This week, our focus turns to Japan as the Bank of Japan (BoJ) prepares for its key policy decision on Wednesday. While the BoJ has made meaningful progress toward monetary policy normalisation, it remains an outlier among major central banks, many of which have already begun easing after previous tightening cycles.

Access hedge fund grade analysis, research, and strategies at a fraction of the cost.

Japan monetary policy

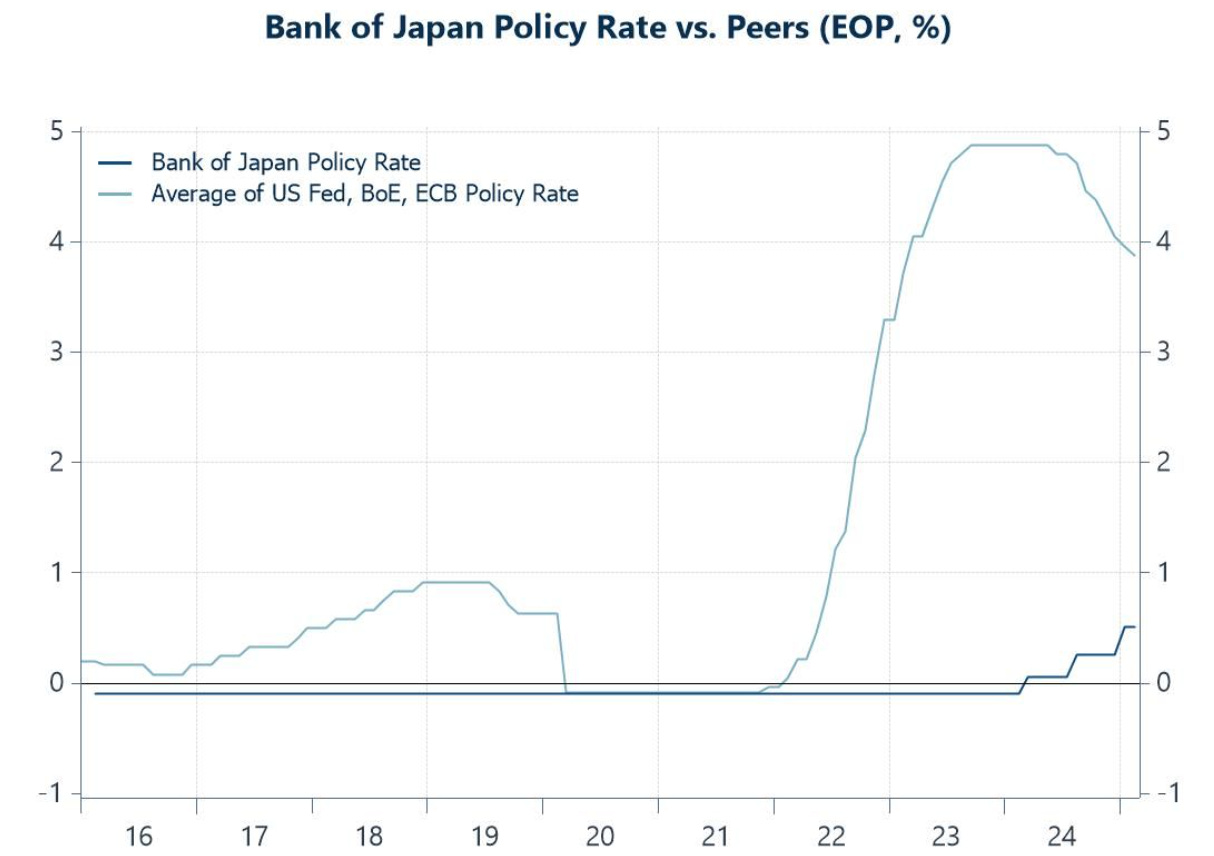

The Bank of Japan (BoJ) initiated a major shift last year, gradually moving away from its eight-year-long negative interest rate policy, signalling a transition from its ultra-loose monetary stance. Since then, the BoJ has raised interest rates three times, citing positive developments in inflation and wage growth—topics we will explore in more detail shortly. However, as shown below, the BoJ remains far behind its peers in the policy cycle. Major central banks like the US Federal Reserve, the Bank of England, and the European Central Bank have already completed their tightening cycles and are now easing, as inflation has become better-behaved. Moreover, Japan’s real policy rates remain deeply negative, with low policy rates persisting while inflation continues to rise. Despite this, investors do not anticipate another rate hike during this week’s BoJ monetary policy meeting, with the next tightening move expected sometime in Q3.

