$4 Billion Drumbeat

Stocks in the US closed mixed on Wednesday, with the S&P 500 breaking its four-day losing streak, while the Nasdaq 100 added 0.2%.

The Dow Jones dropped 186 points amid renewed tariff concerns after President Trump announced a 25% levy on European autos and confirmed tariffs on Mexico and Canada set to take effect on April 2.

Lowe’s advanced 2% after reporting a 0.2% increase in same-store sales, marking its first positive growth in nearly two years.

General Motors climbed 3.7% following news of a 25% increase in its quarterly dividend.

Treasury yields fell for a sixth consecutive session as traders reassessed economic risks.

Nvidia reported yesterday afternoon.

The data center business is now 90% of Nvidia.

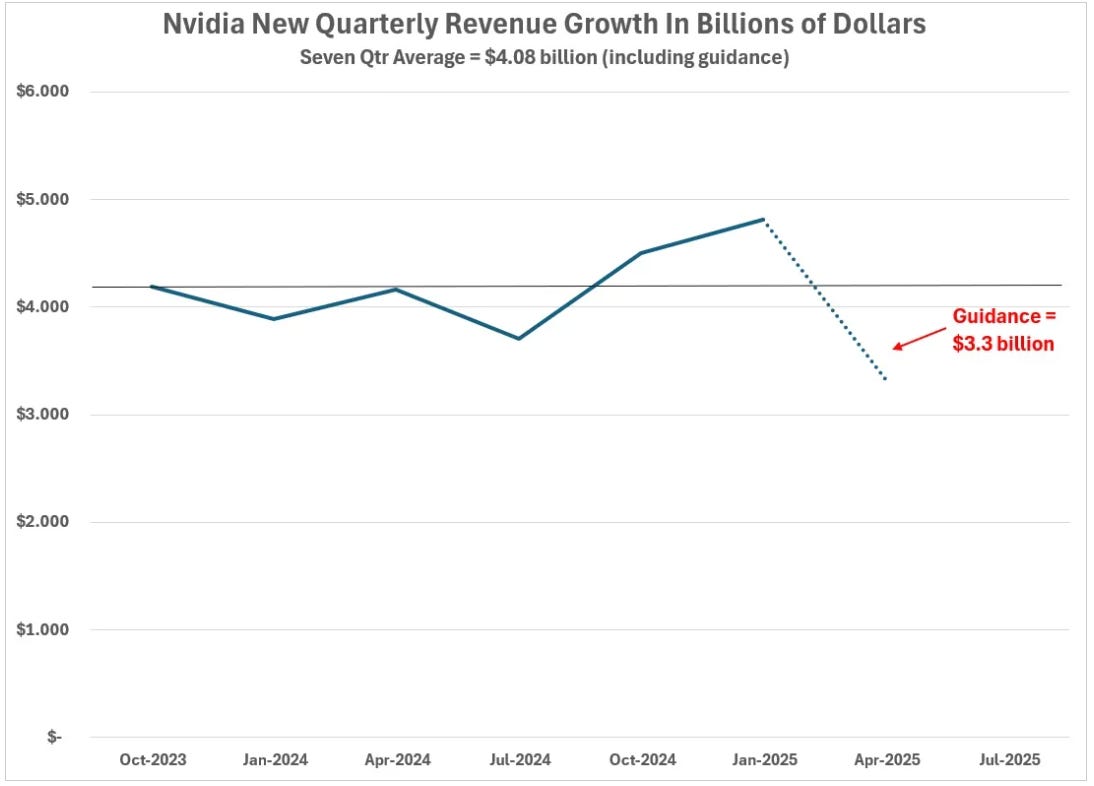

And as we've discussed, the growth in data center revenue has been on a rhythm of about $4 billion a quarter since the second half of 2023.

That said, they reported a bump higher in data center revenue in the report. But, they guided A LOT lower for next quarter. Did they pull forward some sales to boost the overall data center picture? Maybe.

Here's a look at the past six quarters, plus the guidance for next quarter …

It is indeed the $4 billion drumbeat.

Again, while the speed of innovation in AI seems lightning fast, it's being constrained by Nvidia's inability to fulfill at a level that satisfies global demand. It's because Taiwan Semiconductor, Nvidia's manufacturing partner, is clearly maxed out (operating at capacity).

With this all in mind, Jensen always delivers a glimpse into the future on his earnings calls.

He said we are just at the beginning of the age of AI – and he said it several times.

Just as some have thought the massive capex spending by the tech giants would be slowing down, Jensen implied that there would be endless building of computing capacity.

He said, "going forward, data centers will dedicate most of CapEx to accelerated computing and AI. Data centers will increasingly become AI factories and every company will have one, either renting or self-operated."

Surely a bottomless pit of computing demand can't solely be supplied from one company in Taiwan. This makes the case for a war-time like effort to build advanced-chip making capacity in the U.S.

The purpose of the strategy package is to provide traders with informational content that aids in the development of a robust investment process, enabling you to become a professional trader or establish your own fund (more information).