We'll hear from Jay Powell and company on Wednesday.

The market has priced in a 75 basis point hike—that would bring the effective Fed Funds rate to just above 3.75%.

From there, the interest rate market is pricing in a coin flip chance between 50 bps and 75 bps at the December meeting—that could get the Fed Funds rate to 4.5%.

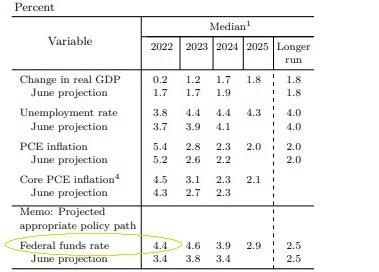

Remember, it was their last meeting, in September, where they created the expectations for this, and did so through their "survey of economic projections" (SEP). These are the economic forecasts made by each board member and each regional Fed President (a total of 19 forecasts).

Here's a look at how these Fed officials presented the outlook in the September meeting...

Let's focus on the Fed Funds rate projection (circled in yellow). This was revised UP a full percentage point.

That projected an additional 125 and 150 basis points of tightening by year end. It's that aggressive posturing by the Fed that sent the interest rate markets in an upward spiral (not just domestic markets, but global).

They went a step too far with the tough talk/ restrictive forward guidance. And with that, we found the uncle point for the global financial system.

The UK government bond market broke and required a rescue from the Bank of England. Stocks made new lows on the year. The dollar made new highs on the year, and then the Bank of Japan was forced to intervene to defend the value of the yen against a strong dollar (which is driven by the U.S. rate outlook).

With all of this going on, both the Australian and Canadian central banks responded with smaller than expected rate hikes in their respective October meetings. They blinked.

So, back to the Fed. Given the exposed fragility in the global financial system to the current level of market interest rates, will the Fed pull the trigger on another 75 basis points this week? Probably, but the treasury market has that rate increase more than priced-in (and consumer and mortgage rates do too, as they are based on treasury rates).

The big questions, will the Fed acknowledge;

the rate sensitivity that has been exposed in the financial system,

the cooling inflation picture,

the likelihood of a (less inflationary) fiscally conservative change in Congress coming?

Let's hope so. If so, the market will dial down (maybe dramatically) the rate outlook for December; rates will go lower, the dollar will go lower, stocks will go higher, the stability will improve.

For perspective on just how "aggressive" the Fed talk is, versus what they really expect, let's take a look at what the Fed's long-run forecast for rates looks like now (in these Fed projections), relative to the past 10 years.

Notice that in the very low inflation environment of the past decade, where deflation remained a bigger risk than inflation, the Fed's projection for the long-run level of the Fed Funds rate was not only higher, but much higher than the current long-run projection (which is just 2.5%).

Does this reveal the Fed's true view, that after ballooning of government debt (globally) there is a very low ceiling on where rates can go (given debt servicing and financial system risk)?

Alpha Trade Idea

BITO 0.00%↑ Long ATM Dec 2nd 12.50 Straddle