A Technical Correction

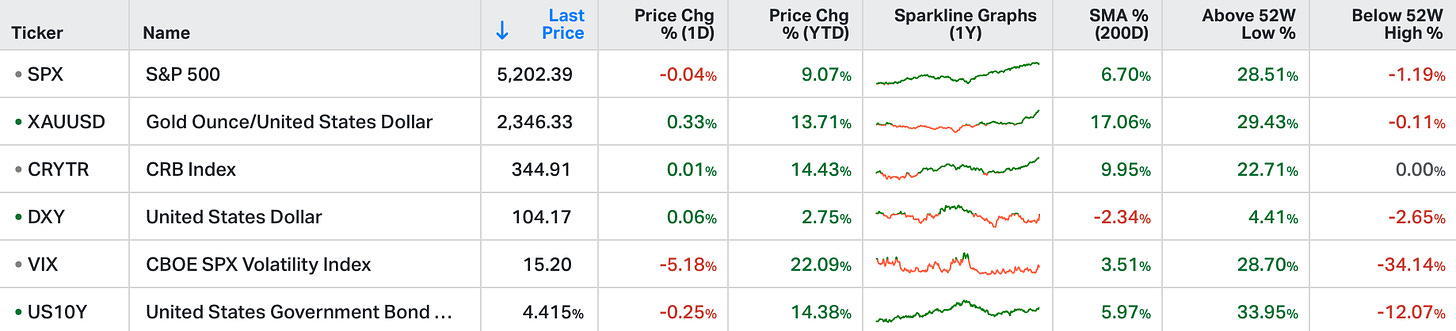

US stocks closed muted on Monday, with investors gearing up for a busy week that includes key inflation data and the start of first-quarter earnings season.

All the three major averages finished near the flat line as the S&P 500 and the Dow Jones booked marginal losses, while the Nasdaq ended 5 points higher.

Earnings season kicks off on Friday with quarterly results from JP Morgan, Wells Fargo, Citigroup, and Blackrock.

Real estate, consumer discretionary, and financials were the top performing sectors while health dragged the most.

Among stocks, Tesla gained 3% after Elon Musk announced the company will unveil its new robotaxi in August.

Let’s build on our conversation from last week, the market has gone from anticipating as many as seven quarter-point rate cuts this year, to five, to three. Meanwhile the Fed has telegraphed three cuts, with some members chattering about the possibility of two, then one. And most recently, the possibility has been floated of maybe none/ no rate cuts this year.

