US stocks erased most of the session’s losses on Wednesday as investors weighed the Fed’s January meeting minutes, while awaited earnings report from Nvidia due after the closing bell.

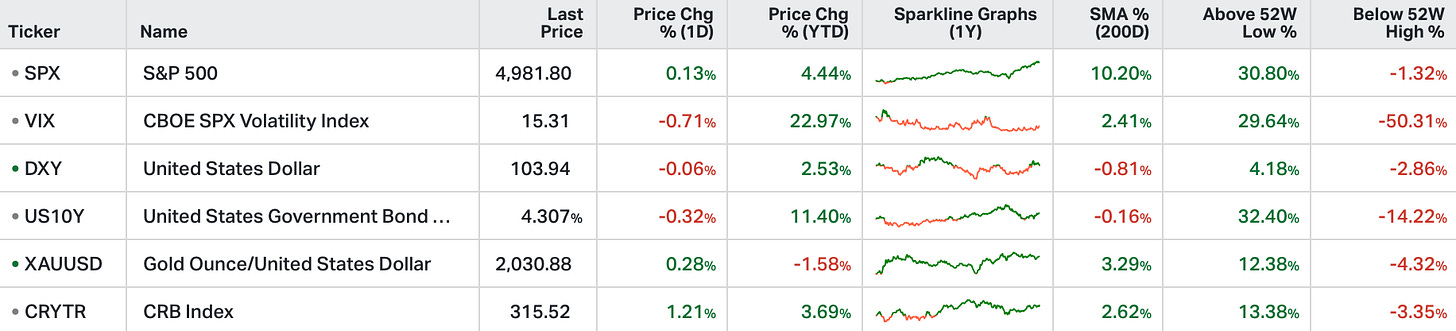

The S&P 500 and the Dow pared most of their losses and gained 0.1%, while the Nasdaq 100 lost 0.3% to extend its losing streak for the third day.

The warnings were aligned with much hotter-than-expected CPI and PPI prints released after the Fed’s January meeting, in addition to a strong jobs report.

Tech shares led the declines as Treasury yields rose and investors positioned cautiously for Nvidia’s earnings release.

The chip maker's shares lost 3.8% and have soared about 230% over the past year.

Nvidia reported after the close.

The market was setting up/ hoping for a disappointing report, with the dream of buying the stock lower, for a second chance at the generative AI trade. They didn't get it.

It was another blow-out number. Nvidia guided $20 billion in revenue. It came in at $22.1 billion. So, they grew revenue 22% just since the prior quarter - that's four billion dollars in revenue growth on the quarter! It's 265% revenue growth on the year - for one of the biggest, most important companies in the world.

We've now seen four full quarters of business from Nvidia since the ChatGPT launch back on November 30, 2022 and they are now doing almost four times the quarterly revenue of a year ago (pre-ChatGPT launch). If we just look at the data center business, which is now 83% of the company's business (up from 60%), they are doing five times as much revenue, compared to a year ago - by supplying the tools that power generative AI to the world's data centers and internet companies.

For a market that was looking for a negative surprise, they clearly weren't listening to what Jensen Huang has been saying in his frequent public speaking engagements. And they weren't listening to what Nvidia's customers were saying (e.g. Microsoft and Meta) in their recent earnings calls, about how aggressively they are spending on computing infrastructure.

We talked about valuation yesterday. On Nvidia's guidance coming into the report, NVDA shares were trading at 43 times the annual net income run rate. With yesterday's revenue beat, plus net income margin expansion, it's now 33 times.