Markets appear to be looking through rose-tinted glasses as a perfect economic landing is now fully priced in. In addition, concerns are mounting that the dis-inflation momentum is fading. This has resulted in significant repricing of front-end rates. Nonetheless, I expect that inflation will resume its gradual downward trend to allow the ECB and Fed to cut rates this summer. Stock and credit markets are priced for perfection, but I do not fully sympathise with current valuations, as weaknesses in many economies remain. Indeed, even though it’s firmly risk-on, downside risk are not fully gone. Adding to curve steepeners and a preference to highly rated SSAs and covered bonds over investment grade and high yield credit may be prudent.

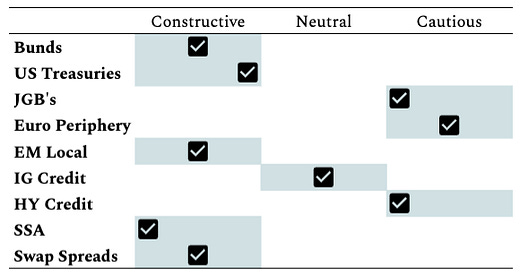

Quarterly Outlook Summary | Asset Class Preferences

Macroeconomic & Policy Outlook

Risk markets anticipate either ‘no landing’ or a clear growth pick-up, and no longer price recession risk.

Downside growth risks have eased, but caution against too much euphoria...

...even as cooling labor markets and underlying inflation allow DM central banks to start cutting rates in mid-2024

Rates strategy

The bond outlook remains supportive due to the expected turn in official rates

Fundamentals and valuations favour euro rates

5-year point on the curve looks attractive versus long end

Fixed income asset allocation

Spreads are entering cycle tights

Caution to underweights – technicals supportive Up-in-quality is a cheap alternative

Credit markets: a cycle of haves and have-nots

Gryning Macro give’s you outlooks on a monthly, quarterly and annual basis covering multi-asset, fundamental equities, fixed income and credits markets. You can access the full report(s) by becoming a member below.