A History of EUR Spikes

US stocks closed lower on Tuesday, amid trade policy uncertainty.

The S&P 500 lost 0.7%, following a 1.5% drop earlier, while the Dow declined by over 450 points and the Nasdaq 100 fell 0.2%.

Airlines were hit hard, with Delta falling 7% after slashing its earnings forecast due to weaker US demand, while Disney and Airbnb dropped 5% each.

Investors are now focused on Wednesday’s CPI report for further market direction.

Investors should add quantitative strategies to their investment pipeline by clicking → Investing by Design

Let's take a look at a few charts ...

Below, we have 15-day rolling periods of the S&P 500 futures, measuring the day-15 low against the day-1 high, and comparing the span of the move relative to other 15-day rolling periods.

As you can see to the far right, this recent decline is just over 10%.

It's not an infrequent occurence over this 28-year history. But if we look back at the recent history with this degree of decline, we can find it with the carry trade unwind last year and the UK and European bond market stress in 2022.

Now, we've talked over the past week about the debt deluge Europe is signaling. Despite risking another European sovereign debt crisis with the plans for an 800+ billion euro spending spree, the euro went UP (and big).

This is the full history of the euro, since its inception in early 1999.

As you can see, the greater than four percent 5-day rise in the euro (highlighted in the yellow circle) has only happened six other times.

Moving from left to right on the chart;

December of 2000 - Less than two-years into the existence of the euro, it had lost 30% of its value (relative to the dollar). There was a crisis of confidence in the euro, and global central banks came in, in coordination, to prop it up.

December of 2008 - It was largely due to dollar weakness, as the Fed slashed rates to zero following the failure of Lehman.

March of 2009 - The Fed started buying Treasuries in response to the Global Financial Crisis.

August of 2015 - Driven by China's surprise currency devaluation.

March of 2020 - That was the Fed and U.S. government covid response (dollar lower, euro higher).

November of 2022 - This was the blow-up of the crypto firm FTX.

So, the observation from these six rare spikes in the euro: these moves in the currency all align with very significant events.

With that, we now have this recent sharp spike in the euro, and it's associated with the European Commission's announcement of massive fiscal expansionary policy – another very significant event.

Will this fiscal plan be a growth catalyst for a stagnant European economy? Or will it trigger another episode of chaos in European government bond markets, and thus another rescue effort by the European Central Bank. In the case of the latter, the future of the euro would be in question.

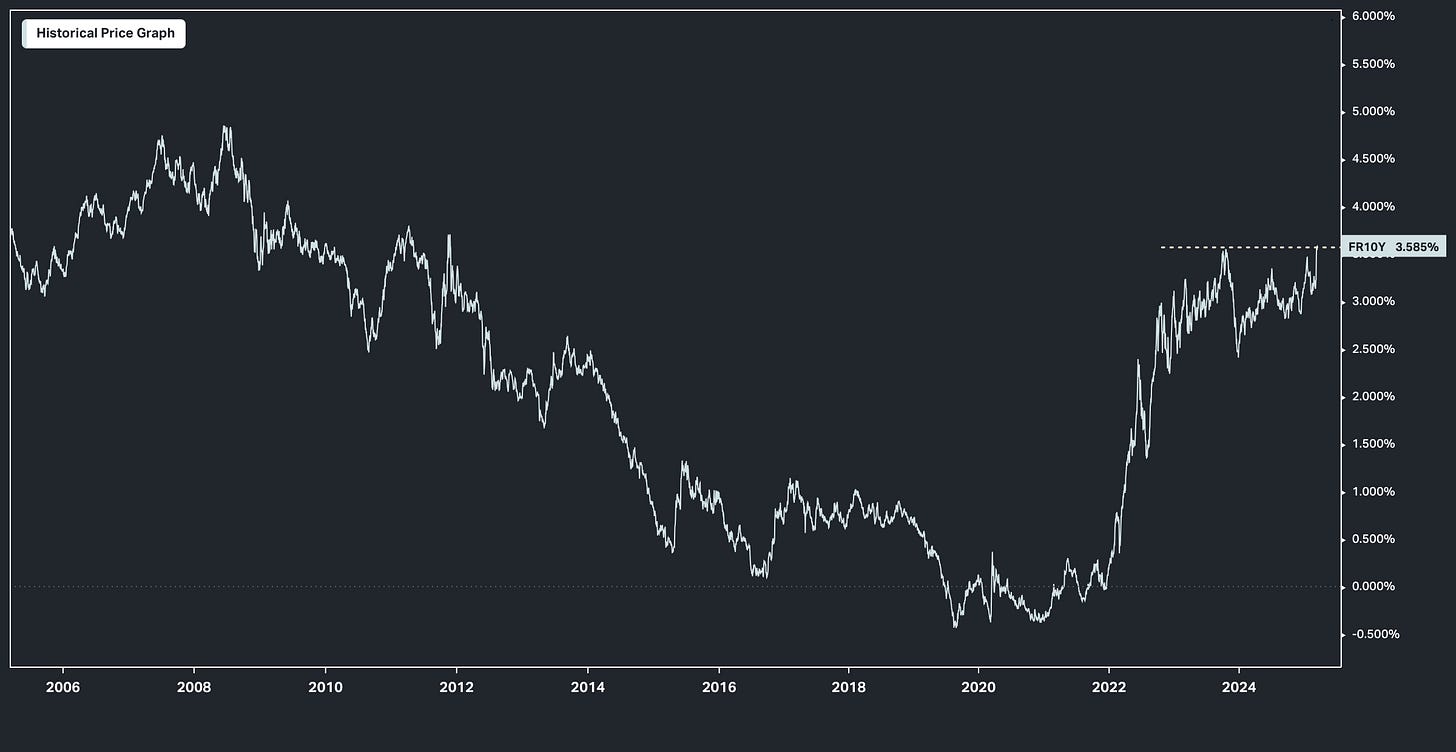

With that, this chart is the one to watch. A break higher in the French 10-year yield, from here, would likely turn market attention to the weak spots of the euro zone bond markets ...