All Things G

Due to travel, Macro Perspective’s commentary will resume on Monday. In the interim, a summary of what you can access via GRYNING.

GRYNING | Trader

Perfect for institutional investors and passionate retail investors who require active dynamical risk assessment and a comprehensive market analysis approach to trading and risk management.

Comprehensive daily & monthly reports highlighting indicators, scenarios, and distributions to identify the start of a new trend.

Daily 15-key-asset trend report.

Daily trend & turning point summary report for up to 100 assets.

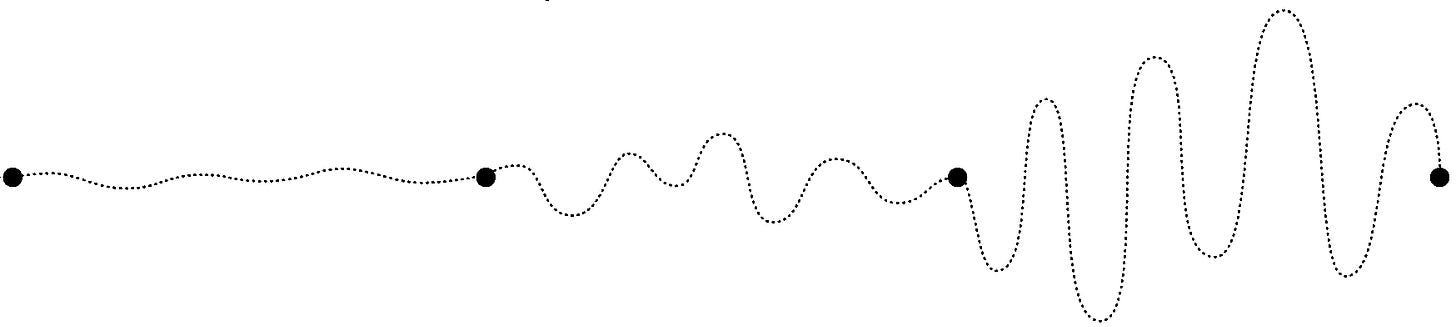

Monthly trend report (sample below) highlighting macro trades/trend signals.

Our analysis contains scenarios for future price developments and forecasting.

Trade Idea’s → Sample Trade Idea

GRYNING | Quantitative

This is for traders and portfolio managers who want to hit the ground running with access to robust, institutional-grade daily, weekly, and monthly signals and trading strategies. Below is a list of offerings:

Market Signals for Position Traders (6 trading strategies & 4 asset allocation models).

TEN strategy rules for sale; robust & not data-mined.

More Information & Latest Report

GRYNING | Valuation Model

Through leading research and analytics, our Valuation Model gives investors insight into factor performance, themes, and other observations within a company or industry - delivering a simple and transparent model and a measure of true valuation for value and growth investors.

SUPERIOR TO TRADITIONAL MEASURES OF PROFIT: PRV cuts through accounting distortions and charges for the use of capital.

STYLE AGNOSTIC: Provides an unbiased view of Quality, Value, and Growth investment opportunities.

LEADING INDICATORS: PRV Metrics provide information that can be tied to future share price performance.

CONSISTENT, TRANSPARENT FRAMEWORK: Comparable across “all” companies, industries, and countries.

GLOBAL COVERAGE: Coverage spans 21,000 companies globally, with historical data going back two decades.

More Information & Latest Report

If in doubt, send me an email, think about this: it’s better to have access to one of the services above and maybe not end up using each and every single snippet than to not have access — and end up missing a major risk or opportunity.