As the spring meetings of the IMF and World Bank begin in a virtual format, U.S. Treasury Secretary Janet Yellen had a message for governments across the globe. "It is important to work with other countries to end the pressures of tax competition and corporate tax base erosion...to make sure the global economy thrives based on a more level playing field in the taxation of multinational corporations," she said in her first major speech on international economic policy.

Yellen is specifically advocating for the adoption of a global minimum levy for corporations in order to avoid a "race to the bottom" on taxation.

While many countries have endorsed a minimum tax (there's been talk at the OECD for years), others may not embrace one unless they can claim a bigger stake in the profits of U.S. tech companies.

The debate also touches on the ongoing friction in international taxation: whether to tax companies based on the location of their income or the location of their headquarters.

The U.S. didn't have a pure system before or after the 2017 tax act, which leaned toward taxes based on where revenues are generated, though the Biden administration appears to be focusing more on the latter.

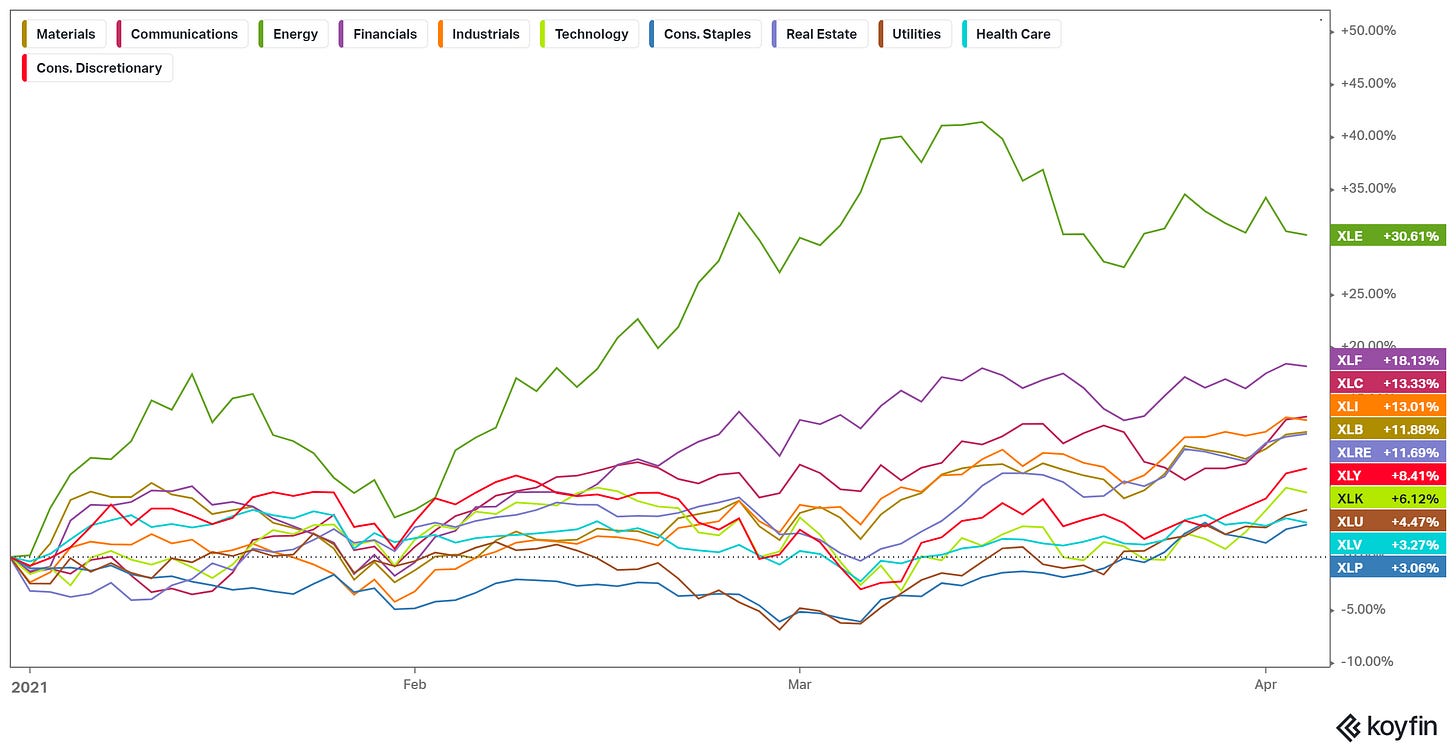

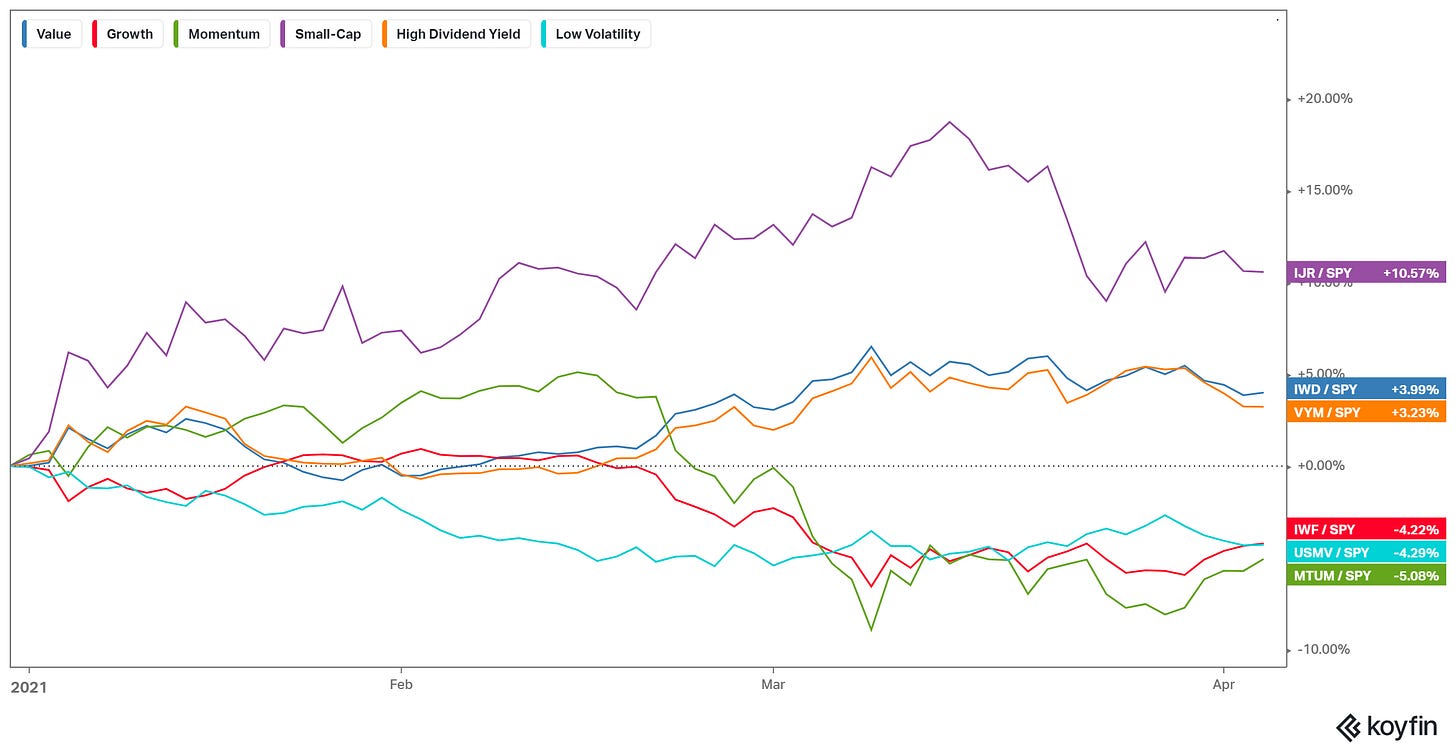

As we get stuck into the meaty part of the week and begin positioning/trading for the quarter ahead, here’s where we stand with U.S. markets:

Happy Trading.