We've talked a lot about the globally coordinated climate agenda for the better part of the past year.

Almost four years ago, a group called Climate Action 100+ was formed. This group comprises every major asset manager and pension fund on the planet and the agenda of the group is/has been very clear: defund fossil fuels and force energy transformation.

With that, all of the oil giants have been ordered to transform to renewables. Fall in line, or be shut-out of the capital markets (frozen out from new investment).

What happens when you choke off investment in new production in traditional energy sources, in favor of building the "next generation" of energy? You guarantee yourself a supply/demand imbalance - at least until" new energy" infrastructure is developed to the extent that it can balance the market. That won't be anytime soon. Which inturn means the climate actioners have guaranteed us an energy crisis.

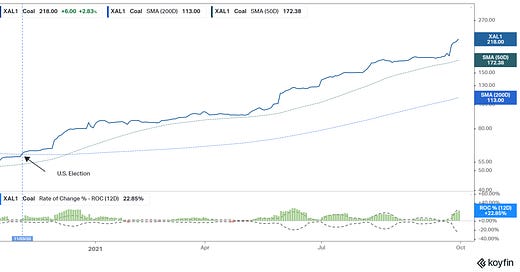

Let's take a look at the price of energy inputs since Biden was elected, which cleared the impediment (i.e. Trump) for the global energy transformation. The price of coal has more than tripled...

Crude oil has doubled and looks like it can double again...

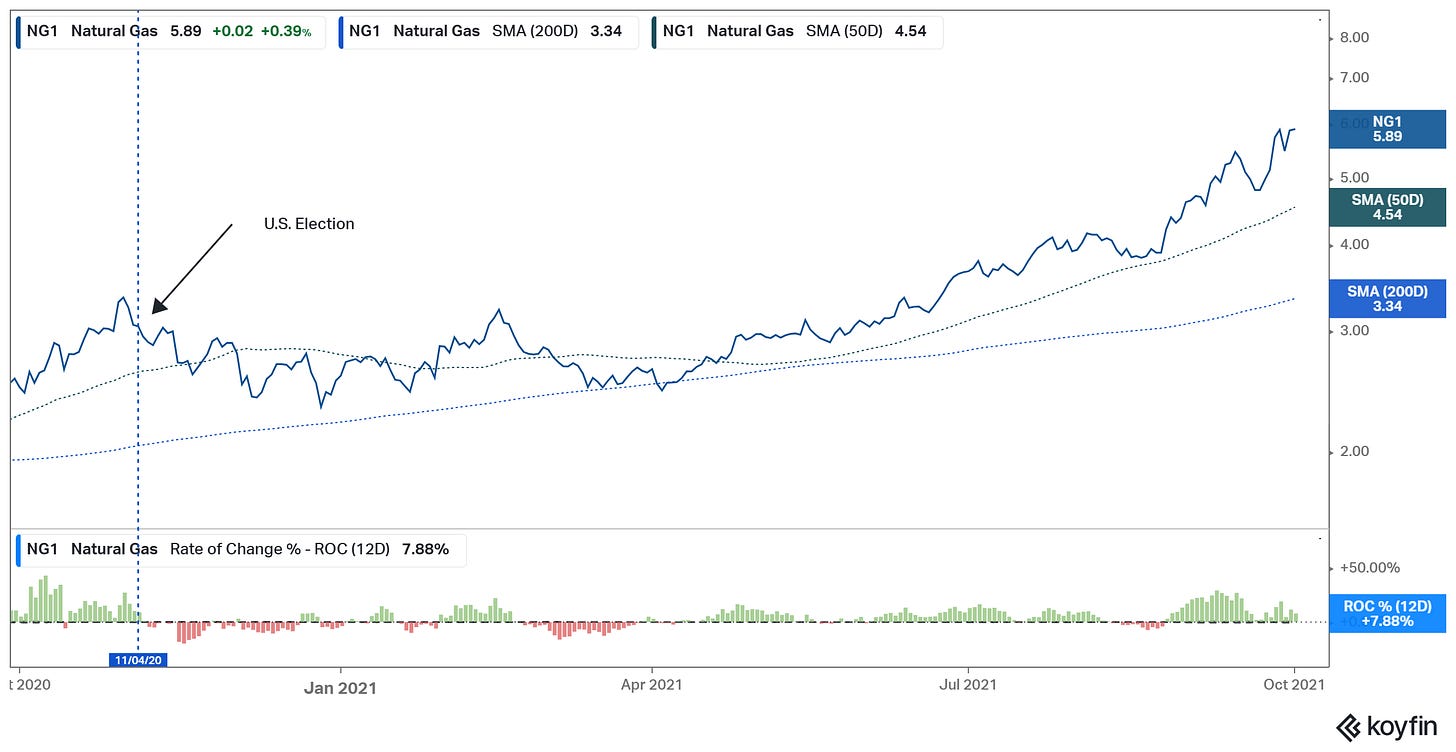

Natural gas is up 87% and on 7 year highs. The last time natural gas prices were here, oil was $100…

So, these prices are reflecting the storm that is brewing: a combination of the war on fossil fuels, meeting supply chain bottlenecks and a global ramping of demand (coming out of the depths of the pandemic).

We're seeing it in China. Consumption is outpacing coal inventories and production - they've been having blackouts. European power prices are at record highs - in the UK, we're seeing images of gas lines. As I said in my June note, get ready for $6 gas.