29 Mentions

The S&P 500 advanced 0.7% on Monday to close at its 30th record this year and the Nasdaq rallied 0.9% notching its 6th streak closing record while, the Dow Jones gained 189 points.

The rally was largely fueled by substantial gains in the tech sector, despite a rise in Treasury yields.

Key economic data including retail sales, industrial production and S&P Global PMIs are also due.

Meanwhile, the NY Empire State Manufacturing Index beat expectations but continued to point to a decline in business activity.

Among megacaps, Apple and Microsoft rose by 2% and 1.3%, respectively, while Tesla soared 5.3%.

The theme from the Fed's policy meeting last Wednesday was that inflation is "still too high."

That said, while the Fed was in session, determining that theme, inflation data was released that was "better" than "almost anybody expected." Those were the words of the Fed Chair himself.

If history is our guide, given that the data may have swayed some of the decision making in that meeting, with more time to digest it, it's reasonable to expect that the Fed would line up some members to get in front of cameras and walk back on some of the hawkish tone delivered by the Fed last week.

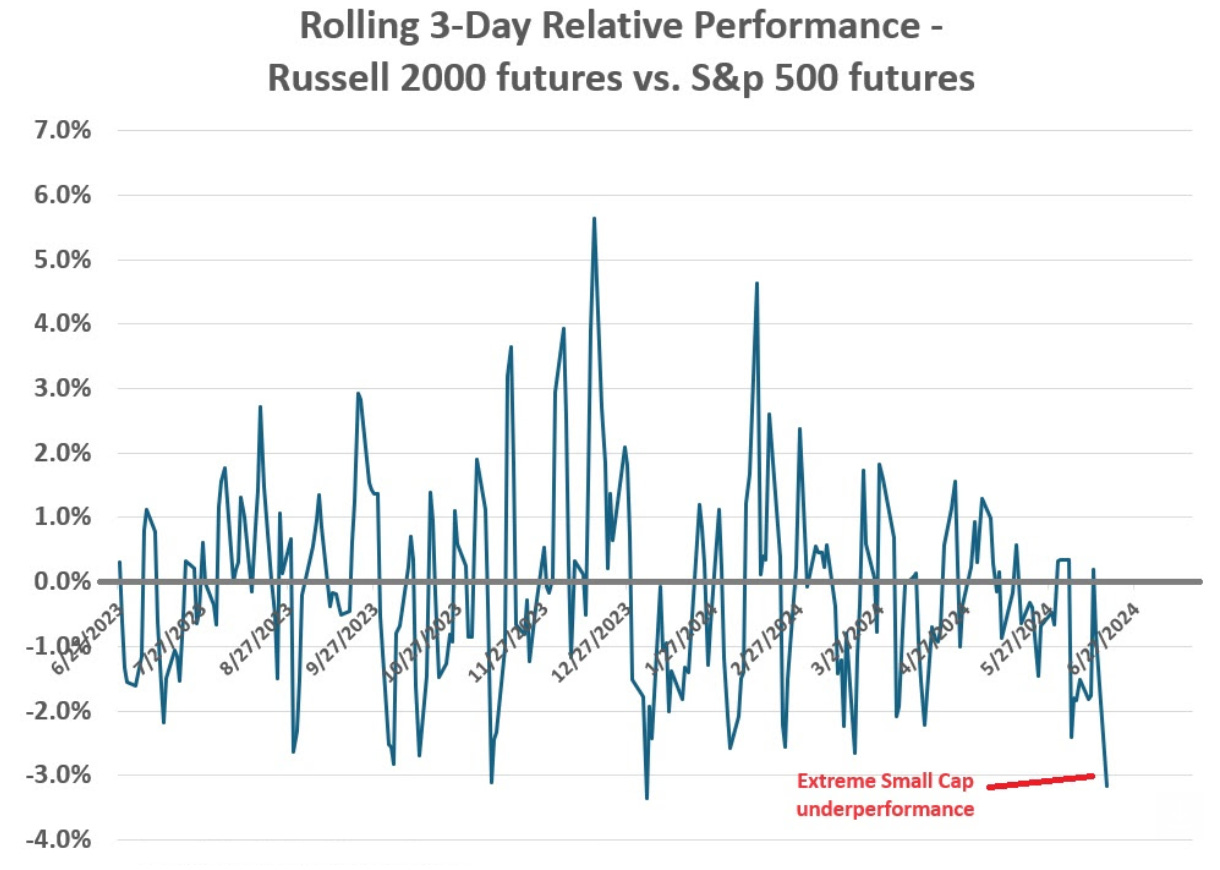

Indeed, we've heard from a few already. But surprisingly, they have held the line. That rate outlook is leading to growing divergence between the performance of cash-rich, big-tech oligopoly stocks ... and the rest.

In fact, at the worst levels yesterday morning, the small-cap index (Russell 2000) was underperforming the S&P at the extremes of the past year.

Let's talk about the G7 meeting that took place in Italy late last week.

The communique mentioned China 29 times - topping last year, where they mentioned China 20 times, which was the most since 2014.

Last year was the first time since 2019 (in the depth of the Trump trade war), that the G7 leaders said they would work towards "diversifying" supply chains, to reduce reliance on China. They addressed Taiwan, human rights, China's ability to influence Russia, and the importance of "playing by international rules."

China's state-controlled media called last year's G7 meeting, an "anti-China workshop." This time, within the 29 mentions, G7 leaders were more forceful and critical of China than they were in 2023. China's Foreign Ministry called the statements an attempt to "vilify and attack China."

Keep in mind, the Trump administration called China "enemy number one."

Their multi-decade economic warfare against the United States (and the West) has since expanded into hybrid warfare (economic, psychological, information, political, cyber). Yet the Biden administration has called China, all along, just a "strategic competitor."

Finally, just in the past year, the administration and its allies are acting as if they are tough on China, one might say provocatively so.

If you know someone that may find this of value, please share this post.