1995?

Macro Perspectives

I try not to consume much financial media, though I listened to some yesterday, while traveling. I heard a fair amount of flippant comparisons to 1999 - the late stages of the speculative internet-stock boom.

This view, of course, relates to the recent resurgence of the big tech stocks, including the leaders of the AI-revolution.

But as we've discussed, it's early innings. The guy that runs the technology that powers AI says that the realization of this revolution just happened six months ago (with the launch of ChatGPT).

And of course, the reference to 1999 has a lot to do with the fact that some of the professional investing community has been wrong-footed this year - positioned for a recession (likely the one we already had, in the first half of last year).

My view: This is indeed looking like the 90s analog. The 1995 analog - the beginning of the boom.

With that, we've looked at this period in my daily notes, particularly related to the Fed stance.

In 1994, the Fed went on an aggressive rate hiking campaign. They did 300 basis points in 12 months (raising into a recovering economy- worried about "sticky" and "persisting" inflation). Then they paused. Within five months they were cutting rates.

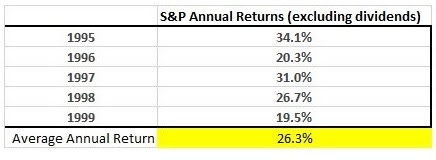

Following the Fed's pivot in '95, the economy went on to average 4.5% quarterly annualized growth through the end of the 90s. And stocks did this . . .

PS: The Gryning Times will be going through some changes this weekend, with the addition of new features and sub-publications. Should you receive a number of posts/notifications, I apologise in advance.

What growth rate do we need today that would result in similar returns in the late 90's? Atlanta FED is projecting approximately 2.2% growth.