Adjusting Up

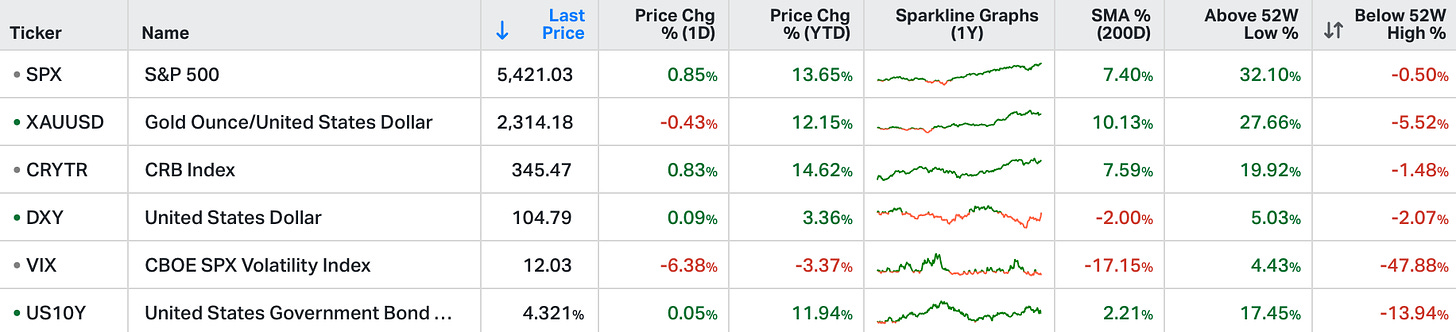

Stocks in the US finished mixed on Wednesday after the Federal Reserve left its funds rate on hold, as expected.

The S&P 500 added 0.8% and the Nasdaq Composite advanced 1.5%, both notching new record highs, while the Dow lost 35 points.

This hawkish revision came despite a softer-than-expected inflation report earlier in the day, with headline inflation unexpectedly dropping and the core gauge falling more than anticipated.

Tech shares led the session, as sharp gains for Treasuries lifted credit-sensitive sectors while energy, consumer staples, and utility shares lagged.

Among megacaps, Apple added 2.8%, Nvidia gained 3.5%, and Microsoft jumped 1.9%.

The monthly change in the May headline inflation data reported yesterday morning came in flat (no inflation). That was a positive surprise;

Stocks rallied.

Yields fell.

The dollar fell.

Commodities went up.

