A Consus View for 2025

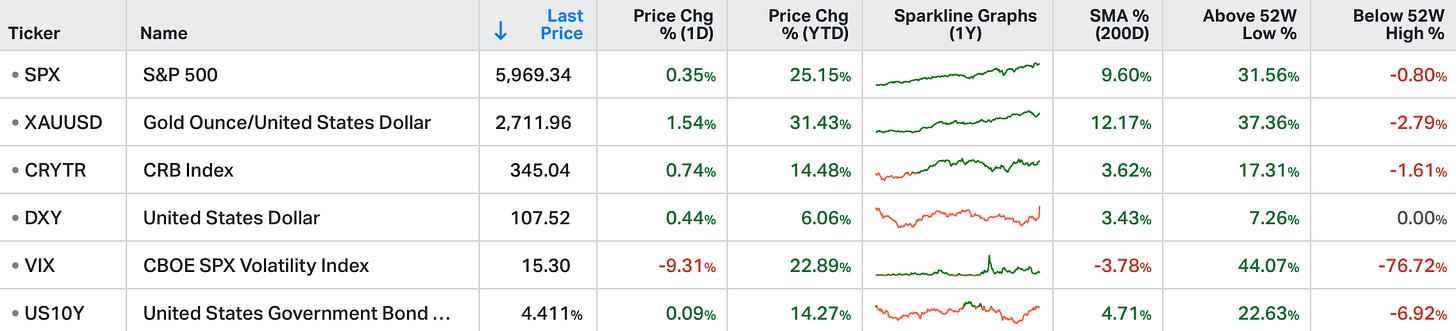

Stocks in the US closed higher on Friday, with the S&P 500 up 0.3% and the Dow gaining 426 points.

Meanwhile, the Nasdaq only added 0.1%, weighed down by declines in major tech stocks like Nvidia (-3.2%) and Alphabet (-1.7%).

Investor rotation from technology into economically sensitive sectors like financials, industrials, and consumer discretionary supported broader market gains.

Additionally, Wall Street awaits the announcement of Trump's Treasury secretary pick, a decision that could influence market sentiment.

Additionally, former Florida Attorney General Pam Bondi has been selected as U.S Attorney General.

Forecasting accuracy has been poor throughout market history:

In 1999 and 2007, valuation was elevated but analysts predicted stock market appreciation based on continued growth.

The same was true in 1972 with the “Nifty Fifty.”

In 1929, Irving Fisher declared nine days ahead of the market crash that the stock market had achieved a “permanently high plateau.”

The market suffered from significant declines (~50% drawdowns) following 1929, 1972, 1999 and 2007.

The most straightforward institutional S&P 500 forecasts for 2025 say stock valuation will follow earnings growth. Earnings are expected to be up 10% year-over-year. The major investment banks are forecasting the S&P 500 to appreciate by about 7-10%.

The current forward 12-month Price/Earnings (P/E) multiple of the S&P 500 is about 22x. The 30-year average is roughly 17x. Because of the elevated valuation currently, strategists do not believe the S&P 500 will enjoy P/E multiple expansion. Because the Federal Reserve is signalling it will be lowering interest rates, strategists are not projecting P/E multiple contraction.

What was unusual about 2024 was the lack of volatility. What is likely to return in 2025 is normalised volatility with the S&P 500 having a realised standard deviation of +/- 15%. The return of volatility may primarily be the result of high valuation and a willingness by investors to capture profits after a long bull run and with valuations elevated. High valuation markets can be temperamental / twitchy when uncertainty spikes.

If the S&P 500 appreciates by 10% in 2025, it would be another good year for the stock market. What is interesting to consider for 2025 is high quality bond funds offer about 7% interest currently. The realised forward five-year return in bond funds has a 95% correlation with the starting interest rate.

From a risk management perspective, increasing the allocation to bonds may help lower portfolio volatility in 2025 and provide dry powder in the event we see a pull-back in equity valuations. Relative to an expected return of about 7-10% for the stock market, 7% bond yields seem attractive on a risk-adjusted basis.

Investors can “hedge” downside stock market risk by buying hedged ETFs. This is a relatively simple risk mitigation approach whereby the amount of downside risk can be managed. New ETF offerings of this type are coming to market regularly.

Keeping some amount of your portfolio in position to opportunistically buy down markets is not a tall order today with money market funds paying about 4.5% and many investment grade, short-duration bond portfolios with higher yields. In any event, it is important to make sure your cash is invested as cash balances at banks and brokerage firms receive very low interest.

In 2024, earnings growth came primarily for the very large-capitalisation technology stocks (Magnificent 7). Small capitalisation stocks collectively experienced an eleven percent earnings decline. In 2025, the earnings growth advantage is expected to flip in favour of small cap stocks with forecasts for 41% earnings growth for small caps versus 15% for large cap stocks.

Because of the backdrop of resilient growth and the easing rate cycle, we expect the S&P 500 should have another good year in 2025. Starting the year at a high valuation creates a potential for elevated volatility. Investment objective’s will be to be positioned to capture expected market upside and to have downside volatility risk mitigated. Whilst also seeking to be nimble in the event stock market leadership moves away from the Magnificent 7 and to other areas including small capitalisation companies.