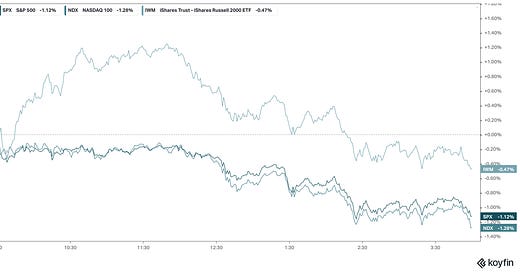

Stocks put in a technical reversal signal. It happened first in the dollar-denominated Nikkei (which was up 20% on the year, at the highs overnight), then in the Nasdaq (up 24% ytd at the highs), and finally the S&P also finished with a bearish outside day.

Small caps were bucking the trend on the day, up 1.3%, but reversed in the afternoon to close down on the day.

What's going on?

The noise about the debt ceiling continues, with speculation increasing about a June pause by the Fed.

But this looks more like profit taking on the artificial intelligence trade going into today's Nvidia earnings.

Nvidia is considered to be the leading provider of technology that powers AI, including ChatGPT. The stock has more than doubled since the beginning of the year, making it the sixth most valuable company in the world. Seven of the top ten are involved in AI (which, by market cap, is about a third of the S&P 500).

I suspect the markets are hoping for an earnings miss, from Nvidia, for the opportunity to buy it cheaper.

More on AI . . . My view: The automobile is to mobility, as AI is to productivity.

A productivity boom is coming, and it is well needed.

Productivity growth is the key to improving living standards. As ChatGPT says, "sustained productivity growth of around 2% per year has historically been associated with positive economic outcomes and improvements in living standards."

We averaged just 1% for the decade prior to the pandemic, and negative 0.7% since the fourth quarter of 2020.

Just as the 1920s were defined by innovation (the automobile and widespread access to electricity), we have the formula here for another "roaring 20s."

PS: If you find value in my notes, please share with those that you think will benefit from reading it.