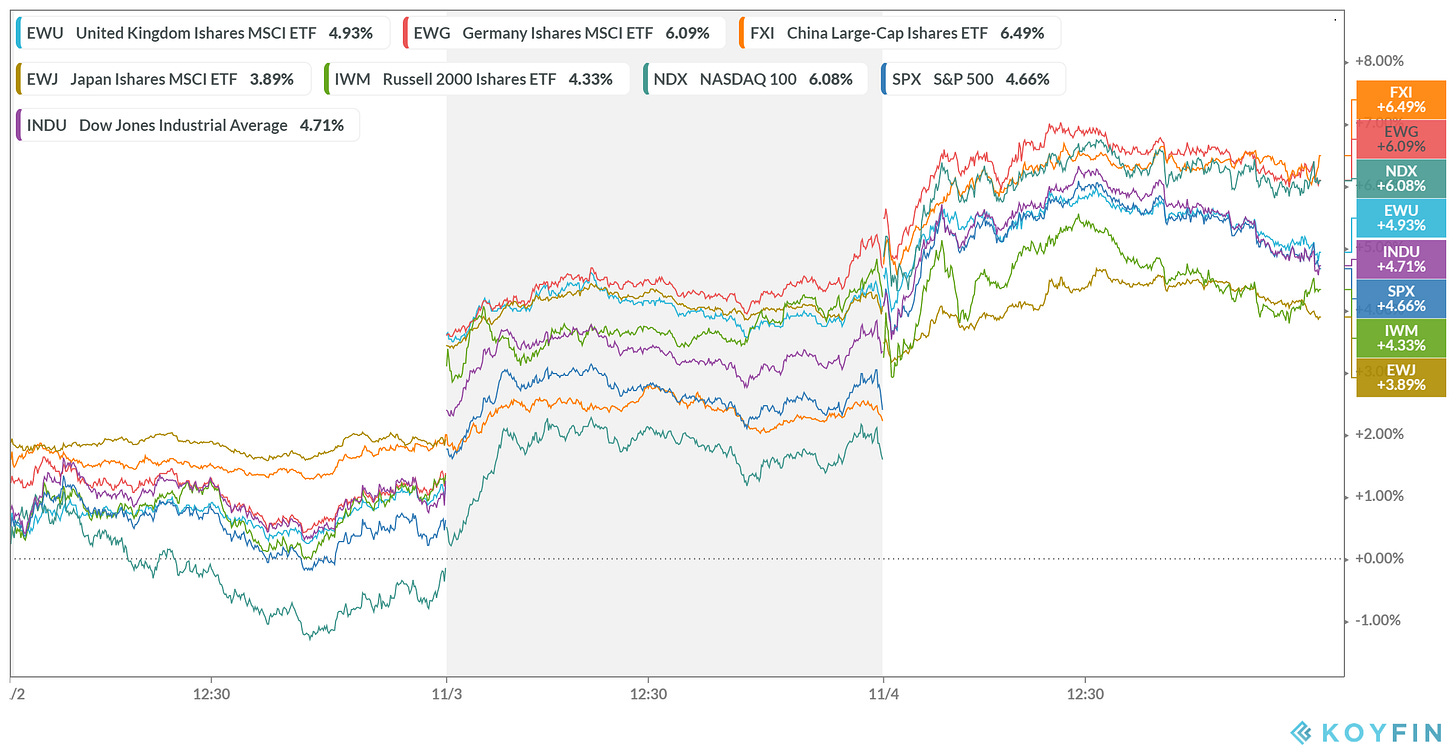

Even with uncertainty around who the next President of the United States will be, Global Equity markets staged a strong rally during the day. Of note was also the continued reversal of certain “pre-election” trends; WTI Crude is now up about 9.3% since 30 Oct, US Bond futures rose about 2 points during the day, whilst the price of Ultra T-Bond was up 4 points (representing an implied yield decline from 1.5833% to 1.4785%).

Predictably, the election has become a drawn out process.

And predictably, in a world where few things have made any sense over the past ten months, we are now seeing the Presidential election count paused in mid-action, held overnight, and flippedon its head during the day.

The predictable reason: ambiguous mail-in ballot discovery and counting.

So, after an endless "whatever it takes" effort to get rid of Trump, over a four year period, the ultimate overthrow appears to be coming from a global pandemic-rationalized mail-in voting strategy, which entails dumping ballots on the doorstep of key toss-up states, in the middle of the night, to be counted after the known majority of Trump votes had been cast and counted.

We will now see how the disputes play out, and there will likely be many states in the mix.

That said, I suspect the media will be happy to call Michigan and Nevada for Biden and set Biden in motion for an acceptance speech. Meanwhile as the Trump team is out fighting for justice, the pressure will build on him to step aside and allow the country to move forward, so that Biden can "get to work on the virus and the economy."

That's my view.

With a split Congress, as we've discussed, I would expect Biden to push for an economic shutdown, to contain the spread of the virus - following the lead of France, Germany and the UK.

That would give him the purpose to turn to Congress and force a massive "relief" package. And from there, he would be flush with, at least, a trillion dollars to plow into his clean energy economic transformation plan.

We will see how it all plays out.