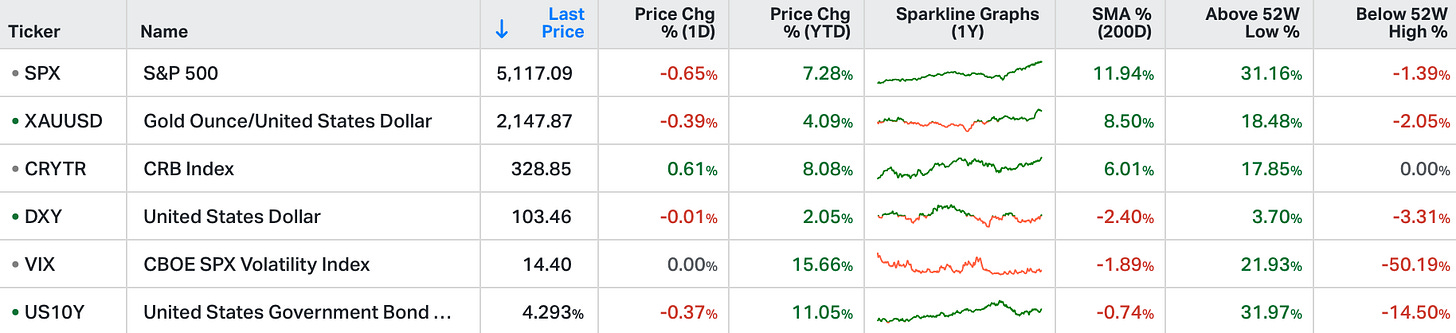

US stocks closed lower on the second session on Friday, the first triple witching of 2024, with the S&P 500 down 0.6%, the Nasdaq fell 1% and the Dow Jones lost 190 points.

Stocks saw a volatile session marked by a significant options expiration and a major tech sell-off, with investors awaiting the Federal Reserve's decision this week.

The tech sector dragged the most, led by decline in shares of Microsoft (-2%), Apple (-0.2%), Amazon (-2.4%) and Alphabet (-1.5%).

Nvidia ended slightly lower after losing 3.2% on Thursday.

On the earnings front, Adobe sank 13.6% after its quarterly revenue guidance disappointed.

In the first week of March, amidst much fanfare, the Nikkei, the Nasdaq and bitcoin (digital gold to its devotees) all soared to new highs.

But the bull market fewer people are talking about is the one in actual gold. It has also reached a new high in dollars of $2,150 per ounce and is trading at all-time highs in every other currency. So what’s behind the ascent? Perhaps it’s not so much that these assets are going up, but that fiat money is going down.

If you wanted one asset to express concerns about financial stability, inflation volatility and financial repression – gold might well be it. And, despite the new nominal highs, gold is still around 50% below its inflation-adjusted price peak in 1980.

Remarkably, gold has achieved its new high despite huge outflows from exchange-traded funds (ETFs) of around 30 million ounces or $60 billion (chart below). That tells you this gold bull market isn’t being powered by retail investors, wealth managers or advisors. A recent Bank of America survey found that 75% of advisors had less than 1% of their portfolios in gold and less than 10% were considering increasing their positions, the lowest interest since 2017. Instead, these types of investors have preferred the allure of the new bitcoin ETFs. At roughly $60 billion, these funds have grown (in the space of a couple of months) to about half the size of the gold ETFs, which have been around for 20 years.

So who has been buying gold?

Precious metals have three types of buyers: central banks and emerging market savers; investors; and jewellers. Forget jewellers, the first two move the price. Since the full-scale invasion of Ukraine, central banks and emerging market savers have been mega buyers of bullion, but they don’t buy ETFs or stocks. Meanwhile, as interest rates rose, gold came to look expensive relative to the dollar, real yields or cash rates, so investors have not been buying, leading to outflows from ETFs and miners.

But perhaps that’s the wrong thing to focus on. Are we in fact in a new era of price insensitive, strategic buyers taking ounces out of the market which will never return? Foreign central banks are not trading gold for a 10% move, they are fundamentally underpinning their currency and diversifying away from US Treasuries. The western banking system could be a dangerous place for anyone who might one day be deemed a bad actor by capricious authorities – much safer to have bullion where you can access it.

This is a bull market nobody cares about… yet. In particular, gold equities have become an investment backwater, down 5% year to date and 53% from their highs of 2011 or 35% below the highs of 2021. They are shunned due to a history of poor capital allocation and ESG concerns. As a result, US listed miners have a combined market cap of some $250 billion, around the same as Nvidia rose in one day the last time it reported earnings. Listed miners’ valuations are attractive and the stocks are naturally leveraged to a rising gold price.

If investors, spotting the sea change and the price momentum, now jump on the bandwagon – because interest rates come down, inflation goes back up or crypto goes pop – you could see fireworks.

Come the next crisis, if the monetary mandarins reach for the printing press again, few investors will feel they have enough gold.

Bitcoin's Wild Ride - Bitcoin's narrative has morphed into a thrilling roller coaster ride, powered by the launch of new spot ETFs and an insatiable market demand, pushing its value to unprecedented heights. Just as Bitcoin enthusiasts began to enjoy a respite from the usual economic headwinds, a stark reminder arrived: a hotter-than-expected CPI and PPI.

You can access the “Market Movers” section by becoming a free member below:

Gold is indeed a bull market that people are not talking about enough, probably because of the wild move in Bitcoin. But the central bank accumulation of Gold amid a resurgence in US inflation and heightening geopolitical tension is one of the most interesting macro themes out there in my opinion.