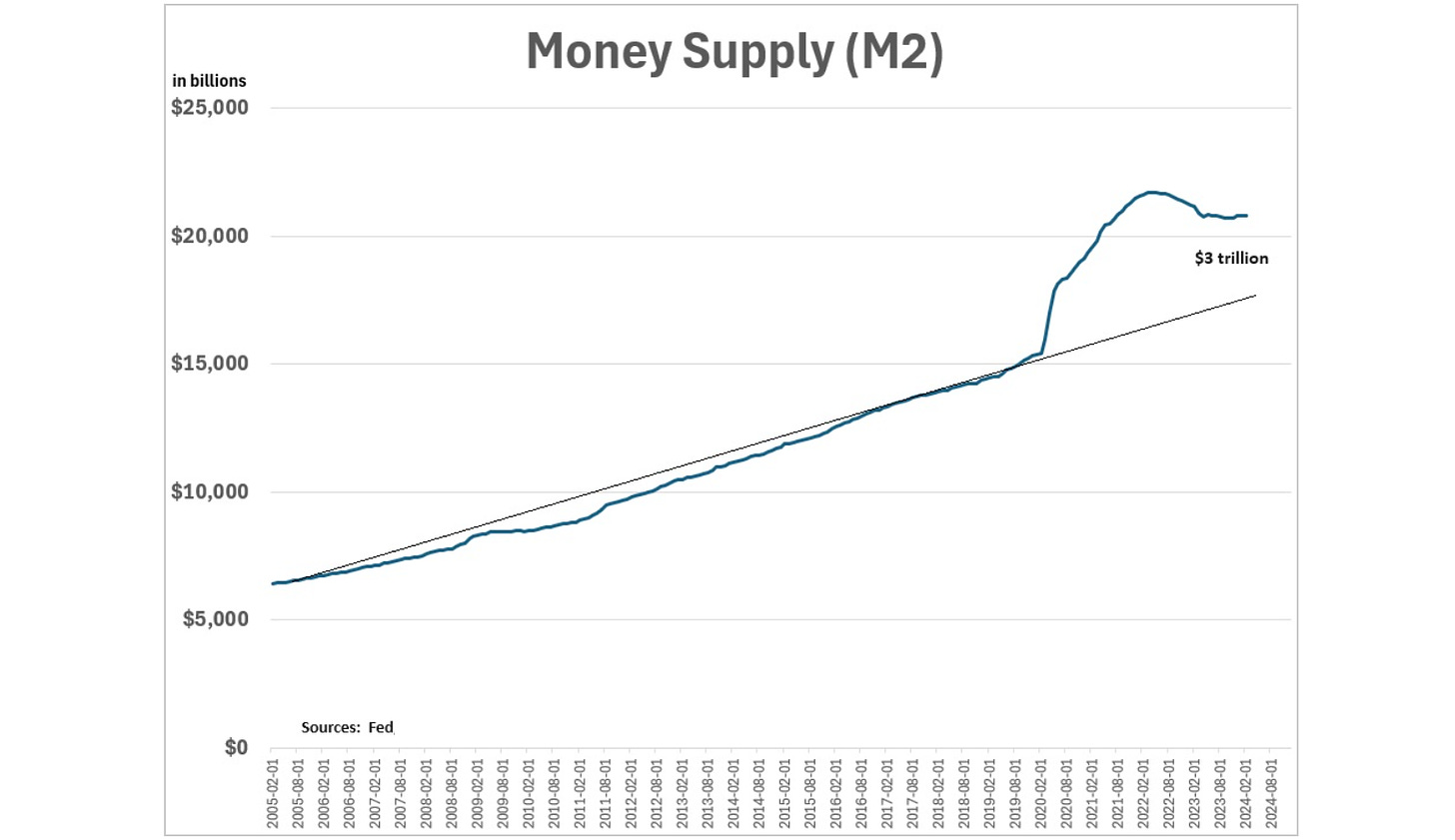

Meanwhile, little attention (still) is given to the fiscal spending side. Jamie Dimon emphasised it in his annual letter. He noted "the economy is being fueled by large amounts of government deficit spending and past stimulus." On the latter, we've been looking at this chart of money supply …

The massive monetary and fiscal response to the pandemic (plus the subsequent agenda spending binge) ramped the money supply by 40% in just two years - that was almost ten year's worth of money supply growth dumped onto the economy over just two years.

The money supply remains trillions of dollars above trend. Biden's proposed 2025 budget would require printing another $1.8 trillion.

While the rate of change in prices has slowed, those trillions of dollars in excess money supply have underpinned the nominal price of stuff. That goes for GDP (the total market value of economic output), and that goes for the nominal revenues and earnings of companies.

With that, we kick off Q1 earnings season later this week, with the big banks. Despite the backdrop we've just discussed, corporate America has spent the past three months dialling down expectations on Q1, lowering the bar so they can step over it.

Earnings growth estimates for the S&P 500 have been lowered to 3.2% year-over-year growth (from 5.7% heading into the quarter). Keep in mind, that was in a quarter where the economy is expected to have grown at an annual rate of about 2.5% (a strong pace). So we enter another earnings season with the set up for positive surprises.

Before the banks report on Friday, we'll get March CPI on Wednesday. Jerome Powell laid out conditions in his post-FOMC press conference last month, that would warrant starting the easing cycle:

unexpected weakening in the labor market,

the continued trend of falling inflation, toward the target and/or,

any stress bubbling up in money markets (i.e. a liquidity shock).

Conditions one and three aren't showing stress. Condition two - it seems unlikely that the March inflation report will show progress on falling inflation.

