5300

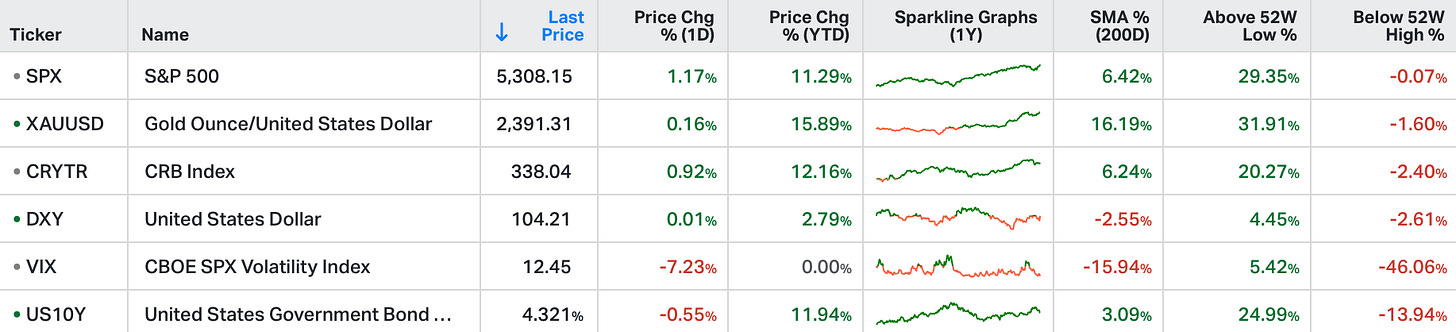

Stocks in the US rallied on Wednesday, with all three major averages closing at record highs, after soft CPI readings.

The S&P 500 added 1.2% settling above 5,308 for the first time, the Dow added 349 points and the Nasdaq 100 advanced 1.4%.

April's inflation data showed that both headline and core annual inflation slowed, and retail sales unexpectedly stalled, bolstering expectations that the Fed might start cutting interest rates in September.

Nvidia surged 3.6%, and Apple and Microsoft each rose over 1.2%.

Dell soared 11.2%, with its market cap rising above $100 billion.

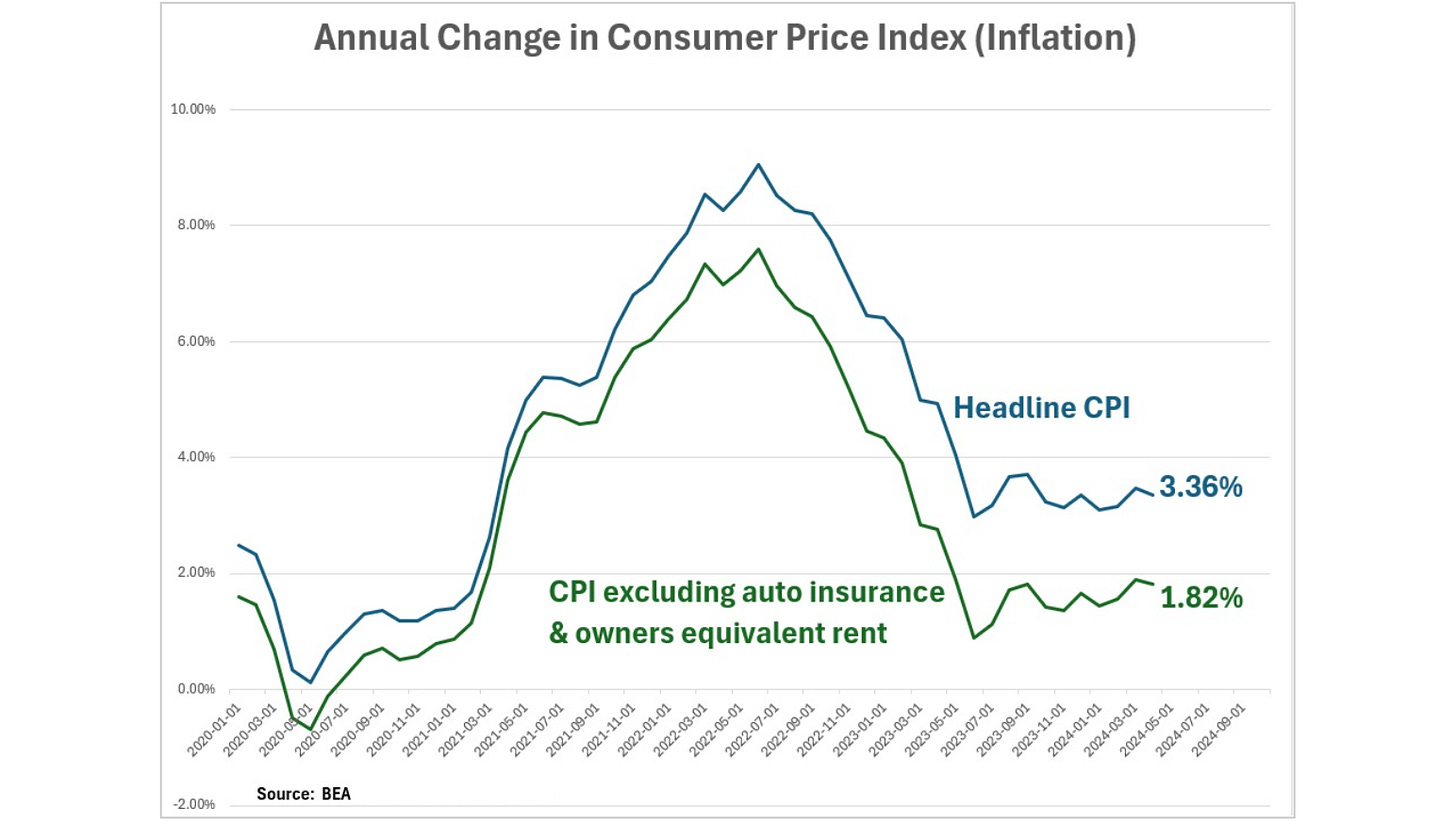

The inflation numbers were in-line with expectations - with that, we had a decline in year-over-year inflation (i.e. a fall in the consumer price index).

Continuing from where we left off yesterday, the hot spots continue to be auto insurance and shelter (which includes the influence of rising insurance prices). Let's take a look at what the inflation number would look like without the effect of a 22.6% annual increase in motor vehicle insurance (the orange line).

Now, what would it look like if we stripped out auto insurance and owners' equivalent rent?

Both auto insurance and owner's equivalent rent make up about 30% of the CPI, with both of these CPI components being lagging features of an asset price boom. Excluding those two inputs we get a CPI that is more representative of the demand trend. And it's running well below 2%.

The Fed holding rates at historically tight levels does nothing to solve the influence of auto insurance premium and owner's equivalent rent on the headline inflation number. If anything, the Fed's high rates are artificially boosting demand for rentals, because the (related) high mortgage rates are prohibitively expensive for potential home buyers.

So, unless the Fed is trying to induce an asset price bust (deflationary bust) and economic contraction, which would mean we get all of the debt from trillions of dollars of fiscal stimulus and none of the growth, then they should be cutting rates.

The market seems to be getting that message.

Actionable Research and Market Insights with conviction and for a limited readership.

We have 10 new members join Gryning AI - welcome.

10 annual membership spots remain - sign up below to add institutional grade analysis to your trading toolbox.