Let's take a closer look at Europe;

We ended last week with G7 countries threatening price caps on Russian energy exports.

Putin responded by taking the Nordstream 1 pipeline offline, indefinitely (for "maintenance").

OPEC has responded with cuts to production, not an increase.

Iran seems to understand its position of strength in negotiating on nuclear energy with the West (i.e. likely a no deal).

The result: The energy crisis is developing rapidly.

What's the answer? The Western world will go back to the playbook of intervention (manipulating markets) - by the end of the week, we may have broad subsidies across Europe to freeze consumer energy prices

It won't come cheap.

Yesterday morning, the new UK Prime Minister led the way announcing such a plan, estimated to cost over 100 billion pounds. Europe is said to be looking at spending close to 400 billion euros.

So, more deficit spending in a euro zone with particularly fiscally fragile countries. And subsidizing prices, while maintaining demand, in a supply constrained world, will only drive energy prices higher and higher, and therefore drive the price tag of subsidization higher and higher.

With that, we should be on high alert for a sovereign debt crisis in Europe - pressure is building in the weak spots, Italy and Spain.

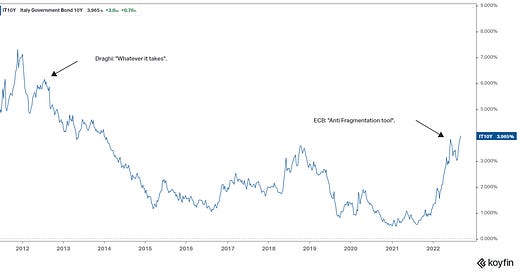

Let's take a look at the chart of the Italian 10-year government bond yield ...

Back in July of 2012, in a zero interest rate world, yields on Italian bonds had soared to 6%-7%+ - Italy was effectively insolvent (Spain, too).

Draghi vowed to do "whatever it takes" to save the euro, and to maintain stability and solvency in the eurozone. He vowed to buy unlimited Spanish and Italian debt - that was good enough to run the bond market speculators off. Yields fell sharply, and stability was restored without Draghi (the ECB) having to buy a single bond.

Fast forward 10-years, and again, a sovereign debt crisis was building back in June, after the ECB announced they would end QE and start hiking interest rates.

Yields spiked on Italian bonds to 4.25%. That was enough to make the ECB balk. They responded with a new plan (same as the old) to buy bonds of the weaker euro zone constituents to defend against "fragmentation" (i.e. an implosion of the eurozone).

Here we are again. Yields are on the move, at around 4% in Italy, and with plenty of fundamental reasons (near record debt, near record deficit spending, multi-decade high inflation and political instability, to name a few). This time, it looks like the ECB will be tested. They will be printing a lot of euros (with the euro already at twenty-year lows against the dollar), and they will be buying a lot of overpriced bonds to keep a lid on government bond yields (interest rates) in Europe.

All this comes as the ECB is actually expected to raise rates by 75 basis points on Thursday!