The Fed Chair (Jay Powell) appeared in a sit down interview on 60 Minutes, link in yesterday’s post.

This type of mainstream media interview/Q&A session is rare. Q&A's are typically done in Congressional hearings, following Fed meetings, or at select economic conferences. The common theme: He speaks economics and policy to economic and policy practitioners.

The interview on Sunday with 60Minutes was clearly a desire to speak to the broader public. Now, while historically rare for a Fed Chair to do this type of media, this is Powell's third 60 Minutes sit down. His predecessor, Ben Bernanke, had also used the 60 Minutes platform to speak to the American people a couple of times.

What was the common theme in each of these sit downs? A crisis of confidence, or (at best) the vulnerability of confidence.

For Bernanke, back in 2009 and 2010, he was directing the Fed through the storm of the financial crisis, and he and the Fed were being destroyed in the media - that media tone was opening the door for global leaders to take shots at the Fed.

The Fed was trying to restore confidence, and it wasn't going well. So, Bernanke took to 60 minutes to speak directly to the people - to set the record straight. He shot down the media criticism and said he was seeing signs of "green shoots" in the economy. This first Bernanke interview (in March 2009) set the bottom in the stock market - and it turned the tide in global sentiment.

In late 2010, the Bernanke interview followed a bad jobs report that left confidence vulnerable, and left stocks vulnerable to undoing the progress of the past year. Bernanke's attempt to assuage fears led to a 10% break higher in stocks, to new post-Lehman highs.

For Powell, his first sit down with 60 Minutes was in March of 2019. We had just ended the week with a 4.4% plunge in Chinese stocks. Powell appeared on 60Minutes that Sunday night in response to the growing risks of a confidence shock (given the December 2018 stock market decline, Brexit drama and China/U.S. trade uncertainty). It was an opportunity to tell the public that the economy is doing well, despite the media's doom and gloom stories. Stocks bounced and rallied 9% over the next month and half and went on to new record highs.

Last year, Powell made another 60 Minutes appearance. It came on the back of a very soft CPI number, which created chatter about negative interest rates and a deflationary spiral (this, despite the massive lockdown policy response). Stocks went south. Powell emerged, by Monday morning, stocks were popping, continuing the sharp recovery (17% higher in just three weeks).

So, here we are again. What's he worried about now? Stocks finished last week strong, and are at record highs (unlike prior 60 Minute appearances).

A confidence risk lies ahead.

The inflation threat is now becoming widely respected, if not feared. Today we get March CPI data. Given this Powell appearance, it's safe to assume the numbers will be hot. And days later, we'll hear from the big banks on Q1 earnings, and it's safe to say those earnings will be hot.

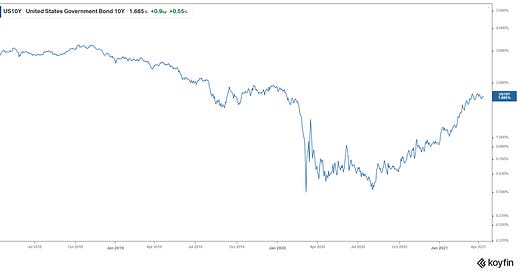

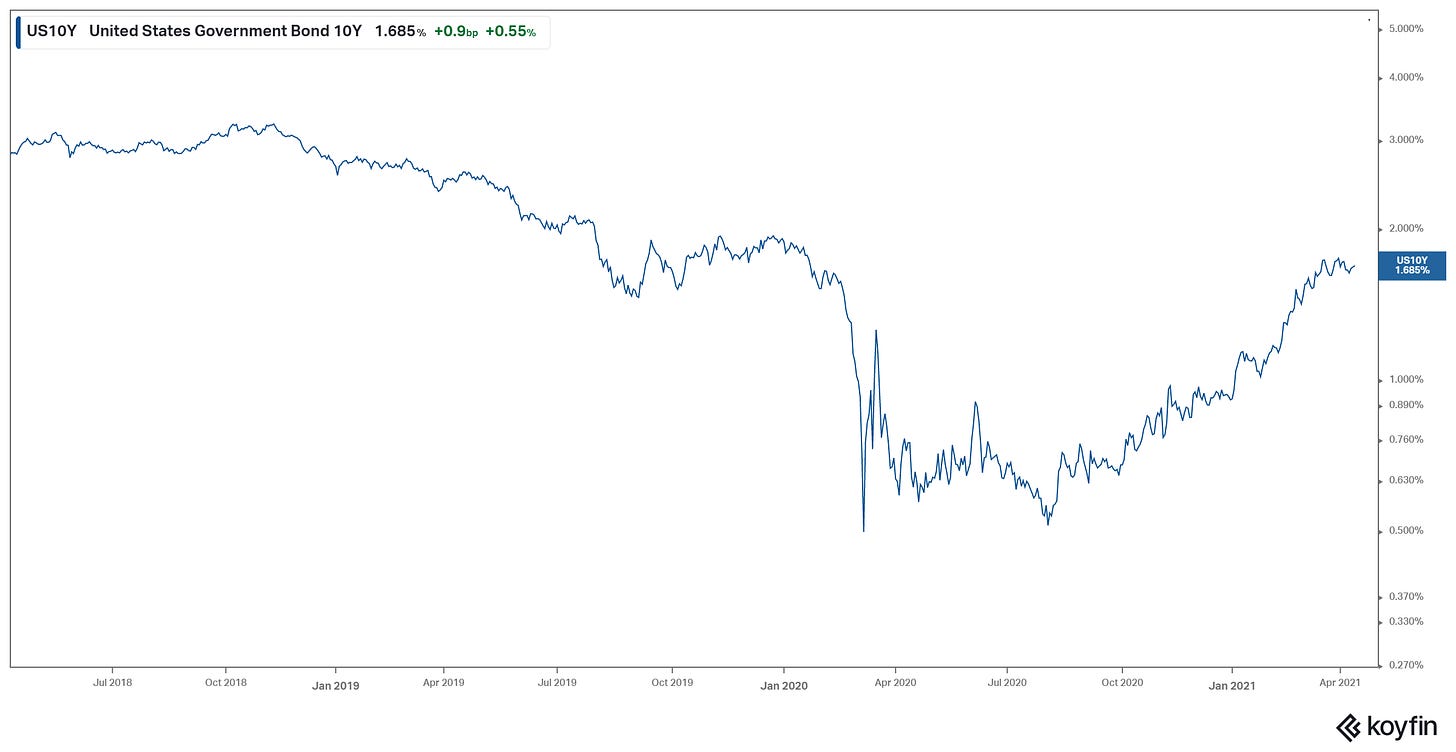

Those numbers will have the propensity of producing a move in this chart (higher)...

That move would reflect an opinion that the Fed might be moving rates far sooner than they have led us to believe, and that would be a negative signal for stocks. Thus, a Jay Powell appearance. He reiterated that they will continue to support the economy for as long as needed, and until a "complete recovery" – saying it’s "highly unlikely" that they will raise rates this year.

These interviews, where the Fed chair is explicitly reassuring the American people, has become a buy signal for stocks. In this recent case, we shall see.