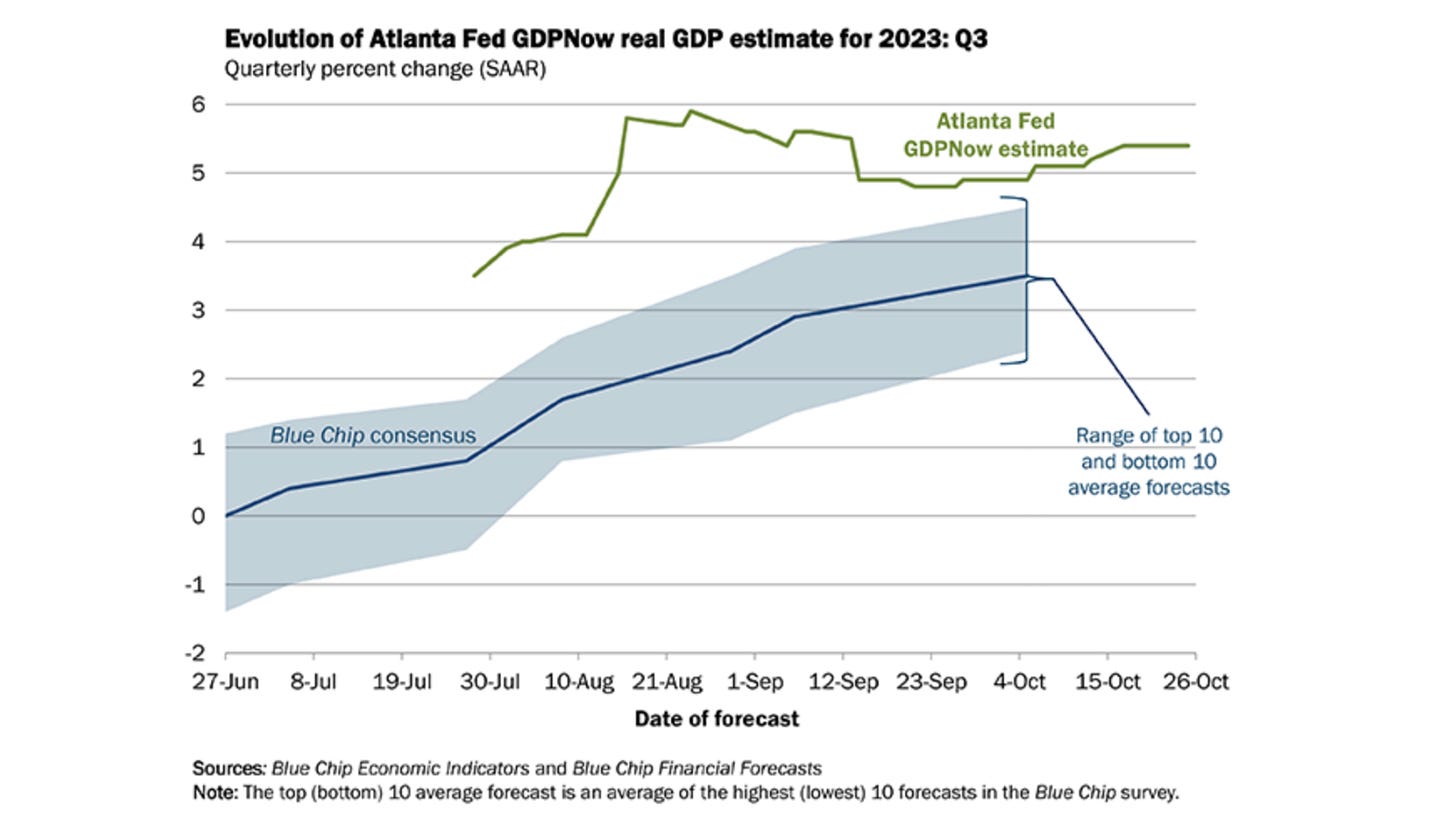

We get third quarter GDP today . . . it will show an economy that was hot in the third quarter.

That said the perception of the economy is very different.

The Wall Street consensus view on the economy (the blue line) has been slowly (seemingly reluctantly) ratcheting higher, but is still well below how the economy is tracking based on the data-driven Atlanta Fed model (the green line).

We had the same scenario going into Q2 GDP data;

The consensus view on the economy was 1% growth.

It was actually growing twice as fast.

This is the Fed's "keeping at it" effect on sentiment, which has now rebranded to "higher for longer." The latter campaign continues to communicate to consumers and businesses that the Fed will keep its foot on the brake.

Keep in mind, this was (likely) a 9% nominal growth economy, in Q3, despite that slowing effect from the Fed.

How does this formula work? Fiscal.

Simultaneously, the government is still running deficit spending, as if the economy is still in emergency/crisis times. Add that the economy still has ten-years worth of money supply floating around dumped onto the economy over a two-year period (i.e. the covid response: forty-percent money supply growth in two years).

We talked about this type of environment in my notes more than two years ago, in the midst of the building inflation: "this type of economy is not a 'feel good' economy. In an inflationary economy consumers feel like they are sprinting on a treadmill just to maintain status quo" (you can see that 31 May 2021 note below).

If we get a wartime economy, it seems likely that we will get even more government spending, even higher nominal growth, and an even faster sprint on the treadmill for consumers.

PS: If you find my notes to be of value, please share with those you feel may benefit from them.