Stocks in the US closed higher on Monday as investors brushed aside concerns about interest rates to concentrate on the potential of advancements in artificial intelligence ahead of the Federal Reserve rate decision.

The S&P 500 rose 0.6%, snapping 3-day losing steak, the Nasdaq added 0.8%, and the Dow Jones ended 74 points higher.

Nvidia also advanced 0.7% ahead of its developers' conference.

Tesla's shares surged 6.3% following the company's announcement of price increases for its Model Y electric vehicles in some European countries and the US.

Conversely, Boeing pulled back by 1.5% amid persistent security concerns.

It's a big week. Nvidia kicked off its annual developers meeting yesterday afternoon. We have the Bank of Japan overnight. The Fed determines policy on Wednesday.

Let’s build on where we left off last week. There has been a clear effort by the Bank of Japan (BOJ) over the past several months to start setting expectations in markets that they will exit emergency level policies - a broader shift away from unorthodox monetary easing. There was talk that they might end negative interest rates. Yesterday, the Nikkei Asia (a Japanese news source) suggested they will also end yield curve control and ETF purchases.

While they would continue with QE, this would be an aggressive exit from a very long period of ultra easy monetary policy.

Given the fragile nature of global financial markets, and the very deliberate telegraphing of policy moves made by the Fed and other major central banks for much of the past 15 years, this seems like an unnecessarily abrupt move by the Bank of Japan. It would create risks to global liquidity at worst, and global market stability and confidence at best.

Keep in mind, the major central banks of the world have coordinated policies and worked as partners throughout the crises of the past 15 years (they talk a lot). With that, we should expect the Bank of Japan to be reluctant to cause any disruption in global markets.

On Nvidia: As we've discussed here in my daily notes, since its May earnings call last year, Nvidia has become the most important company in the world. When Jensen Huang speaks, founder/CEO of Nvidia, he's educating the world on the evolution of generative AI, and (as he calls it) the "rebirth of computing."

Yesterday he did so to an arena full of the world's leading technologists. He announced Nvidia's new chip and says it will be the most successful product launch in the company's history. Keep in mind, this is a company that nearly quadrupled in size over the past year, growing quarterly revenue by $16 billion (year-over-year).

Additionally, Huang has said the future of accelerated computing is where "the digital world meets the physical world." He talked more about this with Nvidia's Omniverse technology to power it, and it will reshape $100 trillion worth of global industry.

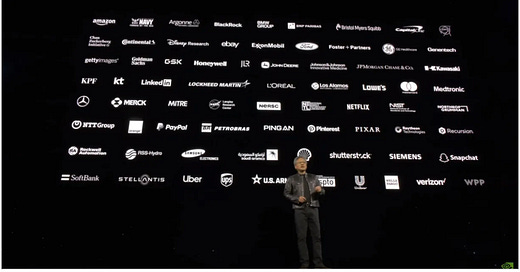

Importantly, the richest and most powerful companies in the world are spending billions of dollars a quarter on Nvidia's AI chips, and partnering with Nvidia on projects ranging from infrastructure to research, to applications. They are all-in and so is (virtually) everyone else. These are companies collaborating with Nvidia ...

It's a new industrial revolution. And it's still very early.

AI-Innovation Portfolio Summary

Enjoy a balance of income and growth.

Diversify from cyclical property exposure and the technology sector.

Own pure physical assets backed by long leases and a broad customer base.

AI-Innovation Portfolio started with a focus on AI infrastructure stocks. These are the "picks and shovels" of this technology revolution. We've since added massive SaaS companies that will deliver the capabilities of generative AI to companies around the world.

Picks & Shovels | The Bedrock of Digital Growth

As investors chase returns in the tech titans, the infrastructure that underpins the technology mega trends is under-owned and offers a valuable blend of growth potential and defensive characteristics.

The Portfolio offers pure exposure to the most valuable physical assets that sustain the world of AI, e-commerce, gaming and social media, including data centers, communications towers and logistics hubs through a selection of listed securities. The world has changed: the way we work, the way we shop, the way we play. And now everything is stored in the cloud. Back in 2010, humanity had created one zettabyte of data. Over the next decade explosive growth in social media and streaming came along and we were at 60 zettabytes.

This has created demand for more and more data center capacity. Tech platforms need this capacity in proximity to big populations, so they either build it themselves or rent it. But it’s becoming much harder to build due to the constraints on power supply and access to the hyper fast fibre optic networks, so the existing companies in this space are very well placed.

The same dynamic is driving the slow but steady rollout of 5G infrastructure worldwide. The acceleration in demand for data is staggering, as exemplified by ChatGPT reaching 100 million users in only two months.

This places owners of telecommunications infrastructure in a sweet spot - with the towers, one is able to invest in concrete and steel owners. When you get a tenant on it and the tenant is a mobile network operator, you have a profitable tower. And when they want to upgrade to 5G that just adds more dishes, which adds more rent.

This “picks and shovels” approach avoids many of the pitfalls of conventional commercial property investment. There are no legacy buildings and there’s little exposure to the tech cycle. They own the space, not the servers or the dishes on towers, or the robotics in a logistics center. Even the electricity is almost always a pass-through cost.

Large tech platforms also invest in their own infrastructure but, because of the need for proximity to customers and limitations on new developments, they also rent space from the existing owners of data center sites and logistics facilities, where the requisite power access and fibre networks are already in place. So whilst some of the cloud providers are competitors to the companies, they are almost always customers too, renting prime space on long leases.

The positive outlook for digital infrastructure is validated by the private equity activity in recent years, attracted by the same balance of reliable income and potential growth. The difference with our portfolio is that it’s a diverse set of best in class investments across the whole space, whereas investing via a private equity route you are probably exposed to more concentration in terms of specific assets, and thus more risk. The portfolio only invests in developed markets and uses a bottom-up fundamental approach to stock selection.

Here's how you can join…

The AI-Innovation Portfolio is about allocating to HIGH-GROWTH.

For £450 per quarter (£150 per month) or £1350 per year (£112.50 per month) you'll gain exclusive access to my in-depth research, expert analysis, and timely investment recommendations focused on the generative AI revolution.

You can join by clicking on the link(s) below and then keep an eye out for Welcome and Getting Started emails from me.