Inflation trends

The significance of Japan’s recent inflation trends should not be understated, especially considering its prolonged period of very low or even negative inflation during the "Lost Decades," a time marked by minimal price changes amid persistent economic stagnation. It was not until the implementation of former Prime Minister Abe’s "Three Arrows" strategy—including unconventional monetary policies like negative interest rates and massive quantitative easing—that inflation in Japan began to rise. Years after Abe’s term ended in 2020, with many of his strategy approaches—particularly ultra-loose monetary policy—remaining in place, Japan finally experienced a sustained reflationary trend, accompanied by higher nominal wage growth. Even more encouraging is that inflation has been rising in "core core" items, as shown below. Today, Japan has reached a point where inflation and wage conditions are deemed strong enough by the BoJ to support the gradual normalisation of its monetary policy.

A deeper – more granular – examination reveals a particularly striking development: the sharp surge in rice prices in Japan. As shown below, consumer rice prices have surged at an accelerating rate, rising by over 70% year-over-year in January. This price increase was driven by a combination of supply-side disruptions and underlying structural vulnerabilities in the Japanese rice market.

The record-breaking summer heat of 2023 severely impacted harvests, reducing domestic supply, while natural disaster warnings triggered a wave of panic buying, further exacerbating price pressures.

Compounding these short-term shocks, Japan’s historically low rice stockpiles and limited domestic production capacity have magnified the impact, leaving the market highly sensitive to even modest supply fluctuations. The situation has become so dire that the Japanese government has begun auctioning off part of its rice stockpile—a first-ever move aimed at alleviating supply-side concerns. While one might think that increasing rice imports could help address the issue, the reality is more complicated.

Japanese consumers are accustomed to specific rice types, particularly short-grain rice, which is integral to their diet and traditional dishes. As such, imports from other countries do not always serve as perfect substitutes. Looking ahead, Japan’s Ministry of Agriculture plans to nearly eightfold its rice exports by 2030. This initiative not only aims to expand Japan's rice export market but also serves as a strategy to reallocate rice production capacity for domestic consumption in case of another shortage.

Spring wage negotiations

The time has come again for Japan’s annual spring wage negotiations, known as “Shunto.” These negotiations have gained increasing attention in recent years, as the Bank of Japan (BoJ) emphasizes wage growth as a key indicator of its desired “virtuous cycles” between wages, inflation, and spending. Such cycles would support the BoJ’s case for tightening monetary policy.

Ahead of the national-level wage outcomes, investors closely monitor the results from major labour union groups, with RENGO being the largest. RENGO provides several preliminary reports before its final one, allowing investors to gauge wage growth trends throughout the process. This year, the preliminary results have been very encouraging. For the first time in over three decades, the weighted average requested wage increase has exceeded 6%, as shown in below. Granted wage increases have also risen, reaching 5.5%. If the national-level figures follow the trends seen in RENGO’s reports, it would further strengthen the BoJ’s case for continued policy normalisation.

Japanese yields and the yen

The yen has surged against the US dollar this year, recovering much of the ground it lost in 2024, although a complete recovery has yet to materialize. This rally has largely been driven by rising Japanese yields, while US yields have fallen, making the yield spread more favourable for the yen. Several factors likely contributed to the increase in Japanese yields, including market expectations for higher BoJ policy rates, rising inflation in Japan, and a shift in investor sentiment towards the Japanese economy. These factors have helped strengthen the yen despite the broader global economic environment.

As shown below, the correlation between the USD/JPY exchange rate and 10-year Japanese government yields has weakened in recent months. This shift highlights an interim decoupling between US and Japanese yields, suggesting that the recent increase in Japanese yields may not have been directly influenced by the fall in US yields, as has often been the case in the past.

