About Demographics

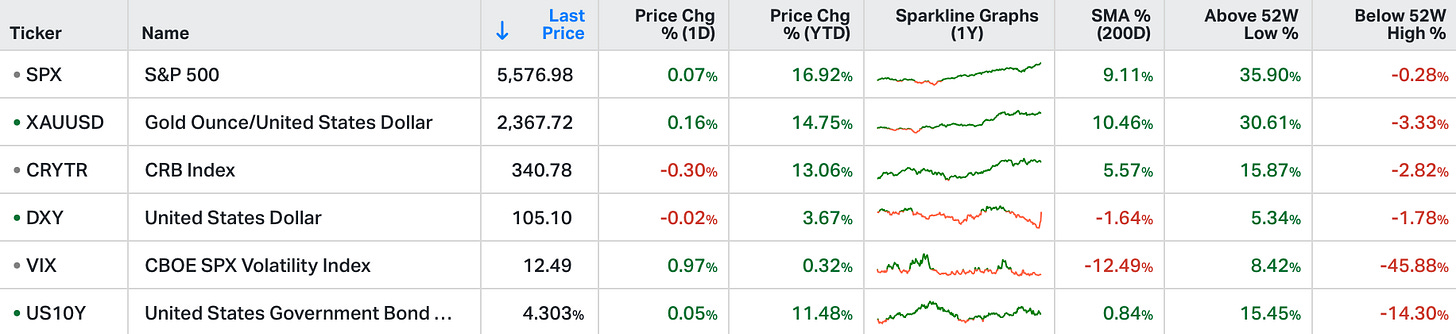

The S&P 500 and the Nasdaq both extended their record highs on Tuesday, adding 0.1% each, while the Dow Jones closed 52 points lower after Federal Reserve Chair Jerome Powell's testimony before the Senate.

He noted that the central bank is getting closer to considering interest rate cuts and expressed optimism about signs of cooling inflation, stating that "More good data would strengthen our confidence that inflation is moving sustainably toward 2%."

Among megacaps Nvidia rose (2.4%), Tesla marked a 10-day winning streak, jumping 3.7% and Apple gained 0.4% to become the first U.S. firm to surpass a market cap of $3.5 trillion.

Conversely, Microsoft fell 1.4%, and Salesforce lost 1.8%, putting pressure on the Dow.

Key CPI and PPI data are also due this week while the earnings season is about to kick off.

The Fed Chair gave testimony to Congress yesterday. He was careful not to send the market a signal on the timing of a rate cut.

But as we’ve discussed, the Fed has told us a condition for a policy response (i.e. a rate cut) - it's any "crack" in the labor market.

And with that, the unemployment rate in June ticked UP to 4.1%. Additionally, importantly, the rate-of-change in the unemployment rate since the cycle low 14-months ago is at a pace consistent with the past four recessions, and (related) consistent with a Fed easing cycle.

Now, interestingly, the San Francisco Fed released a study on the effect of immigration on the jobs data.

To put it simply, based on the CBO's high immigration scenario, the study says, in the short run, the economy needs to grow jobs by 230k a month to keep the unemployment steady. If we look back at the first seven months of last year, when the unemployment rate was holding steady, the job creation averaged 253k a month (higher than the study estimates).

That number has averaged only 212k since August of last year, and the unemployment rate has jumped from 3.5% to 4.1%.

What was clear in the discussion between Jerome Powell and the Senate Banking Committee, is that the Fed hasn't had a handle on how the mass immigration of the past three years has effected the labor supply. This recent study would suggest the supply is bigger than they have assumed. That's why the unemployment rate is rising, despite what looks like solid job growth.

In the end it’s always about demographics and there are indeed cracks in the labor market.