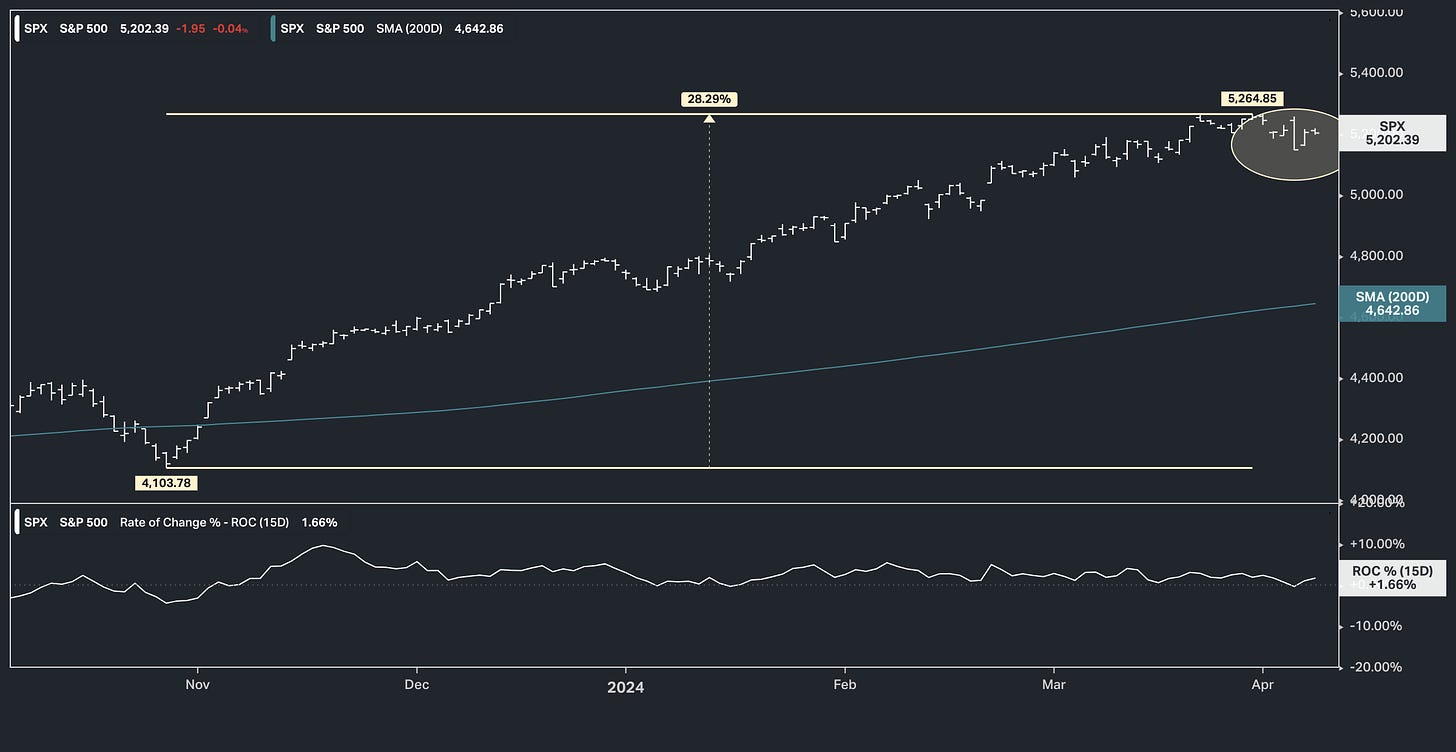

With all of this in mind, we enter the week with the set up for a correction in stocks. As you can see in the chart below, we've moved up nearly 30% in five months, since Jerome Powell signalled the end of the tightening cycle in October.

And last week, as we discussed, the S&P futures put in a technical reversal signal (an outside day). So did the Russell 2000, the Dow and the German stock market (DAX futures).

It looks like a technical correction is underway. If so, the appetite to buy the dip, particularly in the AI theme, will be very healthy.

Stay informed on Gryning’s latest market insights and portfolio allocations.