Asia’s US Treasury holdings

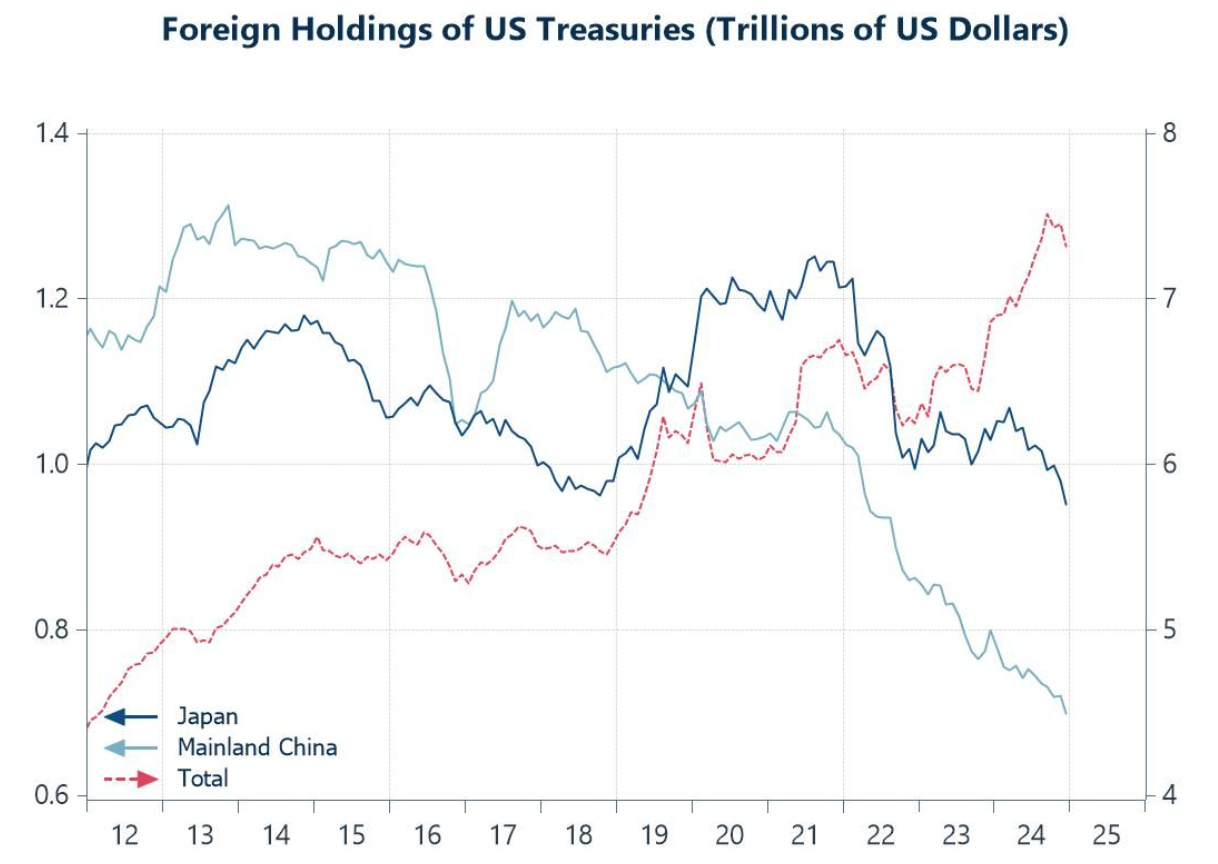

Recent trends in Asia’s US Treasury holdings highlight that Japan and China remain two of the largest foreign holders. As such, meaning any significant shifts in their positions can directly influence US yields. China has been steadily reducing its US Treasury holdings over the past decade, with more pronounced divestments since 2022. Japan, meanwhile, has seen a renewed wave of Treasury sales since 2024, marking a shift after a period of relative stability. Interestingly, despite these reductions from two of the largest Asian holders, overall foreign ownership of US Treasuries has continued to rise, suggesting that other buyers have more than offset these sales.

While the exact motivations behind China’s and Japan’s drawdowns remain difficult to pinpoint, several key factors could be driving these moves. These include efforts to stabilise domestic currencies against a strong US dollar, shifting expectations around US inflation and interest rate policy, concerns over the long-term stability of the dollar, or a broader strategic push to diversify foreign exchange reserves. Each of these dynamics has significant implications for global capital flows and the future trajectory of US bond markets.

Investing by Design : Bringing creativity, customisation, and precision to how you express your view. Join a limited readership and add our quantitative strategies to your investment pipeline.