Last week the Fed laid out a more aggressive path and destination for interest rates.

The path they telegraphed still leaves them fueling the fire of a hot, high inflation economy through next year - it didn't sound (at all) like a Fed that was prepared to do "whatever it takes" to slay inflation.

Yesterday Jay Powell may have corrected the mistake. In a prepared speech, he set the expectations for possible 50 bps increments (in rate hikes), and made it clear that the Fed is no longer sitting back and waiting for supply disruptions to normalise. They are looking to bring demand down, to come in line with supply - this is quite a stark contrast from the inflation-denying Fed of 2021.

In fact, all along the way, they have been telling us that the deflationary forces of the past three decades wouldn't turn on a dime, and therefore wouldn't expose us to a dangerous inflation scenario - that's changed too.

Powell's flip-flop was expressed like this: "it's hard to say what the economy will look like post recent events, but no one is sitting around waiting for the old regime to come back."

To be sure, they were (arrogantly sitting back and waiting), hopefully not any longer.

So, what will it take to beat inflation? In the 73-74 and early 80s inflation spikes, the Fed had to ratchet rates above the rate of inflation to finally get it under control. If history is a guide, the past five tightening cycles ('87, '94, '99, '04 and '15), the Fed has averaged about 50 bps of hikes a quarter.

Alpha Idea:

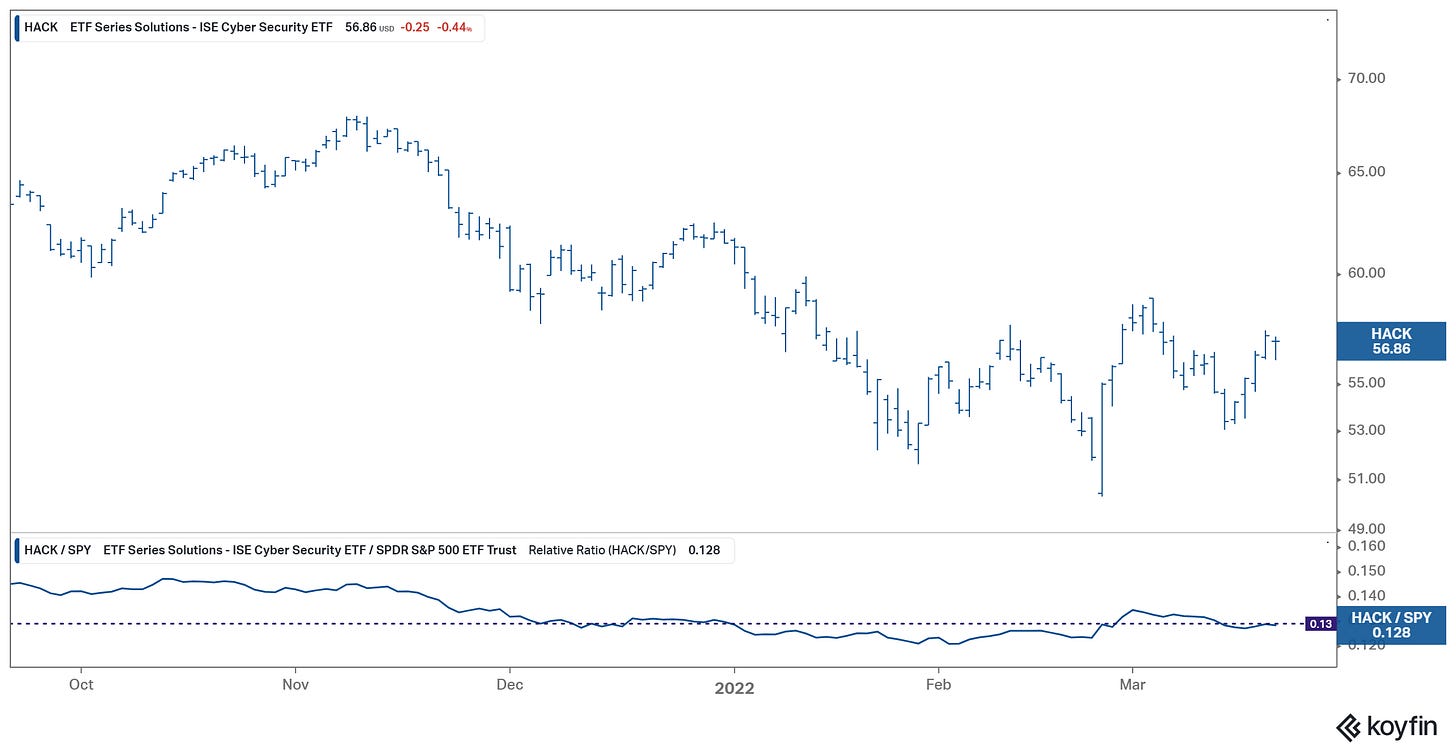

Bullish $HACK - The fund invests in stocks of companies operating across cyber security companies sectors.

Elevator Pitch: The Russia/Ukraine conflict shows no signs of coming to a resolution and seems to have morphed into an attrition engagement. The longer this goes on, the more “plays” various governments will bring into action - disruptions in key infrastructure facilities is likely to become a tool used to gain strategic advantage / apply pressure.

$HACK gives us broad side protection to an uptick in cyber security, whilst allowing for any technology ($QQQ, $NDX) tail-winds to further pull us along.