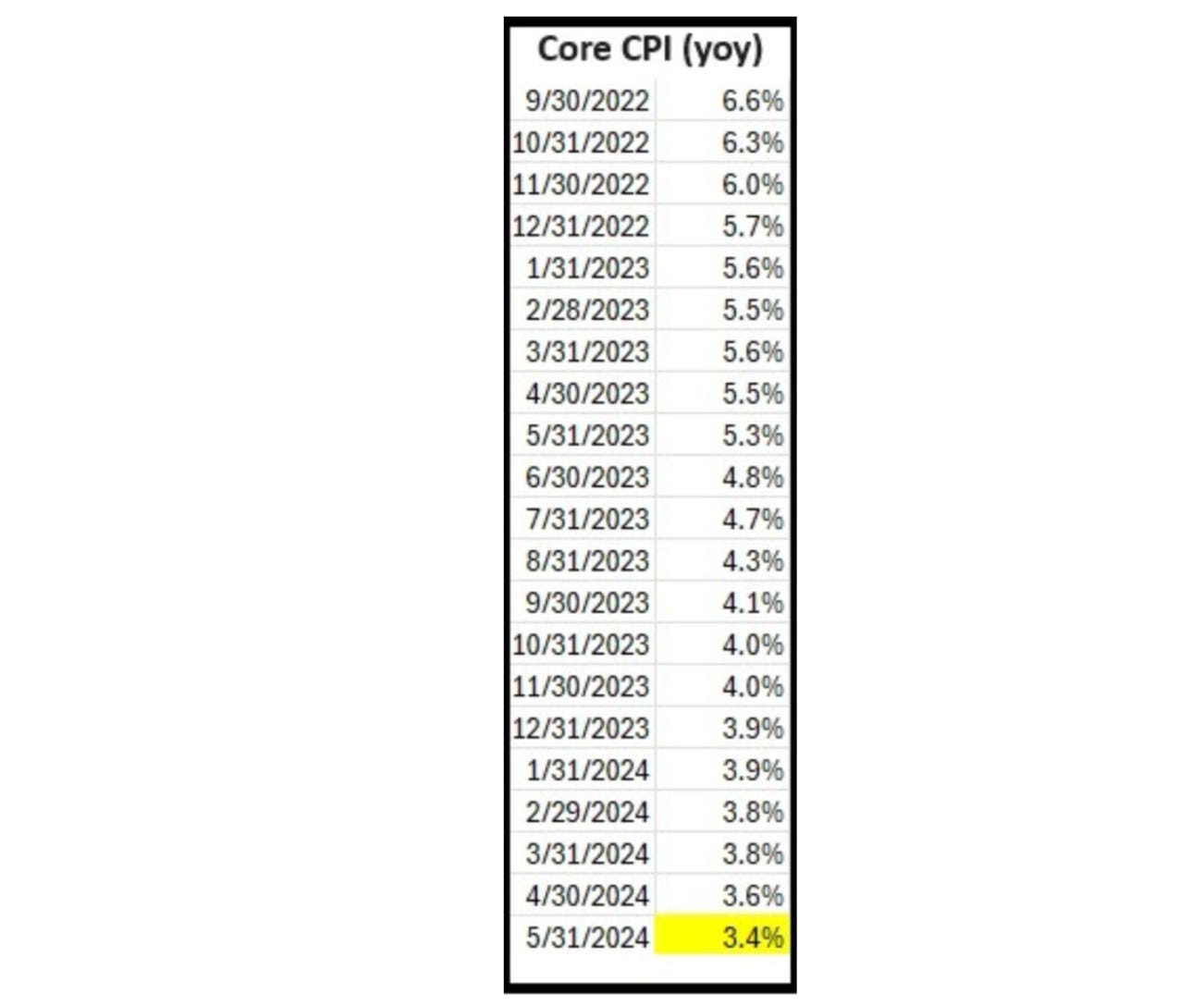

For a Fed that's been looking for "more progress" in the decline in the inflation rate, they're getting it. As you can see below, the core inflation rate (which excludes food and energy) has been in a very clean descent from peak levels ...

And as we've been discussing here in my daily notes, the two hot spots in the consumer price index have been auto insurance and owners' equivalent rent. But in May, auto insurance declined for the first time in 29 months!

Now, that's just a month-over-month change. It will take many more months for the year-over-year change in these two components to normalise due to the base effects of the calculation. With that, these two components are creating the illusion that inflation is "sticky" at higher levels.

We've looked at where inflation would be if we stripped these two components out of the CPI - it falls well below 2%. But a better analysis would be "normalising" the influence auto insurance and OER have on CPI, using pre-pandemic averages. If we do that, core CPI falls to 2.35%. Headline CPI falls to 2.25%.

This is quite a different reality than the greater than 3% number in the reports. This simply gives us insight into whether or not the Fed is sincere, when they say inflation is "still too high."

Well, they said it. Moreover, they crafted policy ("forward guidance") around that view, by adjusting UP the end of year projection for the Fed Funds rate from 4.6% to 5.1% - which implies just one rate cut this year.

So, that's 125 basis points of tighter policy than the market was expecting early this year. But as you can see in the chart below, the stock market has not been too concerned.

However, with stocks at record highs, perhaps the Fed IS concerned about giving the green light to markets (at this stage) to price in an easing cycle.

PS: The Practical Frameworks for Financial Markets course has taken shape and the syllabus finalised. Course material, tradingview codes, & the private twitter feed will be sent out to members on 01 July 2024. For more information and to register your interest, please send me an email at a.karlsson@gryningcapital.com