A Good Story

US equities closed lower on Wednesday as investors took profits after strong November gains and assessed the latest economic data.

The S&P 500 and Dow Jones retreated from the record highs reached in the previous session, dropping 0.4% and 0.3%, respectively, while the Nasdaq 100 saw a steeper decline, losing 0.8%.

October’s Personal Consumption Expenditures index, the Fed's preferred inflation measure, rose 0.2% (2.3% YoY), and core PCE increased 0.3% (2.8% YoY), meeting forecasts but suggesting progress toward the Fed's 2% target has stalled.

Weekly jobless claims fell to 213,000, and Q3 GDP growth held at 2.8%, underscoring economic resilience.

Markets now anticipate a 34% probability to the Federal Reserve keeping rates unchanged at its December meeting, up from 24% a month ago.

The market needs another positive story. Some people understand that the old stories are fading away, and the new stories will not only serve as drivers of equity returns but may also disentangle humanity from conflicts.

Since its Thanksgiving, here are 4 short stories, and if you make it to the end, an offer for you to consider.

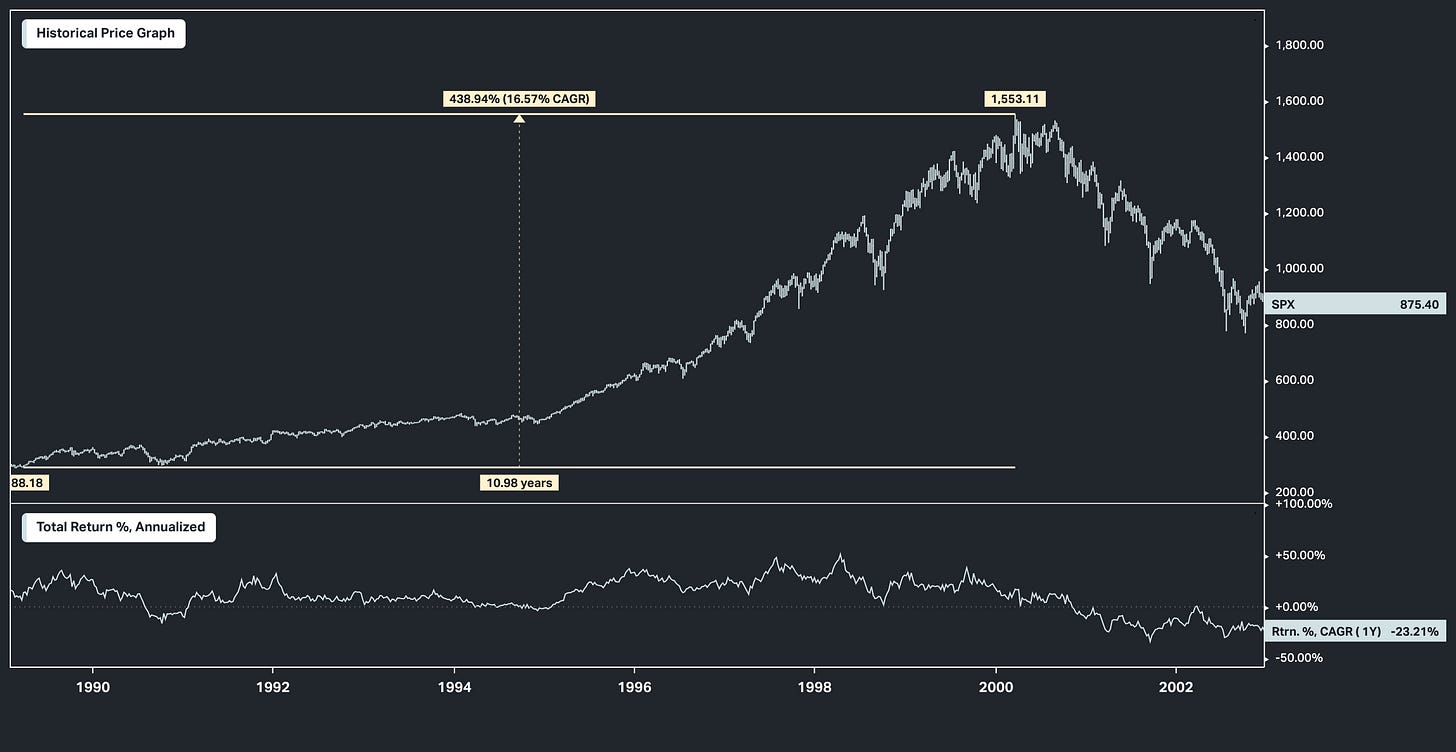

Information highway and globalization

The information highway narrative and globalisation drove a dynamic uptrend with gains of about 440% in the 1990s. Although the stock market greatly benefitted from the development of the Web and globalisation, the main beneficiary was China, which grew to challenge the hegemony of the USA. After this regime ended with a crash, reality sank in.

