The more efficient American government becomes, the more capable it will be of lifting the quality of life for everyone within its influence.

Summary:

In 2024, about 50% of the entire budget deficit went just to paying interest on accumulated debt. If the US government were a company, its CFO would have been fired a long time ago.

For the last 23 years the US government has been breaking the golden rule of budgeting: make more money than you spend. In 2024, about 50% of the entire budget deficit went just to paying interest on our accumulated debt

Rather than address this issue, the federal government continues to vote to raise the debt ceiling. This ever-expanding deficit isn’t sustainable, but it also isn’t inevitable.

The most effective private sector businesses often have operations that boil down to a two-piece framework to drive efficiency: context and control. “Context” refers to understanding where your spend is going. “Control” means proactively and precisely managing where spend occurs.

For both governments and businesses, while growing revenue is important, eliminating inefficient spending can be just as, if not more, effective at improving the bottom line.

Categories of waste in government spending can be referred to as “drag.” This includes $100 billion in Medicare and Medicaid fraud, $200 billion in SBA loan fraud, and $236 billion in “improper payments.”

Imagine a world where the US government is both more efficient and more effective. When America is at its best, it can accomplish exceptional things.

Build Your Investment Operating System

This is a systematic framework for seeing what others miss and making confident choices under pressure. Built for analytical minds who hate fuzzy thinking. In an age where most investors get their “insight” from headlines, we prefer something a little more… robust.

This Long Form Note is part of the information package for members of Investing by Design. For more information on the quantitative strategies, click here.

The USA’s $36 Trillion Problem

If the US government were a company, its CFO would have been fired a long time ago.

Most organisations, from companies to local and state governments, have to abide by the golden rule of budgeting: make more money than you spend. Every state except Vermont has stipulations dictating how they have to have a balanced budget. But for the last 23 years, the US federal government has been violating that rule and has been operating at a deficit.

The result: the US owes a cumulative $36 trillion in debt as of December 2024, and that number continues to climb. In 2024, the US government generated $4.9 trillion in tax revenue compared to $6.8 trillion in spending, yielding a $1.8 trillion deficit. Net interest payment alone for 2024 was $882 billion, edging out Medicare, Medicaid, and defense spending and becoming the second-largest single source of government spending behind social security.

In other words, approximately 50% of last year’s budget deficit went toward paying interest on our accumulated debt.

Rather than address this issue, the federal government continues to vote to raise the debt ceiling, kicking the can further down the road. This ever-expanding deficit isn’t sustainable, but it also isn’t inevitable. As recently as 23 years ago, the US ran a budget surplus, and there’s no reason it couldn’t do so again.

Spending is Cyclical – Just Not for the US Government

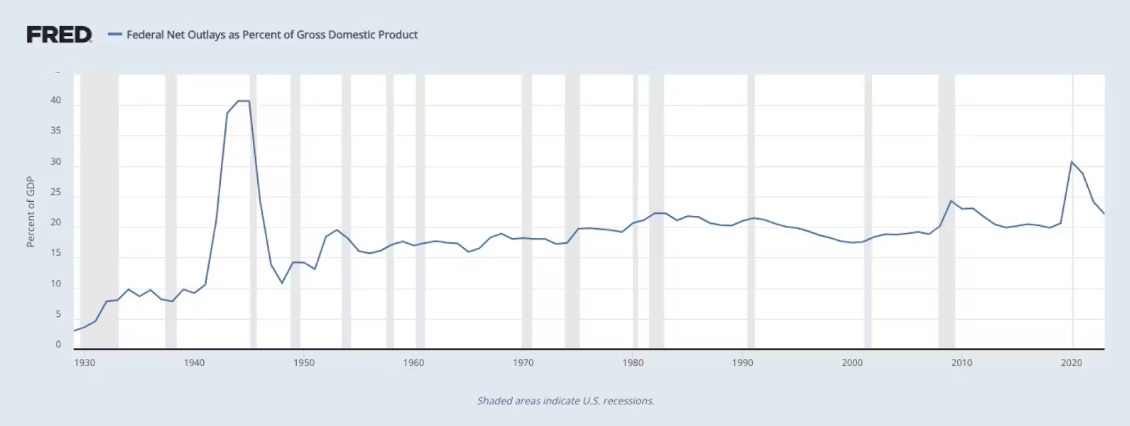

Businesses are cyclical, with revenue and earnings rising and falling with changing market conditions. However, US government spending has consistently increased regardless of market conditions:

Even after adjusting for inflation and headcount, government expenditure figures are still astronomical.

In 2023 dollars, government spending per person in the US grew from $4.3K in 1965 to $19.6K in 2022, a 4.5x increase.

From 1980 to 2019, inflation-adjusted federal spending grew by 2.3% annually, outpacing its 2.1% annual revenue growth.

