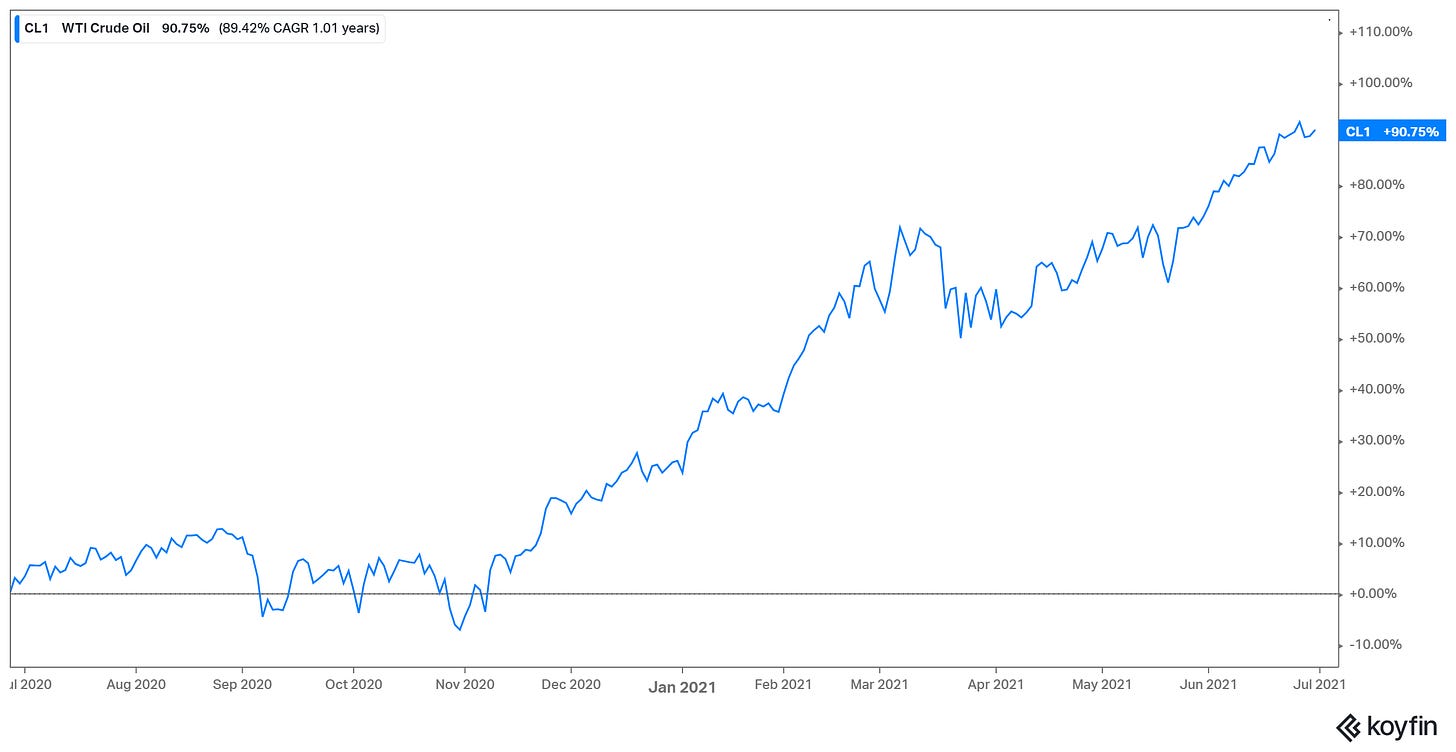

A month ago we were talking about the set-up for a spike in oil prices heading into Memorial Day - Oil prices have risen as much as 20% in a little more than a month.

Now we're heading into the 4th of July weekend. Remember, this has been a date/holiday the administration has touted as a "turning the page" on the virus celebration. Travel will boom. This comes with the national average gas price at $3.10 - up 42% from a year ago and that number will probably rise as we head into the weekend. There are already reports circulating about gas shortages at stations, as the supply/demand mismatch in oil is getting exposed.

As we've discussed, the Biden administration is regulating away domestic (U.S.) oil supply. That puts OPEC back in the position to dictate global oil prices and it's a safe bet that they want prices higher, not lower. With that, OPEC (plus Russia) meets on Thursday to discuss potential output increases in the months ahead.

They bumped output gradually higher in June. Oil prices went up, not down.

I don't expect them to make a material move on Thursday, with the cover of "the unpredictable foe and vicious mutations" of COVID as a threat/excuse - in the words of the OPEC Secretary-General. A “nothing material” outcome from OPEC+ should continue to underpin the oil market (i.e. higher prices).

As we've discussed here in my daily Macro Perspectives, the focus in the oil market has been all about future demand - meaning less demand, driven by the fantasy of rapid change to ubiquitous electric vehicles and wind farms. Thus, they have underestimated oil demand, and therefore they have underestimated the economic impact that is coming down the line from regulating away supply (from the climate activist movement).

Some are now waking up to this reality, as the forecasts for $100+ oil have emerged from a few big institutional oil trading houses and investment banks over the past few weeks. As I've said, get ready for $6 gas.