Positive

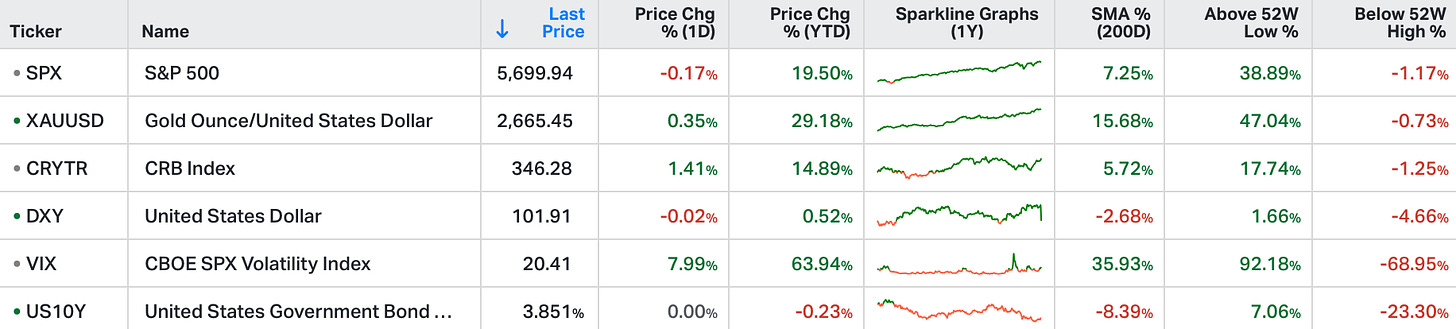

US stocks extended losses on Thursday amid increased geopolitical tension in the Middle East, while markets assessed the latest data for hints on the Fed’s policy outlook.

The S&P 500 and the Nasdaq 100 were down by 0.3% each, and the Dow was down over 200 points.

In the meantime, the ISM Services PMI surged in September to indicate a more resilient economy than expected, adding to the optimistic labour market data released earlier in the week and limiting bets of an aggressively dovish Fed.

Most major sectors were in the red, with Apple, Amazon, JPMorgan, Tesla, and Eli Lilly dropping between 3% and 1%.

On the other hand, Nvidia was 3% higher and oil producers benefited from higher energy prices.

We get the big September jobs report today.

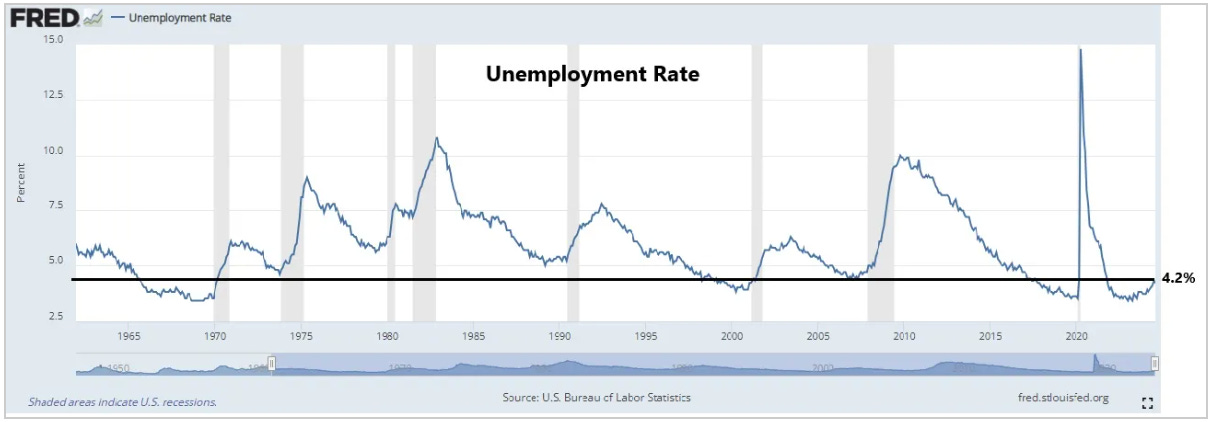

The Fed has made the employment situation the central focus. Specifically, it's "unexpected weakness" (in the words of Jerome Powell) in the unemployment rate that would trigger a faster pace of rate cuts.

The last reading was 4.2%. As you can see in the chart below, it's a low unemployment rate, relative to history. Even if we pull out recession periods over the 60+ year history of this chart, the average unemployment rate is in the high 5s.

So, it's not the level of unemployment rate, but the speed of change that has worried the Fed. It's consistent with past recessions.

The Fed made clear following its September meeting, where they surprised markets with a large 50 basis point cut to kick off the easing cycle, that they wanted to signal that they are on high alert to protect the economy.

That said, we've had some significant new information since that Fed meeting. Jerome Powell spoke on Monday at the NABE in Nashville (National Association of Business Economics), where he talked about the September 26th revisions on economic growth made by the government's Bureau of Economic Analysis (BEA).

Specifically, he pointed to the significant revision made to second quarter Gross Domestic Income (GDI).

He said, "there is research that says GDI gives a better real-time reading (than GDP). And for the last year and a half or so, GDI has been quite low relative to GDP."

In fact, the last reading had GDP at 3% and GDI at just 1.3% - that's a huge gap.

He said the Fed has been concerned that GDP would be revised DOWN to GDI. "That's been a downside risk we've been monitoring."

Good news: The revision came in the other way.

GDI was revised UP from 1.3% to 3.4%. The Fed Chair called it a "very large" adjustment that now "removes a downside risk to the economy."

With that, if we listen to Jerome Powell, we should expect the Fed to be less sensitive to a tenth of a tick here or there in the unemployment rate. And factoring in these BEA revisions, which included revisions higher to personal incomes, consumer spending and the personal savings rate, the market should be less sensitive to whether the Fed cuts 50 or 75 basis points into the end of the year.

For perspective, we know the direction of rates is lower. The Fed is "guiding" a path to neutral territory, which mean large rate cuts through next year. The economic growth is tracking 2.5% for Q3, whilst earnings growth is expected to be mid-teens in the fourth quarter.

This is a positive formula for stocks.

Add to this, a risk to the rate path and economic stability was removed late yesterday with the postponement of the port strike.