We had some surprisingly good commentary on the debt ceiling negotiations.

It started with this statement from Biden in the morning, signaling a deal by Sunday. He also said, importantly, "to be clear, this negotiation is about the outline of what the budget will look like, it is not about whether or not we will pay our debts."

McCarthy followed a half hour later and said "a deal by Sunday is doable."

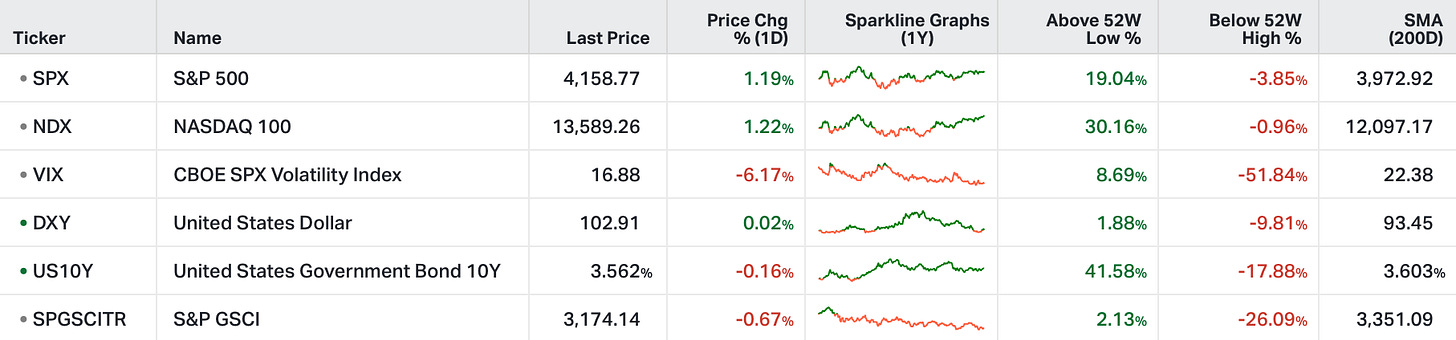

Stocks did this . . .

That said, we need the government to get out of the way, and let the liquidity that is already in the system do its job - to ensure a sustainable recovery from the 2020 economic damage.

But what about rates? We've never seen rates go from zero to 5% in a year's time.

Whilst true, we've also never seen ten-years worth of money supply growth dumped onto the economy over a two-year period (the pandemic response). The tidal wave of new money should trump the adoption of what is (at 5%) an historically normal interest rate.

This money supply explosion should have resulted in inflation. It did. It also should have resulted in boom-time economic activity.

Coming out of the pandemic recession, the economy should be in the midst of multi-year double-digit nominal growth (before the effects of inflation), and well above trend in real growth (after stripping out the effects of inflation). Instead growth has been petering out.

The good news: The pandemic emergency policies and all of the subsidies and moratoriums that came with it, are over (or coming to an end). This should normalize the labor supply (which has been in a shortage), and we need higher wages (a reset in wages to offset the reset in prices) - to restore the standard of living.

That being the case, we could be looking at a boom in economic growth, just as people have been looking for recession. On a related note, I want to revisit some of my analysis of the long-term path of the stock market.

This chart shows us what it would take to put us back on the path of 8% annualized growth in the S&P 500.

The blue line represents what the S&P 500 would have looked like, had it continued to grow at its long-run annualized rate of 8%, from the 2007 pre-Great Financial Crisis peak. The orange line is the actual path of stocks (which includes the deep financial crisis decline and the subsequent recovery).

Through the years of looking at this chart above, there has been plenty of chatter along the way about the performance and status of the stock market - plenty of bubble and overvaluation talk. The reality is, we were knocked off of the path of the long-term trajectory of stocks (the orange line) and that path of a long-term 8% annualized appreciation has never been regained (the blue line).

What can we attribute this gap to? Post-recession economic recoveries in stocks are typically driven by an aggressive bounce-back in growth, to return the economy to "trend growth." We didn't get it in the post-great recession era. Growth was dangerously shallow and slow. Deflationary pressures persisted.

However, the pandemic fiscal response, unlike the great recession fiscal response, put cash in the hands of consumers. We can see what the short-lived boom-period did to close that gap in the chart (the orange line converging to the blue line).

PS: The markets can appear noisy. At Gryning we make calm out of the chaos.

If models & frameworks are your thing, including a portfolio based on my daily notes:

If AI & Quant analytics are your thing:

When are the dollar become to strong? That it becomes negative for the average domestic American? Is there some analysis on this ? Can it be to strong ?

If they raise the debt ceiling it should become negative for the Usd however in my opinion the stock market takes out this event in advance and we might see a sell on news event, haven’t seen this in the Forex market though. Is there a good explanation for why ?

Or is it just big banks that hedge the other way just in case?

Perhaps it’s other people in our group that have same ideas and wonder the same things