With the big July inflation report coming this morning (EDT), let's take a look at what we know about a key input into the CPI calculation…

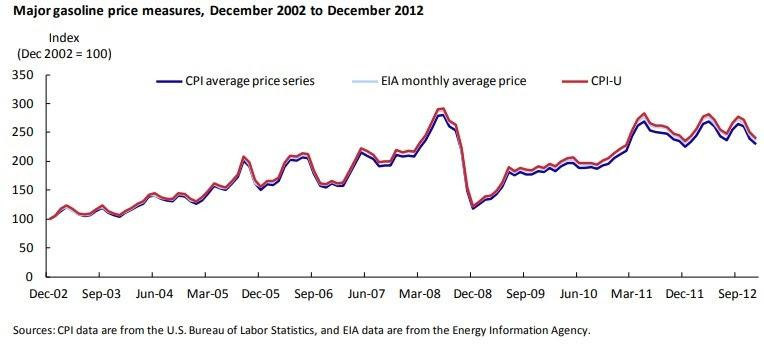

Gas prices have about a 1/5th weighting in the consumer price index. Remember, last month we looked at the below chart of a 10-year period that shows how closely gas prices and the consumer price index track.

So, what did gas prices do in July?

The Energy Information Administration (EIA) does a weekly survey of gas stations across the country - those survey results show a fall in gas prices of 7% during the month.

Let's take a look at how this number has correlated with the month-to-month change in the CPI this year.

As you can see in the above table, the sharp monthly rise in gas prices has resulted in big monthly changes in CPI. And for perspective, these monthly CPI changes of around 1% mean that prices in the economy are increasing at a double-digit annualised rate.

Conversely, the April decline in gas prices, gave us what would be a very welcomed (by the Fed) inflation number.

Now, it was the big jump in gas prices in June (of 11%) that gave us reason to believe a hot number was coming last month (and it did).

We head into this CPI number today, with a decline in gas prices - that's good news, and signals what should be a cooler inflation number.

Add to this, if we get a fourth consecutive lower Core CPI reading (i.e. excluding food and energy ... chart below), the stock market should take off. It would build market confidence in the Fed's recent assessment that they have reached the neutral level for interest rates.