On Monday (click here) we looked at a couple of key levels for stocks that looked like a valid spot for a relief rally.

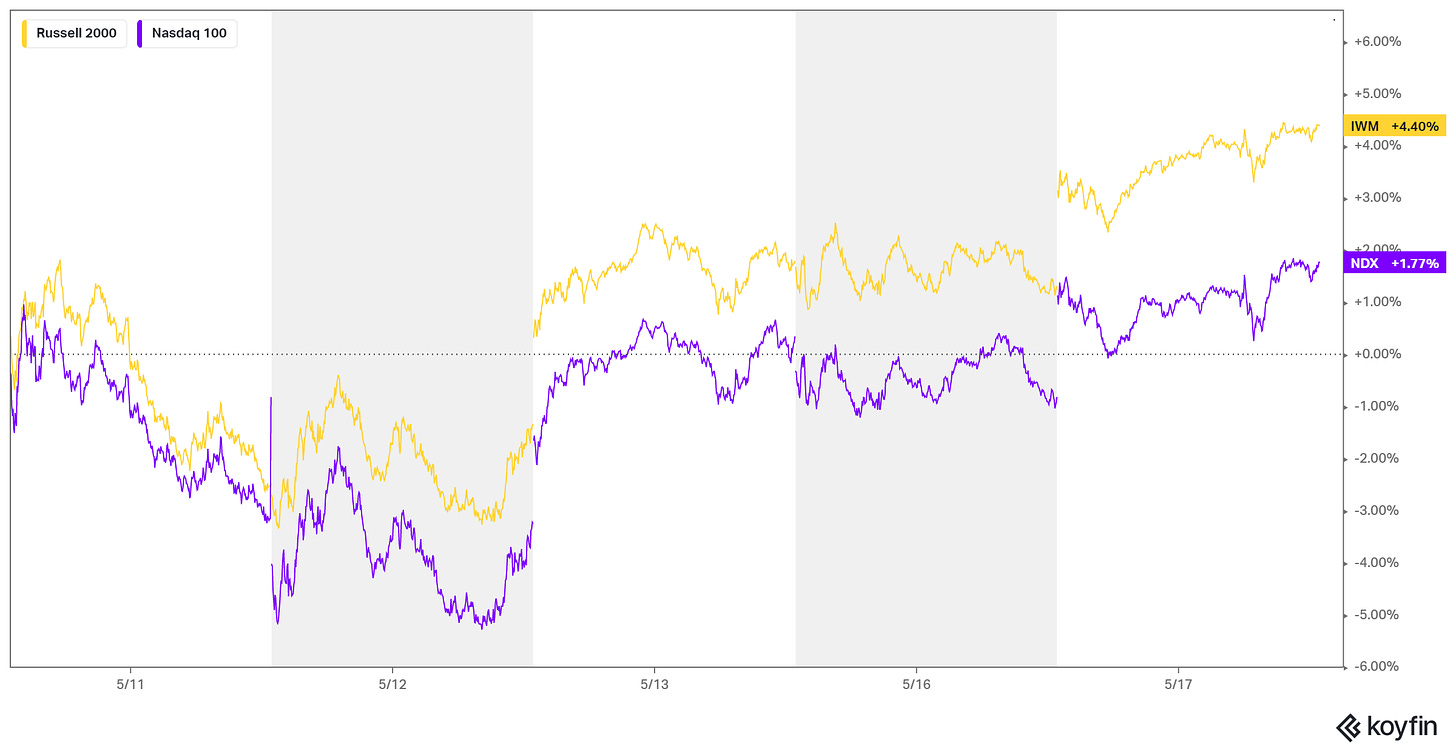

We hit a 50% retracement in the Nasdaq, from the pandemic lows to the post-pandemic highs, on Thursday (hit it on the nose). It bounced, and we've since had three days of higher highs for a near 8% bounce.

We also fully retraced to pre-pandemic levels on the Russell 2000 (small caps) - that too, has bounced for 8%

Is it the greenlight for the broad stock market? Very unlikely. The Fed appears to be using stocks as a tool to "bring demand down", and they are doing it through tough talk, or as they call it, "forward guidance."

For fourteen years, the Fed (and global central banks) used this tool of promises and threats to manipulate stocks higher, to induce confidence, paper net worth, and therefore, demand. Now, it looks like we're seeing this strategy in reverse.

With that, yesterday, in the face of a nice three day rally for stocks, (Fed Chair) Jay Powell was interviewed as part of a Wall Street Journal event, where he hammered home this message ...

Again, those are the words we're hearing, but they aren't even projecting to end the rate cycle above what would be considered historically "normal" levels (which is around 3%) - much less anything near the current rate of inflation (above 8%).

Still, this continues to be framed by the Fed and the media as an "aggressive" posture by the Fed.

Contrast this with what former Fed Chair, Ben Bernanke, said during the depths of the financial crisis. When asked about the inflationary risks of QE, back in 2010, he said dealing with inflation is no problem, "We could raise rates in 15 minutes."

That would be an aggressive offense against inflation.