3 Big Developments

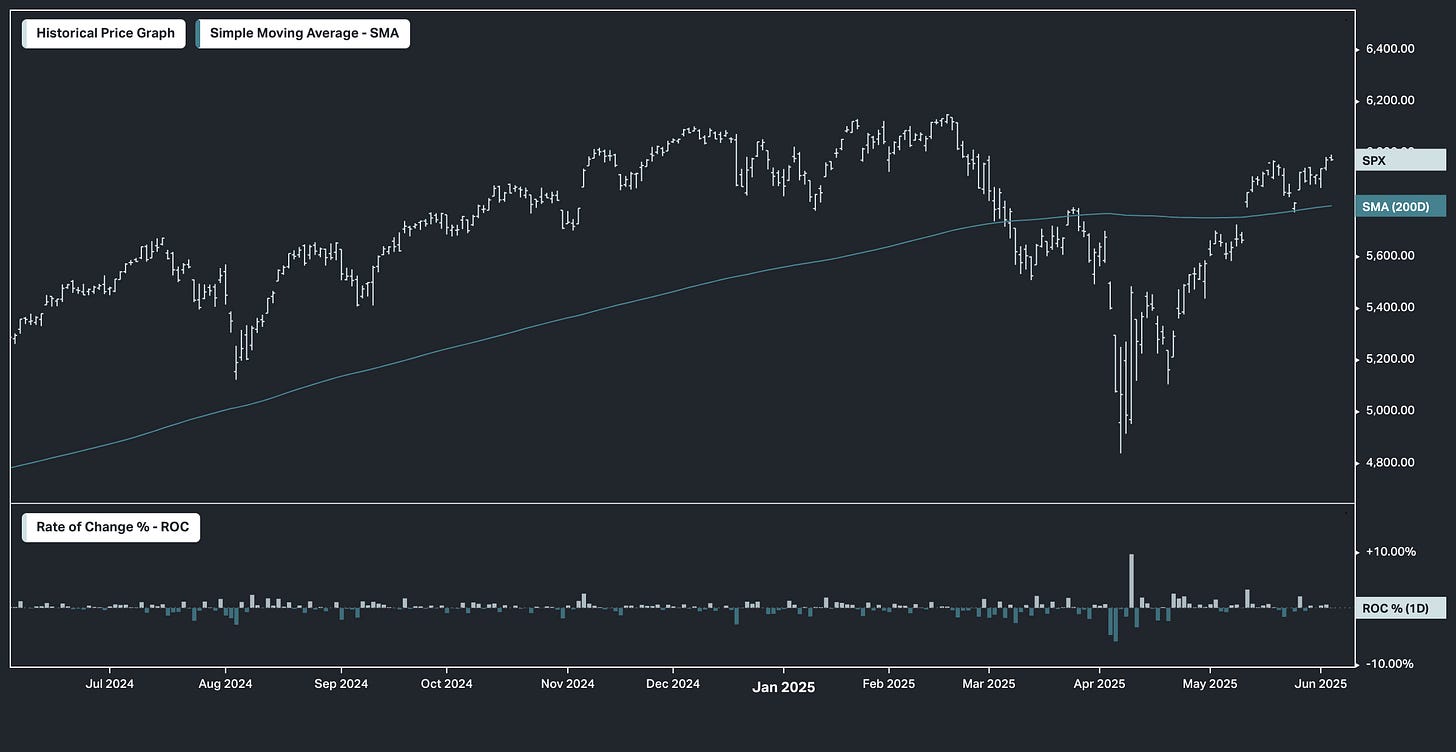

The S&P 500 closed mostly muted on Wednesday, the Nasdaq added 0.3% while the Dow lost almost 92 points, breaking a four-day winning streak.

The market struggled for momentum as investors digested a steep slowdown in private-sector hiring, with the ADP report showing just 37K new jobs in May, well below expectations and the lowest in over two years.

Services sector activity also contracted in May, further fuelling concerns about the broader economic outlook.

Meanwhile, President Trump doubled tariffs on steel and aluminium imports to 50% and lashed out at Fed Chair Powell, renewing pressure for interest rate cuts.

Hopes for a US-China trade resolution dimmed as Trump called Xi Jinping “extremely hard to deal with”, underscoring the fragile nature of current negotiations.

Over a weekend in early May, there was a de-escalation with China in the form of a 90-day tariff reduction. That catalyst has returned stocks to positive territory on the year, on the best May performance since 1990.

But, over the past several days, both the U.S. and China have accused each other of violating the trade deal. Is the 90-day deal still on? Trump and Xi have a call scheduled on Friday. We will see.

Ukraine and Russia were due to have peace talks this past Monday.

But, Ukraine rightly became an antagonist and escalated the war the day before. What will be the magnitude of the retaliatory response? We will see.

The house has passed the budget bill that, very importantly, extends the tax cuts, and eradicates the climate and social agenda that was a transformative strangulation of the U.S. economy.

But, there's Republican resistance in the Senate, and Elon Musk is now campaigning against it. Will this be a threat to getting the two most important issues across the finish line (tax cut extension and rollback of the climate agenda)? We will see.

These are three very big developments that have taken place in a short period of time. The outcomes could be:

A return of an imminent effective embargo on trade with China.

A reversal on a peace path in the Ukraine/Russia war and resumption of World War 3 risks.

Potential for defections on the Trump tax cut extension (i.e. taxes go UP).

All of this, and yet the world's proxy for economic health and stability, the S&P 500, was flat on the day, and traded in the tightest range of the year!

PS: You should join us. The Global Trend Report provides indicators and diagnostics to help assess the current state of financial markets across various asset classes and regions. I show the summary page from the most recent report below.