#16 $NVDA

Open to Memberships - Portfolio’s for Capital Appreciation

An investment strategy comprising of three data-driven market beating portfolio’s, using the Gryning AI Score to demonstrate the predictive power of our models.

U.S. Listed Single Stock Portfolio

European Listed Single Stock Portfolio

U.S. Listed ETF Portfolio

Stocks are picked using data-driven analysis, with no subjectivity or emotion. The portfolio’s are built using the analysis highlighted in these trade idea’s.

Trade Idea of the Week

We highlight every week a stock with a high average win rate for its BUY signals (above 70% after 3 months since 2017), and which is currently rated as a BUY or Strong BUY by Gryning AI.

NVIDIA Corp [NVDA]

Fundamental 9 | Technical 10 | Sentiment 9 | Low Risk 5

AI Score 10 | Strong Buy

NVDA - Suggested Trading Parameters

Entry price: $1096

Horizon: 3 months

Stop Loss: $966 (-11.86%) or AI Score < 7/10

Take Profit: $1578 (+43.98%) or AI Score < 7/10

Today our AI maintains a BUY rating (AI Score 10/10) on NVIDIA Corp [NVDA], because its overall probability of beating the market (S&P 500) in the next 3 months (47.13%) is +13.05% vs. the average probability (34.08%) of all US-listed stocks.

NVDA Buy Signals Track Record

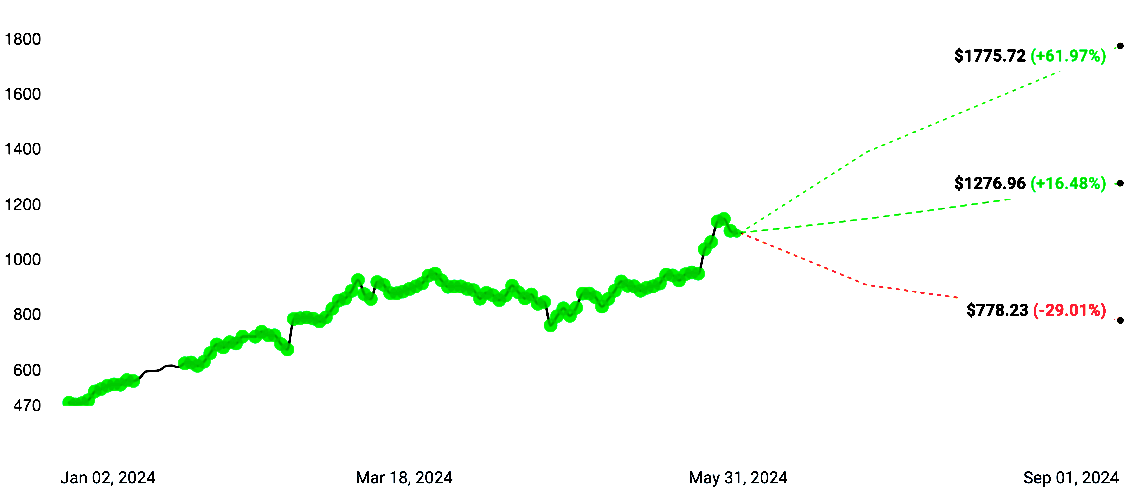

Below, you can see the NVIDIA Corp chart since December 2023, with the past Gryning BUY signals (AI Score 7 to 10) highlighted in green. In the 3-month forecast, the central dotted line shows the most expected price path (+16.48%). The shaded area is the expected price range (-29.01% to +61.97%) based on the previous BUY signals with a 90% confidence level:

3 months after each of its 1182 BUY signals (since Jan. 2017), NVDA achieved in the past a 76.28% win rate (positive performance cases) and a +16.49% average performance.

Today's NVIDIA Corp BUY rating (AI Score 10/10) is based on the 36 fundamental, technical, and sentiment features that are among the ones that had the greatest impact on the performance of stocks during the last 12 months (alpha signals). Below, you can see the top 10 alpha signals, ordered by relevance:

One of the top NVDA alpha signals today is its EPS estimate for next quarter. It currently stands at $6.38, ranking it among the highest (decile 10/10) of all US-listed stocks.

During the last 12 months, stocks with this feature (an alpha signal) outperformed the market in 50.68% of the cases after 3 months vs. the average (34.08%) of all US-listed stocks. This feature is in the 98th percentile, which means that 98% of the alpha signals analysed by Gryning have an equal or lower probability of generating market outperformance (alpha).

Hypothetical Portfolio | Weekly Trade Idea’s