We started Friday by discussing the very well placed Fedex warning.

Not only was it unnecessary to pre-announce seven days before a scheduled earnings call, but moreover, the Fedex CEO thought he needed to deliver a warning on the global economy.

Again, this act looks like it may have created cover for the Fed to under-deliver this week. If that's the case, we'll probably have more tumult for markets going into Wednesday's Fed decision (BoJ, SNB, and BoE will be announced on Thursday).

Anything less than 75 basis points combined with a zealously hawkish tone would be a positive surprise for markets.

That's a big event ahead. Let's talk about the bigger event ahead—the November elections.

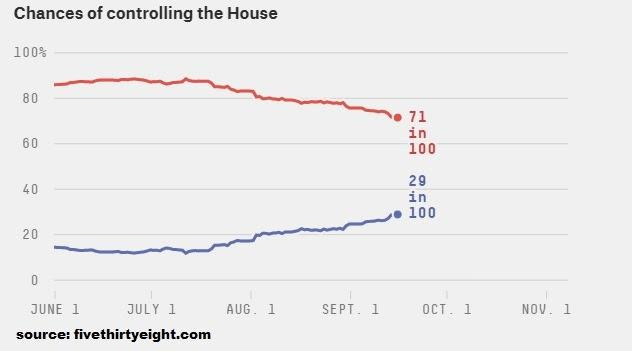

Below is a look at the model projections from FiveThirtyEight.

A 71% chance of a Republican-led House after November 7.

71% chance of a Democrat-led Senate.

This is in-line with the averages from the national polling (which puts the U.S. at a 67% chance of a Republican-led House and a 65% chance of a Democrat-led Senate).

What do the betting markets look like? The oddsmakers like about a 47% chance of a split Congress and a 33% chance of a Republican sweep. Three months ago, the betting markets were pricing in a 75% chance of a Republican sweep.

A split Congress would introduce gridlock into what has been run amok or destructive policy making in DC—that would be good for markets.

The Gryning Times Portfolio | Week Starting September 12, 2022.

The portfolio is a reflection of the views expressed in my daily Macro Perspectives. Please consider subscribing for up-to-date and timely portfolio allocation changes.