which pushed expectations for a Federal Reserve interest rate cut to September from November.

The S&P 500 gained 1.2%, the Nasdaq advanced 2% and the Dow Jones closed 450 points higher.

Additionally, the unemployment rate ticked up to 3.9% while wages rose less than forecasts.

Apple rallied nearly 6% after announcing a $110 billion share buyback and reporting better-than-expected earnings and revenue.

Amgen also surged 11.8% on an earnings and revenue beat, to book its best day in nearly 15 years, while Cloudflare tumbled 16.4% after issuing weak revenue guidance for the full year.

Inflation depends, in part, on what consumers expect it to be. If consumers expect prices to be higher in the future, they buy now which creates inflationary demand pressures now.

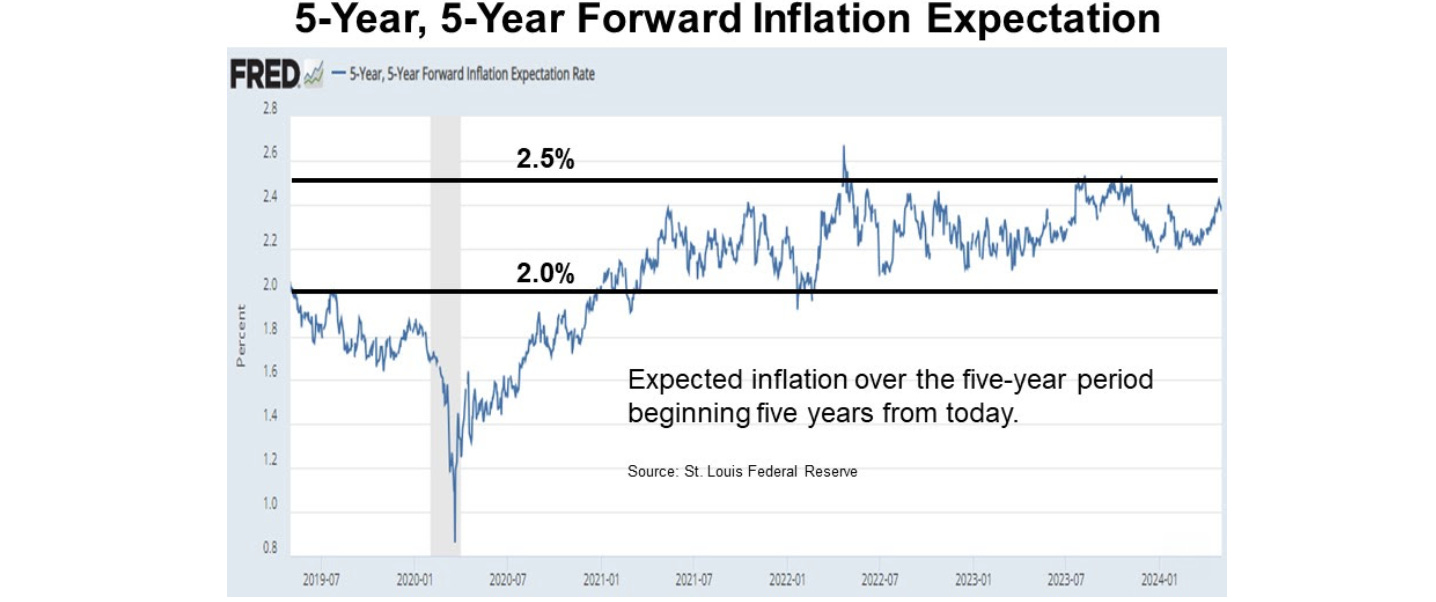

In the Fed statement and press conference held last week, the Fed said inflation expectations are anchored. The 5-year forward inflation expectation rate is 2.37% currently and for the past two years, the expectation rate has been bounded between 2% and 2.5%.

The Fed is also anchored. It is holding off on rate cuts while the economy is strong and the downtrend in inflation remains stalled - the Fed believes inflation will trend lower later this year.

If and when lower inflation becomes evident, the Fed will lift anchor and drift rates lower. The initial market reaction to the Fed news release was favourable, as the Fed said it is unlikely that there will be rate hikes and they are optimistic that inflation will trend lower once lag effects subside.

On a related note, there has been an uptick in commentary about the supply of U.S. stock contracting over the past three years as stock buyback volume is outpacing volume creation from initial public offerings (IPOs) and secondary offerings.

Last week, Goldman Sachs raised its 2024 buyback forecast to $925 billion, up 13% year-over-year. For 2025, they predict buybacks to rise by 16% year-over-year.

In the last four years, the Magnificent 7 large-cap technology stocks (Microsoft, Apple, Nvidia, Amazon, Alphabet/Google, Meta and Tesla) increased their annual buyback spend by $83 billion as compared with the remaining S&P 500 companies buyback spend declining by $17 billion over the same period.

In an uncertain market, rising stock buybacks should directly help support the largest companies in the S&P 500 and indirectly support the overall index. As of March 31, the 10 largest stocks in the S&P 500 represented 33.5% of the index.

Synthesis of all Perspectives

A confluence of forces drives asset prices. Gryning leverages buyside experience across each vertical as the foundation for every market insight.

Members receive Actionable Research and Bespoke Market Insights from a Buyside Perspective.

ps: Annual membership, currently available at 20% discount, will be upgraded for readers of Gryning Times.