China win-win

The assumption that globalisation and free trade with China would be a win-win arrangement ended with the 2008 financial crisis. The Chinese pegged their currency to the dollar and applied capital controls. The result was the accumulation of huge surpluses that were invested back in the US. The resulting liquidity kept interest rates low, leading to the real estate crisis and a stock market crash after gains of about 120%.

Quantitative easing, cheap money, EVs and green energy, and crypto

After the reality about a win-win arrangement with China sank in, the solution was quantitative easing in conjunction with a story about climate change, electric vehicles, and a new digital economy driven by cryptocurrencies. After extraordinary gains of about 800%, inflation got out of control due to a long period of interest rates at 0% and the refusal of the central bank to hike interest rates, which was justified with a “transitory inflation” narrative.

AI

As the market crash was about to accelerate, a new story appeared: artificial intelligence and the road to an accelerated abundance. In conjunction with a promise of low rates, the stock market rebounded, and it has gained about 70% since the bottom of October 2022.

An Offer to Consider: Three Strategy Rules plus access to GRYNING | Research!

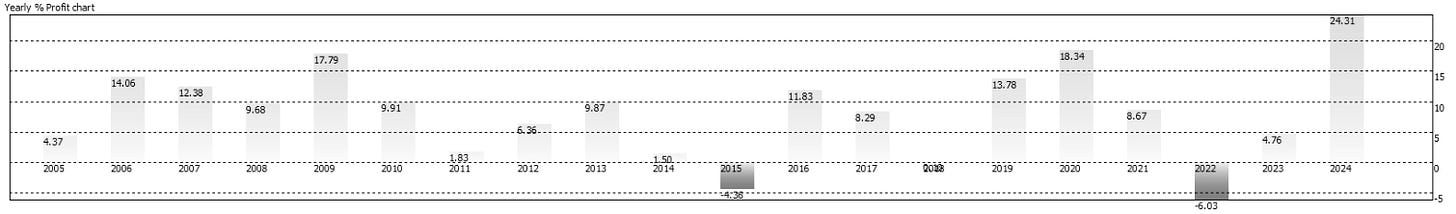

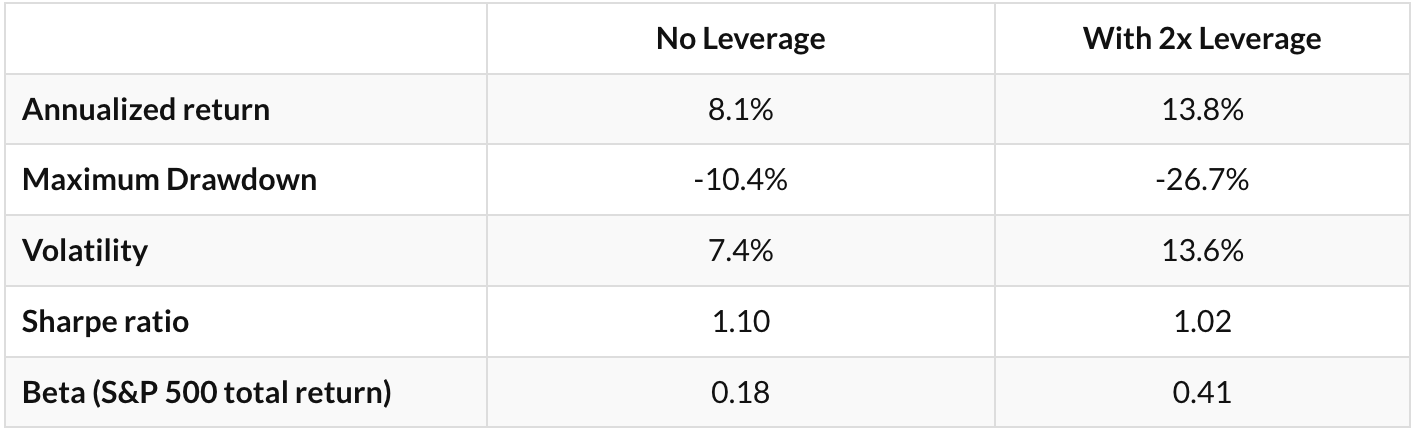

The three weekly trading strategies trade ETFs and large-cap stocks long only. Below, I display the ensemble performance of the three weekly strategies, assuming equal allocation. There is no use of leverage, the period for all backtests is from 01/03/2005 to 11/22/2024.

Performance Metrics:

Strategy 1: This strategy trades ETFs in the weekly timeframe.

Strategy 2: This strategy trades large-cap stocks in the weekly timeframe.

Strategy 3: This strategy trades a gold ETF based on a signal from another market.

Table of performance parameters

One time offer valid till midnight Sunday, December 01 2024.

The strategies are suitable for traders with basic knowledge of programming and testing rules on backtesting platforms. We provide the rules only in plain English and simple math. We do not provide any code. The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules. Do not expect anything overly complicated. Delivery will take place via email next Sunday.