3 Changes

US stocks remained mostly higher on Thursday, extending the presidential election-fueled rally from the prior session after the Federal Reserve delivered a 25bps rate cut, as expected.

The S&P 500 and the Nasdaq 100 were nearly 1% and 2% higher, respectively.

Tech shares led the rally, with TSCM and Meta soaring 4% while Nvidia, Apple, and Alphabet jumped over 1.5%.

Investors continued to assess the impact that economic policies in Trump’s upcoming term may have on the sector, including wider fiscal deficits and lower regulation.

In turn, banks and financial services providers booked sharp losses to drive the Dow to underperform by hovering marginally above the flatline, with JPMorgan, American Express, and Goldman Sachs falling between 5% and 2.3%.

The Fed cut rates by a quarter point, as expected, and Jerome Powell didn't offer much new information about the policy outlook.

If we look back at their September projections, they saw another quarter point lower from here by year end, and another 100 basis points lower for rates next year.

At that time, it was clear that they wanted to get rates down aggressively to what they consider "neutral," where policy is neither restrictive nor stimulative to economic activity (most importantly, no longer restrictive). The commentary from Jerome Powell in that September post-meeting press conference, and other Fed officials over subsequent days, sounded like they knew they were behind the curve, but they didn't want to give that signal to markets.

The "cracks" in the labour market clearly had the Fed worried that they had indeed waited too long (held rates too high for too long, damaging the economy). But if we fast forward to today, there have been three significant changes that have entered the Fed's calculus.

Change #1: A week after that September meeting, the BEA (Bureau of Economic Analysis) published revisions to economic output data from the first quarter of 2019 to the first quarter of 2024.

It was all revised UP.

The report also revised personal incomes up, consumer spending up and with a higher personal savings rate — and estimated higher productivity.

From this report, the Fed Chair clearly found relief on the economic picture. In a Q&A event, he specifically addressed the report, and said that some "downside risks" to the economy they were concerned about had been "removed."

Change #2: The Fed has now moved rates down 75 basis points since September. But bond yields - interest rates determined by markets - have moved UP by about the same amount.

The bond market (arguably) neutralised the Fed's attempt to ease financial conditions. Mortgage rates have reversed, from 6.1% back to 6.8% (levels of last July).

Remember, it was the sharp move higher in bond yields a year ago (last October) that led to a reaction from the Fed. Jerome Powell signalled the end of the tightening cycle, citing the tightening of financial conditions that had taken place in bond yields.

With that, Jerome Powell was asked about this recent big, adverse move in bond yields.

He seemed unworried. Why? Likely because of what is detailed in "Change #1" (above), and "Change #3."

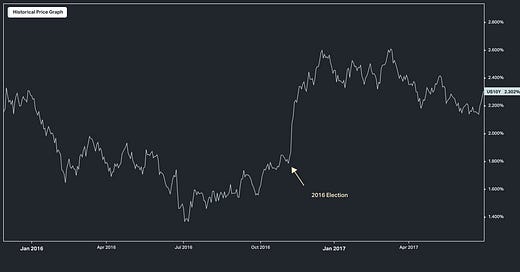

Change #3: The election. The Trump presidency brings with it a pro-growth agenda. We looked at my chart on Tuesday (here) that showed the 10-year yield rising alongside the rise in the probability of a Trump win. If we look back at 2016, we saw a similar Trump influence on bond yields…

Is the bond market behaviour pricing in growth or inflation concerns?

For the three years prior to covid, the Trump economy grew at an average of 2.7% annualised (the best three-year average growth since 2007), with an average of just 1.7% inflation (PCE), and while the Fed mechanically raised rates throughout the period from 0.5% to 2.25%.