Let's continue our discussion from where we left it on Friday ( Peak Fed Lunacy ) on the difference between a deceleration in rate-of-change in prices, and outright price declines (i.e. deflation).

The Fed's stated goal is to slow the rate-of-change in prices to their inflation target of 2%. However, they are inducing a decline in prices/deflation, rather than just a slowdown in inflation.

Is it by design?

That brings me to a very important statement made by the Fed Chair in the last post-FOMC press conference. In response to a question about the lag effect between policy and prices, Jerome Powell said "we do need to see inflation coming down decisively, and good evidence of that would be a series of down monthly readings."

"Down monthly readings" means negative change in prices. He wants to see deflation (at least for a period of time) - that suggests the Fed wants to move the level of prices lower, not just the rate of change.

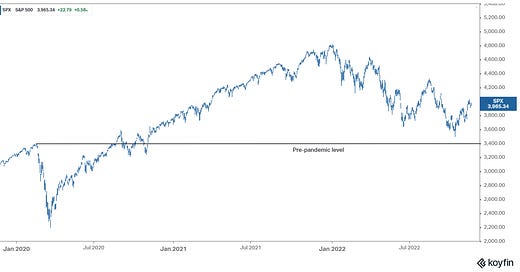

Well, he's getting it. They nearly returned stocks to pre-pandemic levels this summer...

Gold, the historic inflation hedge, has fully retraced to pre-pandemic levels ...

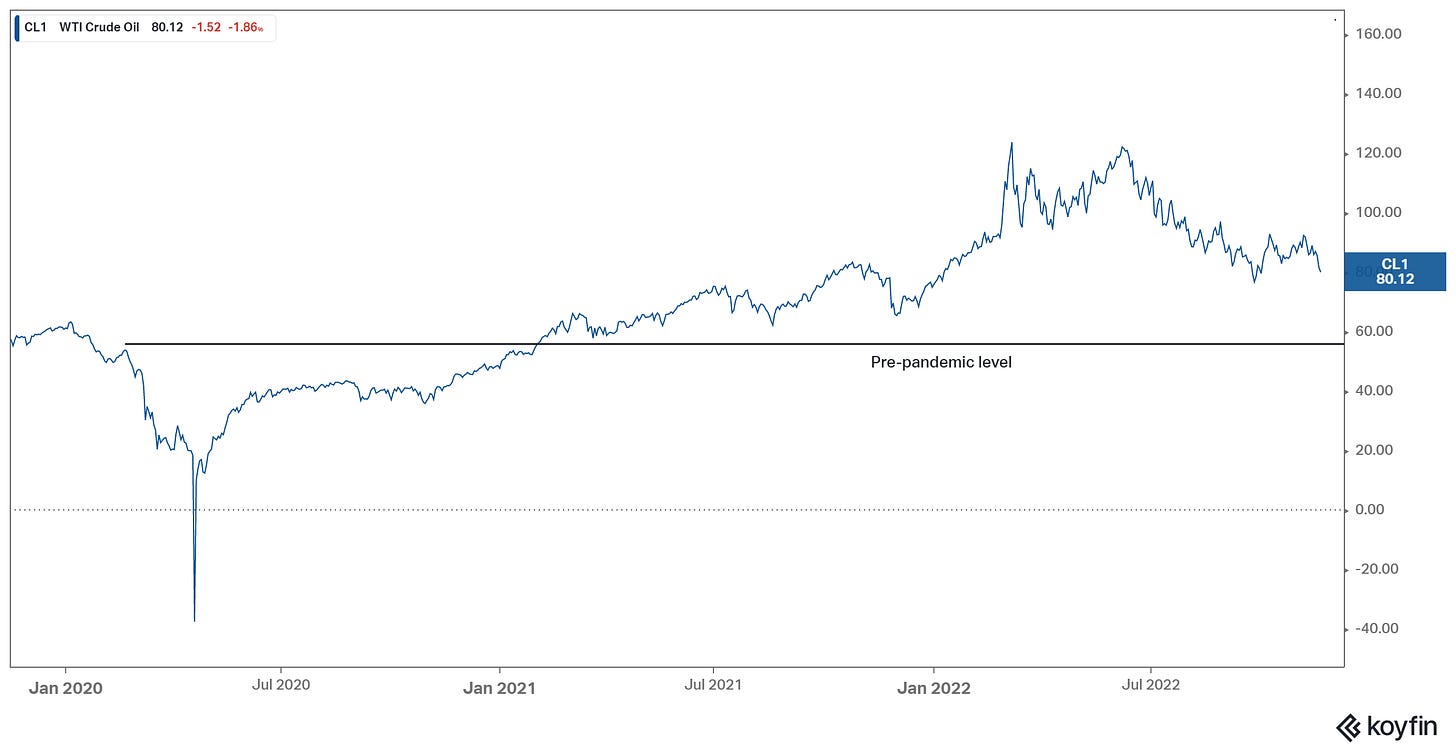

Energy? Crude oil prices are not too far off from pre-pandemic levels ...

Here's a look at global food prices ... falling, but still 25% above pre-pandemic levels ...

What about housing?

Housing prices have rolled over. Jerome Powell should be careful what he wishes for. A return to pre-pandemic prices in housing would bring a deflationary vortex. And the Fed would quickly be back in the business of zero rates and quantitative easing.

With all of the above said, observing real-time inflation data over the past few months (on things like car prices, housing prices and rents, etc), rather than relying on the stale data within the government's inflation report, we can indeed project negative monthly price changes to materialise in the government's inflation report, soon.