This trend accelerated in 2020 during COVID-19, when spending jumped 45% while revenue declined 2.6%.

Overall, the size of federal government spending in relation to GDP has grown by an order of magnitude over the past 100 years. In 1930, the percentage of spending to GDP was 3%; by 2023, it reached 22%.

The government has made attempts to address government spending and budget deficits but has largely failed. One of the only attempts that has even had a passable impact was the creation of the Government Accountability Office (GAO). The GAO prepares 900 annual reports on government finances and investigations, but in 2010 couldn’t even render an opinion on the consolidated financial statements of the government because of “widespread material internal control weaknesses.”

Given the ever-expanding budget, one would hope that at least the outcomes of the US people would be continually improving, but that doesn’t seem to be the case. Outcomes have stagnated across a range of measures, including healthcare efficacy, education outcomes, and US military capabilities relative to expenditure.

Among wealthy nations, the US ranks last in healthcare access and outcomes, with life expectancy at 76.1 years versus the developed country average of 82.4.

In education, despite spending the second-most per student among 80 peer countries on education, US math scores hit an all-time low of 465 in 2023, below the international average of 480, with reading and science scores also declining.

The US military, which accounts for 37% of global defence spending, shows mixed results. During almost every war game the US loses against China. This is due to a combination of factors including overspending on ineffective, obsolete weapons systems and the inability to make a proper accounting, with the Defense Department having failed seven audits in a row.

If a business had the same track record, it wouldn't be allowed to operate. The average American business is being held to a higher standard than the US government.

Imagine this: Six months from now, you’re no longer second-guessing your trades or reacting emotionally to market swings. Instead, you’re executing with precision—backed by systems that work and a community that supports your growth every step of the way.

Inefficient Government Spending – The Main Culprits

Drag 1: Medicare & Medicaid Fraud

Medicare and Medicaid cost $874 billion and $618 billion respectively in 2024, making them the third and fourth largest government expenses. According to the National Health Care Anti-Fraud Association, these programs are losing more than $100 billion annually to fraud – and that’s likely a conservative estimate.

$100 billion in Medicare and Medicaid fraud represents 1.5% of total government expenditures.

So, how are these frauds propagated? It comes down to a lack of context around the flow of information and money.

Common schemes include criminals cycling prescription drugs through a closed loop: fraudsters recruit patients to get prescriptions, which pharmacies fill using Medicare funds. The fraudsters then clean and resell them to wholesalers, who sell them back to pharmacies for Medicare patients, and the cycle repeats. Basically, the same pills cycle through the system in a closed loop, with fraudsters extracting money from Medicare each time a prescription is filled while no one actually benefits.

Other schemes involve criminals setting up shell companies for medical equipment fraud and using stolen patient and doctor information to submit false Medicare claims.

In both cases, insufficient context around fund flows is to blame.

Drag 2: SBA Loan Fraud

During the COVID-19 pandemic, the government disbursed approximately $1.2 trillion in COVID-19 Economic Injury Disaster Loans (EIDL) and Paycheck Protection Program (PPP) funds.

More than $200 billion – at least 17% of all COVID-related Small Business Association (SBA) loans – were fraudulent.

The OIG noted that “as pandemic assistance programs swelled to more than $1 trillion, the risk to the taxpayer increased because SBA’s internal control environment was calibrated to expedite loans and grants.” While OIG recommended stronger controls to the SBA, like validating per-employee loan amounts and business details, the SBA’s recommendations came too late. The combination of loose internal controls and minimal oversight created an environment ripe for fraud, costing taxpayers at least $200 billion.

Drag 3: Improper Payments

According to the GAO, the federal government reported an estimated;

$236 billion in “improper payments” during fiscal year 2023, including overpayments, inaccurate recordkeeping, and fraud.

74% of these improper payments were overpayments, such as sending money to deceased individuals or people no longer eligible for government programs.

In what’s becoming a common theme for the examples of wasteful expenditures discussed in prior “drag baskets”, the GAO noted that federal agencies need to conduct better monitoring to minimise improper payments.

In other words? Not enough context, and not enough control.

We Need to Reignite American Efficiency

When America is at its best it can accomplish exceptional things, from airplanes to polio vaccines, from MRIs to personal computers. The rate at which America can increase its velocity is only limited by the thrust of resources available and the magnitude of drag holding it back. America’s GDP is already nearly 2x the next largest nation, while it collects almost $5 trillion of tax revenue.

We’re entering one of the most pivotal decades in financial history. The old system is crumbling. The new one is forming. Let’s not be caught off guard and instead use this crisis to build generational wealth (more information).

It doesn't seem hard to believe that $600B - $800B of fraud and waste could be saved without reducing programs to beneficiaries. if you add on the removal of some superfluous programs, like Education and Housing, $1 trillion would be almost easy. as well, by removing waste, this would cut baseline spending going forward.